Last Updated: February 23, 2026

TL;DR

- Employment contracts establish traditional employer-employee relationships with benefits, tax withholdings, and legal protections under U.S. labor laws

- Independent contractor agreements define relationships with self-employed individuals who maintain control over how they complete their work

- Key distinction: Control level determines classification - employees are directed on both what to do and how to do it, while contractors control their methods

- Legal consequences: Misclassification can result in IRS penalties, back taxes, and violations of federal labor laws

- Use employment contracts for ongoing roles requiring supervision, integration into company culture, and access to benefits

- Use contractor agreements for project-based work, specialized expertise, or when the worker maintains independence and serves multiple clients

- Ziji Legal Forms can help you create Employment Contracts and Independent Contractor Agreements in no time.

Introduction: Why the Classification Matters

The decision between using an employment contract or an independent contractor agreement represents one of the most critical choices businesses make when bringing on new talent. This distinction extends far beyond simple paperwork - it fundamentally shapes the legal, financial, and operational relationship between your organization and the people who work for you.

Under U.S. law, the consequences of misclassification are severe and expensive. The Internal Revenue Service actively pursues businesses that incorrectly classify employees as independent contractors, with penalties including back taxes, interest, and substantial fines. The Department of Labor enforces wage and hour violations that can result in overtime back pay, while state agencies may impose additional penalties for benefits violations. Recent enforcement actions demonstrate that companies of all sizes face these risks, from small regional businesses to Fortune 500 corporations.

The classification decision affects every aspect of the working relationship. Employment contracts create traditional employer-employee relationships subject to federal labor laws, tax withholdings, and comprehensive benefits requirements. Independent contractor agreements establish business-to-business relationships with self-employed individuals who maintain autonomy over their work methods while accepting greater financial responsibility for taxes and benefits.

Understanding these differences protects your business from costly compliance failures while ensuring workers receive appropriate protections and compensation. The stakes are too high to rely on assumptions or informal arrangements when clear legal frameworks exist to guide proper classification decisions.

What Is an Employment Contract?

An employment contract serves as the foundation for traditional employer-employee relationships in the United States. This legal document establishes the terms under which an individual becomes an integral part of your organization, subject to company policies, supervision, and the full range of federal and state labor law protections.

Unlike casual working arrangements, employment contracts create legally binding obligations for both parties. The employer gains the right to control not only what work gets done, but how and when it gets completed. In return, the employer accepts responsibility for tax withholdings, benefits provision, and compliance with wage and hour laws that protect the employee's interests.

Essential Components of Employment Agreements

Employment contract templates typically include essential elements that define the relationship. The document specifies the employee's job title, responsibilities, and reporting structure within the organization. Compensation details cover salary or hourly wages, payment schedules, overtime eligibility, and any performance-based incentives. Work arrangements address schedules, location requirements, and expectations for availability or flexibility.

Benefits and protections form a crucial component of employment agreements. Federal law requires employers to provide certain protections including minimum wage compliance, overtime pay for non-exempt employees, and unemployment insurance coverage. Many employers also offer health insurance, retirement plans, paid time off, and other benefits that enhance the total compensation package.

Employment contract forms also address confidentiality, intellectual property ownership, and termination procedures. These provisions protect the employer's business interests while ensuring employees understand their rights and responsibilities. Termination clauses specify notice requirements, severance provisions, and any restrictive covenants that may apply after employment ends.

The free employment contract templates available online provide starting points, but each agreement should be customized to reflect specific job requirements and company policies. Whether you need a simple employment contract or a comprehensive executive agreement, the document must comply with applicable federal and state employment laws while serving both parties' legitimate interests.

What Is an Independent Contractor Agreement?

An independent contractor agreement governs relationships with self-employed individuals who provide services to your business while maintaining their independence. Unlike employment relationships, these agreements establish business-to-business arrangements where the contractor retains control over how they accomplish the agreed-upon work.

The fundamental principle underlying independent contractor agreements centers on autonomy and results-oriented relationships. While you can specify what needs to be accomplished and when it should be completed, you cannot control the methods, tools, or daily work processes the contractor uses. This distinction proves critical for legal compliance and determines whether the relationship qualifies for independent contractor status under federal law.

Essential Components of Independent Contractor Agreements

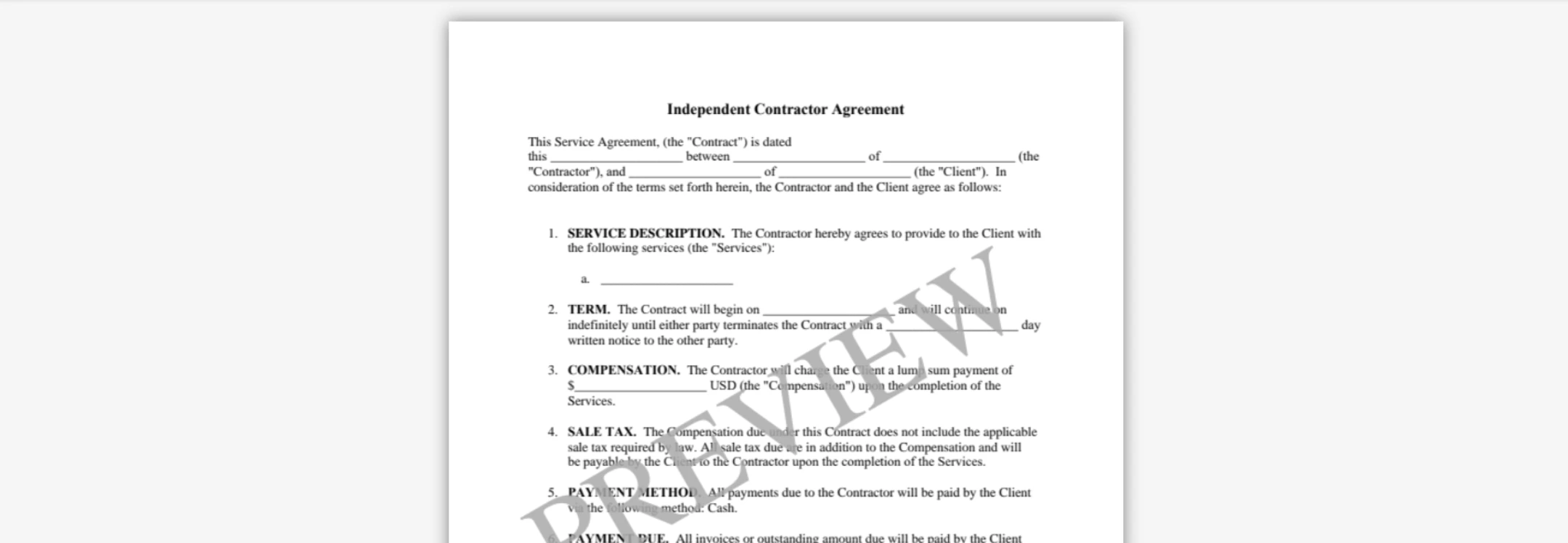

Independent contractor agreement templates typically address different concerns than employment contracts. The document focuses on deliverables, deadlines, and payment terms rather than ongoing supervision and benefits. Project specifications define the scope of work, quality standards, and acceptance criteria that determine when the contractor has fulfilled their obligations.

Payment structures in independent contractor contracts reflect the business-to-business nature of these relationships. Contractors typically receive payment based on project completion, milestones, or agreed-upon rates rather than regular salaries with tax withholdings. The contractor becomes responsible for their own tax obligations, including self-employment taxes, and must handle their own benefits and insurance coverage.

Sample independent contractor agreements demonstrate how these documents address liability, intellectual property, and termination differently than employment contracts. Contractors often carry their own professional liability insurance and may retain ownership of their work methods or tools. Termination procedures tend to be simpler, often allowing either party to end the relationship with minimal notice.

Free independent contractor agreement templates provide frameworks for common arrangements, but customization remains essential. The agreement must accurately reflect the actual working relationship to support the contractor classification. Arrangements that look like employment relationships in practice may be treated as such by regulatory agencies, regardless of the contract language.

Whether you need a simple independent contractor agreement or a complex project-based arrangement, the document should clearly establish the contractor's independence while defining mutual obligations. This clarity protects both parties and supports compliance with federal classification requirements that determine tax and labor law obligations.

To better understand how contractor relationships differ from broader service-based arrangements, read our article on the difference between an Independent Contractor Agreement and a Service Agreement.

Key Differences Between Employment Contracts and Independent Contractor Agreements

The distinctions between employment contracts and independent contractor agreements extend across multiple dimensions that affect legal obligations, financial responsibilities, and operational relationships. Understanding these differences helps ensure proper classification and compliance with federal regulations.

Control and Supervision

This represents the most fundamental difference between these arrangements. Employment agreements grant employers the right to direct both what work gets done and how employees accomplish their tasks. This includes setting work schedules, specifying methods and procedures, providing training, and evaluating performance. Independent contractor contracts, by contrast, focus on results rather than methods, allowing contractors to determine their own approaches while meeting agreed-upon deliverables and deadlines.

Tax and Benefits

These Obligations create dramatically different financial responsibilities for businesses. Employees require comprehensive payroll tax withholdings including federal income tax, Social Security, Medicare, and unemployment taxes. Employers must match Social Security and Medicare contributions while providing workers' compensation coverage and potentially offering health insurance, retirement plans, and paid leave benefits. Independent contractors receive Form 1099-NEC payments with no tax withholdings, handling their own tax obligations and benefits coverage.

Legal Protections and Rights

These vary significantly based on classification status. Employees enjoy protections under the Fair Labor Standards Act including minimum wage requirements, overtime pay eligibility, and various anti-discrimination laws. They may also qualify for family medical leave, unemployment benefits, and workplace safety protections. Independent contractors operate outside these employment law protections, relying instead on contract terms and general business law principles.

Duration and Commitment

These patterns typically differ between these relationships. Employment contract templates often establish ongoing relationships with indefinite duration, regular schedules, and expectations for exclusive or primary commitment to the employer. Independent contractor agreement templates more commonly address specific projects or defined time periods, allowing contractors to serve multiple clients simultaneously.

Equipment and Resources

These provisions reflect different operational approaches. Employers typically provide the tools, equipment, workspace, and materials employees need to perform their jobs. Independent contractors generally supply their own resources, maintain their own workspace, and invest in the tools necessary for their trade or profession.

Termination and Dispute Resolution

The procedures acknowledge different relationship structures. Employment terminations may trigger obligations for final pay, benefits continuation, or severance payments, while also potentially invoking wrongful termination protections. Contractor relationships typically end more simply upon project completion or contract expiration, with fewer ongoing obligations for either party.

When to Use Each Document Type

The choice between employment contracts and independent contractor agreements should be based on the actual nature of the working relationship rather than desired cost savings or administrative convenience. Federal agencies evaluate the substance of relationships, not just contract labels, when determining proper classification.

Using an Employment Contract

Employment contracts suit situations where you need ongoing integration of workers into your organization. Use employment agreement templates when the role requires regular supervision, adherence to company policies, or participation in team-based activities. Positions involving customer service, operations management, or collaborative project work typically benefit from employment relationships that provide clear authority structures and accountability measures.

Consider employment contract forms for roles requiring specialized training, access to confidential information, or representation of your company to external parties. Employees can be trained in specific procedures, granted access to proprietary systems, and held accountable for following company standards in ways that independent contractors cannot. The investment in training and development makes sense when you plan to retain workers for extended periods.

Free employment contract templates work well for standard positions with typical benefits and protections. More complex roles may require customized agreements that address specific compensation structures, performance metrics, or advancement opportunities that align with your organizational goals.

Using an Independent Contractor Agreement

Independent contractor agreements make sense for project-based work with clear deliverables and timelines. Use independent contractor agreement templates when you need specialized expertise that your internal team lacks, such as web development, graphic design, or consulting services. These arrangements work best when the contractor can complete the work independently without ongoing supervision or integration into your daily operations.

Consider independent contractor contracts for seasonal or temporary needs that don't justify permanent hiring. Marketing campaigns, system implementations, or facility renovations often suit contractor relationships where you need specific skills for limited time frames without ongoing employment obligations.

Independent contractor agreements demonstrate appropriate uses for these arrangements, such as engaging consultants for strategic planning, hiring specialists for compliance audits, or contracting with vendors for specific deliverables. The key is ensuring the contractor truly operates independently and provides services similar to what they offer other clients.

Independent contractor agreements can handle straightforward service relationships, while complex projects may require detailed specifications for deliverables, quality standards, and acceptance criteria. The agreement should reflect the actual working relationship and support the contractor's business independence. Avoid using contractor agreements as a way to reduce costs for roles that actually function as employment relationships. This approach creates significant legal risks and may not achieve the intended savings when penalties and back taxes are factored into the total cost.

Creating Employment and Independent Contractor Agreements with Professional Tools

Modern businesses can draft both employment contracts and independent contractor agreements efficiently and accurately by leveraging purpose-built legal platforms such as Ziji Legal Forms. These professional tools take the guesswork out of compliance and help organizations ensure all key documentation meets current federal legal standards.

How Professional Contract Platforms Add Value

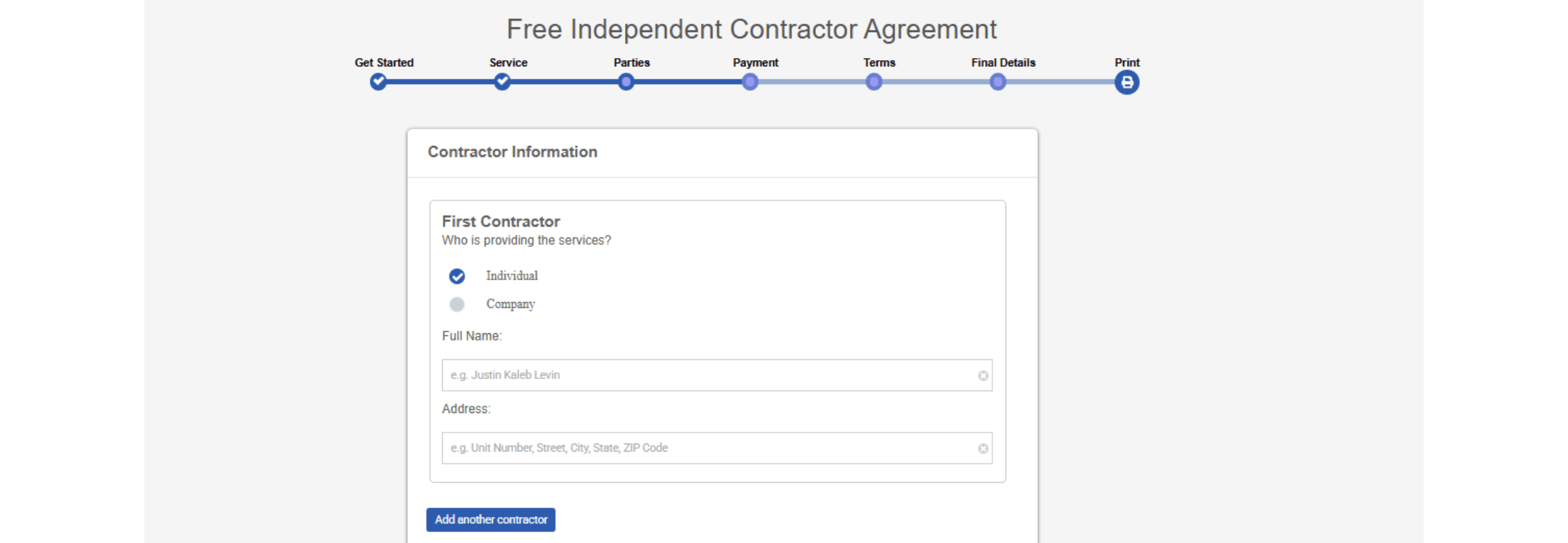

Rather than starting each agreement from scratch or relying on generic templates, businesses benefit from guided workflows within contract creation platforms. When creating either an employment or independent contractor agreement, these systems prompt users to input all essential details, such as duties, compensation structure, confidentiality requirements, or project deliverables via user-friendly questionnaires. Once complete, the platform auto-generates contracts that are organized, clearly worded, and designed to avoid common legal pitfalls.

A crucial strength of modern contract platforms is their built-in compliance intelligence. As you fill out details, the software checks for missing information, flags potentially out-of-date clauses, and recommends language that aligns with the latest wage, overtime, and classification regulations. This ensures employment contracts address requirements like pay schedules and benefits, and independent contractor agreements avoid triggers that could undermine the contractor’s legal classification.

Customization, Consistency, and Reducing Risk

With these tools, businesses can customize agreements to reflect specific job roles, project scopes, or business needs, without losing out on legal thoroughness. The platform’s contract library enables version control and easy tracking of executed agreements, which is especially valuable for companies hiring regularly or managing multiple contractors in different roles. Centralized management allows organizations to maintain consistency across documentation while adapting certain terms for individual hires or projects.

Digital signature functions further streamline the process, making it easy for all parties to sign and finalize agreements regardless of location. Secure storage keeps everything organized for future reference, audits, or renewals.

Convenience and Ongoing Compliance

When using a platform like Ziji Legal Forms, both employment agreement templates and independent contractor agreement templates are regularly updated by legal professionals. This means you’ll have access to forms that reflect the latest changes in the law and recommended best practices.

For businesses or individuals seeking to save time and avoid costly errors, leveraging these professional tools provides a clear edge. They make it simple to create, update, and execute agreements for a variety of roles and working arrangements helping protect your business while building strong, compliant relationships with employees and independent contractors alike.

Creating Agreements Easily in 5 Steps with Ziji Legal Forms

Whether you need an employment contract or an independent contractor agreement, Ziji Legal Forms makes the process simple, fast, and accurate:

Visit Ziji Legal Forms: Start by accessing the platform online from any device.

Navigate to the required agreement type under Business: Under the Business tab you will be able to access the Employment Contract Template and the Independent Contractor Agreement. Choose the specific agreement you need.

Answer a few guided questions to ensure your agreement is accurate: Fill out a brief online questionnaire covering all necessary details and legal requirements.

Preview the document: Review the completed agreement to make sure all terms, conditions, and details are correct.

Get it signed by the concerned parties: Download or send the agreement for digital signatures, making it legally binding and ready for use.

Legal Compliance and Risk Management

Proper documentation serves as the foundation for compliance with federal employment and tax law requirements. Both employment contracts and independent contractor agreements should be designed to support your classification decisions while protecting against regulatory challenges or disputes.

Regular review of working relationships helps identify situations where arrangements may have evolved in ways that affect proper classification. Employees who begin working more independently or contractors who become more integrated into daily operations may require relationship adjustments or documentation updates to maintain compliance.

Professional legal review remains valuable for complex arrangements or high-value relationships where classification errors could create significant financial exposure. While free employment contract templates and simple independent contractor agreements handle many situations effectively, unique circumstances may warrant customized legal analysis.

Training managers and supervisors on the differences between employee and contractor relationships helps prevent inadvertent actions that could undermine proper classification. Understanding control limitations, communication protocols, and integration boundaries protects the legal distinction you've established through proper documentation.

Conclusion

The right agreement depends on whether you need ongoing employees or independent specialists. Employment contracts offer structure and legal protection for traditional staff, while independent contractor agreements are best for project-based and specialized work. Using accurate, compliant documents helps ensure you meet federal requirements and avoid costly mistakes. Professional tools like Ziji Legal Forms make it easy to create clear agreements tailored to your business needs. With the right paperwork, everyone’s rights and expectations are protected.

Independent Contractor Agreement FAQs

Do independent contractor agreements need to be in writing?

While some verbal agreements are legally valid, a written contract is essential for clarity and legal protection.

Can a contractor work for multiple clients?

Yes, unless restricted by an exclusivity clause, independent contractors are free to take on multiple clients.

Are independent contractors entitled to employee benefits?

No, contractors are not eligible for benefits like paid leave, health insurance, or unemployment.

Can a contractor use subcontractors?

Only if permitted in the agreement. It should also define who bears responsibility for the subcontractor's work.

How are disputes typically resolved?

Most agreements include dispute resolution clauses specifying mediation, arbitration, or court jurisdiction.

Employment Contract FAQs

Does an employment contract need to be in writing?

While oral agreements can sometimes be valid, a written employment contract is essential for clear terms and legal protection.

Can an employee work for multiple employers?

Usually not, unless the contract specifically allows it; most employment contracts require full-time commitment or restrict outside work.

Are employees entitled to company benefits?

Yes, employees are generally eligible for benefits such as paid leave, health insurance, and retirement plans, as outlined in the contract.

Can an employee delegate their work to others?

Typically no; employees are expected to perform their duties themselves unless expressly permitted by company policy or their contract.

How are disputes between employer and employee resolved?

Most employment contracts include dispute resolution clauses, detailing mediation, arbitration, or the process for resolving matters in court.

What jurisdictions can use our independent contractor agreement or employment contract?

You can use our template to create a legal and valid independent contractor agreement or employment contract for the following jurisdictions:

| Alabama (AL) | Alaska (AK) | Arizona (AZ) | Arkansas (AR) | California (CA) |

| Colorado (CO) | Connecticut (CT) | Delaware (DE) | District of Columbia (DC) | Florida (FL) |

| Georgia (GA) | Hawaii (HI) | Idaho (ID) | Illinois (IL) | Indiana (IN) |

| Iowa (IA) | Kansas (KS) | Kentucky (KY) | Louisiana (LA) | Maine (ME) |

| Maryland (MD) | Massachusetts (MA) | Michigan (MI) | Minnesota (MN) | Mississippi (MS) |

| Missouri (MO) | Montana (MT) | Nebraska (NE) | Nevada (NV) | New Hampshire (NH) |

| New Jersey (NJ) | New Mexico (NM) | New York (NY) | North Carolina (NC) | North Dakota (ND) |

| Ohio (OH) | Oklahoma (OK) | Oregon (OR) | Pennsylvania (PA) | Rhode Island (RI) |

| South Carolina (SC) | South Dakota (SD) | Tennessee (TN) | Texas (TX) | Utah (UT) |

| Vermont (VT) | Virginia (VA) | Washington (WA) | West Virginia (WV) | Wisconsin (WI) |

| Wyoming (WY) |

GET STARTED FOR FREE

Create your

Get Started For Free