TL;DR- Independent contractor agreements face common risks including scope creep, payment disputes, intellectual property conflicts, and confidentiality breaches that require proactive management

- Compliance and misclassification risks can trigger IRS audits, penalties, and back taxes if businesses fail to properly classify workers or maintain adequate documentation

- Proper documentation, clear contracts, change order procedures, and dispute resolution clauses help prevent most contractor relationship problems before they escalate

- Regular contract reviews, audit preparedness, and professional templates like those from Ziji Legal Forms reduce legal exposure and operational risks

- Well-structured independent contractor agreement templates protect both parties while ensuring compliance with federal regulations and industry best practices

Introduction

Independent contractor relationships continue rising across the United States as businesses seek specialized expertise, operational flexibility, and cost-effective solutions for project-based work. However, behind this growth lies a complex web of hidden risks that can expose companies to disputes, regulatory audits, and significant compliance issues if not properly managed.

The challenges extend far beyond simple contract drafting. Businesses face potential financial liability from misclassification penalties, intellectual property disputes, scope creep conflicts, and payment disagreements that can escalate into costly legal battles. The stakes have never been higher, with recent enforcement actions resulting in millions of dollars in penalties for companies that fail to properly structure their contractor relationships.

This comprehensive guide provides practical strategies to identify, assess, and mitigate the most common risks in independent contractor agreements while establishing systems that protect both your business and the contractors you engage. Understanding these risks and implementing proper safeguards transforms contractor relationships from potential liabilities into strategic business assets.

Common Risks in Independent Contractor Engagements

Successful contractor relationships require careful management of several recurring risk categories that can derail projects and create lasting business problems. Understanding these patterns helps businesses develop proactive strategies rather than reactive solutions.

Risk Gaps Caused by Unclear Contract Terms

Many independent contractor agreements fail not because they are missing, but because they lack precision in critical areas. Unclear definitions of scope, deliverables, or timelines often lead to disagreements over performance expectations. Missing or weak intellectual property clauses can expose businesses to long term ownership disputes, especially when contractors contribute to core products or content. Another frequent issue is misclassification risk.

Agreements that mirror employment terms through control, exclusivity, or fixed working hours can attract regulatory scrutiny. Without clear confidentiality, indemnity, and termination provisions, businesses may face financial loss and legal exposure. Addressing these gaps within the agreement itself is essential for managing contractor related risk effectively.

Scope Creep and Timeline Management

Scope expansion represents one of the most frequent sources of contractor disputes, occurring when projects gradually expand beyond their original parameters without corresponding adjustments to compensation or timelines. What begins as a simple request for "minor modifications" can evolve into substantial additional work that strains relationships and budgets.

Timeline slippage often accompanies scope creep, creating cascading effects on project delivery and business operations. Contractors may struggle to meet original deadlines when additional work is requested, while businesses face delays in product launches, service delivery, or internal milestones that depend on contractor deliverables.

Prevention strategies include establishing detailed project specifications upfront, implementing formal change order procedures, and creating clear boundaries between original scope and additional requests. Documentation of all scope changes protects both parties while ensuring fair compensation for expanded work requirements.

Payment Disputes and Financial Conflicts

Late payment issues create cash flow problems for contractors while potentially damaging business relationships and professional reputations. Industry research indicates that over 40% of independent contractors experience payment delays, with many waiting 30-60 days beyond agreed-upon terms for compensation.

Disputed work quality often triggers payment conflicts when businesses claim deliverables don't meet specifications or contractors assert that requirements changed during project execution. These disagreements can escalate quickly without clear quality standards and approval processes established in advance.

Invoice and billing conflicts arise from unclear payment terms, disputed hours, or disagreements about reimbursable expenses. Professional invoicing systems and detailed expense tracking help minimize these administrative disputes while providing clear documentation for resolution efforts.

Intellectual Property and Ownership Issues

Work product ownership conflicts can create serious legal and business complications when contracts fail to clearly establish who owns deliverables, code, creative content, or other intellectual property created during contractor engagements. Default assumptions about ownership often prove incorrect under applicable legal standards.

Pre-existing intellectual property complications arise when contractors incorporate their existing tools, methods, or content into client projects without clear licensing agreements. These situations can create ongoing obligations or restrictions that weren't anticipated during contract negotiation.

License and usage rights require careful definition to prevent future conflicts about how work products can be used, modified, or commercialized. Businesses need appropriate rights to use contractor deliverables for their intended purposes, while contractors may retain certain rights for portfolio use or future development.

Confidentiality and Data Security Breaches

Sensitive information exposure poses significant risks when contractors access proprietary business data, customer information, or strategic plans without adequate protection measures. Data breaches or unauthorized disclosure can damage competitive positions and violate regulatory requirements.

Third-party access risks emerge when contractors use subcontractors, work from shared spaces, or employ cloud-based tools that may compromise information security. These indirect access points require specific attention in confidentiality and security planning.

Ongoing confidentiality obligations need clear definition regarding duration, scope, and consequences of violations. Contractors may continue accessing confidential information long after projects end, requiring appropriate protective measures and monitoring systems.

Disputes and Breach of Contract: What You Need to Know

Contract disputes can take multiple forms, each requiring different approaches for resolution and prevention. Understanding these categories helps businesses respond appropriately while minimizing disruption and costs.

Types of Contract Breaches

Material breaches involve fundamental failures that defeat the contract's essential purpose, such as complete failure to deliver promised work or delivery of work so defective it cannot serve its intended purpose. These situations often justify immediate contract termination and pursuit of damages.

Minor breaches represent failures to meet specific contract terms without undermining the overall agreement's value. Examples include late delivery within reasonable tolerances or minor deviations from specifications that don't affect core functionality or business value.

Anticipatory breaches occur when one party indicates they will not perform future obligations before performance is due. This might involve contractor communications suggesting they cannot meet deadlines or business statements indicating they cannot provide promised resources or payments.

Escalation and Resolution Strategies

Direct negotiation should always be the first step in dispute resolution, focusing on understanding underlying interests rather than rigid position-taking. Many disputes arise from miscommunication or changed circumstances that can be addressed through collaborative problem-solving approaches.

Mediation services provide neutral third-party assistance in reaching mutually acceptable solutions while maintaining business relationships and avoiding public proceedings. Professional mediators skilled in business disputes often achieve faster, less expensive resolutions than formal legal proceedings.

Arbitration and litigation represent formal resolution mechanisms that may be necessary when negotiation and mediation fail to resolve significant disputes. Independent contractor agreement templates should specify which approach will be used and establish procedures for initiating formal dispute resolution processes.

Prevention Through Clear Contracts

Comprehensive dispute resolution clauses should outline step-by-step procedures for addressing conflicts, including notification requirements, informal resolution attempts, and formal proceedings if necessary. Clear processes reduce confusion and delay when problems arise.

Performance standards and acceptance criteria help prevent disputes by establishing objective measures for evaluating work quality and completion. These standards should be specific enough to guide contractor work while providing clear benchmarks for business acceptance decisions.

Communication and reporting requirements create regular opportunities to identify and address potential problems before they escalate into formal disputes. Structured check-ins and progress reviews help maintain project alignment and relationship health.

Compliance and Misclassification Risks

Worker classification represents one of the most serious legal risks facing businesses that engage independent contractors. Misclassification can trigger substantial penalties and ongoing obligations that extend far beyond the original contract relationship.

Federal Classification Standards

The

IRS test examines behavioral control, financial control, and relationship type to determine whether workers should be classified as employees or independent contractors. The test considers factors like work method control, tool provision, payment structures, and relationship permanence.

Department of Labor guidelines focus on economic dependence and control factors that may differ from IRS criteria, creating potential conflicts when businesses must satisfy multiple regulatory frameworks. Recent rule changes have increased enforcement focus on contractor relationships that may actually constitute employment.

Control and independence factors require careful documentation showing that contractors operate as independent businesses rather than integrated employees. This includes contractor control over work methods, schedule flexibility, use of their own tools, and ability to work for multiple clients simultaneously.

Misclassification Consequences

Tax penalties and back payments can include unpaid payroll taxes, interest charges, and penalties for each misclassified worker. The financial exposure often exceeds the original cost savings from contractor classification, particularly when violations affect multiple workers or extended time periods.

Employment law violations may trigger obligations for overtime payments, benefits coverage, workers' compensation, and unemployment insurance contributions. These obligations often apply retroactively, creating substantial unexpected costs for businesses.

Audit triggers and investigation processes can result from complaints, routine examinations, or coordinated enforcement efforts between agencies. Businesses need comprehensive documentation and response procedures to manage audit processes effectively while minimizing operational disruption.

Audit Preparedness for Contractor Engagements

Regulatory audits can occur with little warning, making advance preparation essential for businesses that regularly engage independent contractors. Proper documentation and internal systems protect against penalties while demonstrating good faith compliance efforts.

Common Audit Triggers

Tax filing patterns that show heavy reliance on contractor relationships or unusual payment structures may attract attention from revenue agencies. Businesses should understand how their contractor usage appears in their tax reporting and prepare explanations for legitimate business arrangements.

Industry-specific enforcement targets sectors with historical compliance problems or high contractor usage, such as construction, technology, transportation, and professional services. Businesses in these sectors should expect higher audit probability and maintain enhanced documentation standards.

Complaint-driven investigations often result from disgruntled contractors who claim employee status or competitors who report suspected violations. These situations require immediate response capabilities and comprehensive documentation to support classification decisions.

Essential Documentation Requirements

Written contractor agreements form the foundation of compliance documentation, but agreements alone don't determine classification. Businesses must demonstrate that actual working relationships match contract terms through ongoing documentation and management practices.

Financial records and payment documentation should clearly show contractor invoicing, business expense payments, and absence of employee-style benefits or reimbursements. Payment patterns must support independent business relationships rather than employee-like arrangements.

Work independence evidence includes documentation of contractor control over work methods, schedule flexibility, use of their own tools and equipment, and ability to work for multiple clients. This evidence must reflect actual practice rather than contract language alone.

Internal Best Practices

Regular compliance reviews help identify potential classification issues before they trigger audits or penalties. These reviews should examine actual working relationships rather than relying solely on contract terms to assess compliance status.

Training and awareness programs ensure that managers and project leads understand classification requirements and maintain appropriate contractor relationships. Human resource and legal oversight helps prevent inadvertent creation of employee-like arrangements.

Documentation maintenance systems should organize and preserve all contractor-related records in accessible formats that facilitate rapid response to audit requests. Electronic systems with search capabilities help manage large volumes of contractor documentation efficiently.

Best Practices to Reduce Risk Before It Starts

Proactive risk management prevents most contractor relationship problems while creating foundations for successful long-term business partnerships. These strategies require upfront investment but generate substantial returns through reduced disputes and improved project outcomes.

Comprehensive Contract Development

Detailed scope definition eliminates ambiguity about work requirements, deliverables, and performance standards while providing clear boundaries for project execution. Comprehensive scopes reduce disputes and provide frameworks for managing legitimate changes that may arise during project execution.

Payment term clarity should specify rates, payment schedules, invoice requirements, and expense policies to prevent financial disputes. Professional payment terms that respect contractor cash flow needs while protecting business interests help maintain positive working relationships.

Intellectual property provisions must clearly establish ownership rights, license terms, and usage permissions for all work products created during contractor engagements. These provisions should address both original creations and incorporation of pre-existing contractor intellectual property.

Change Management Procedures

Formal processes to change the terms of the agreement provide structured mechanisms for managing scope expansions, timeline adjustments, and compensation modifications that may become necessary during project execution. These processes protect both parties while maintaining project momentum.

Authorization and approval requirements ensure that only appropriate personnel can commit to contract modifications while creating clear documentation trails for all changes. Proper authorization prevents unauthorized commitments that can create liability exposure.

Documentation and communication standards for changes help prevent misunderstandings while creating records that support future reference and dispute resolution if necessary. Written confirmation of all changes protects both parties' interests.

Termination and Exit Planning

Clear termination procedures should specify notice requirements, work completion obligations, payment terms for partially completed work, and procedures for returning confidential information or materials. Well-defined exit procedures reduce complications when relationships end.

Work transition requirements help ensure smooth handovers when contractor relationships end, whether due to project completion, performance issues, or business changes. Proper transition planning protects business continuity while respecting contractor interests.

Final payment and settlement processes should address all outstanding obligations, expense reimbursements, and final deliverable acceptance to achieve clean relationship closure without ongoing disputes or obligations.

Insurance and Risk Transfer

Professional liability coverage helps protect against errors, omissions, or performance failures that may cause business damages. Appropriate insurance requirements should match project risk levels and potential exposure amounts.

Indemnification provisions can transfer certain liability risks to contractors while providing businesses with protection against third-party claims arising from contractor work or conduct. These provisions must be carefully drafted to ensure enforceability and fairness.

Risk assessment and management should evaluate potential exposure levels for each contractor engagement while implementing appropriate protective measures. Systematic risk evaluation helps optimize protection levels without creating unnecessary barriers to contractor relationships.

Creating Independent Contractor Agreements with Ziji Legal Forms

Professional legal form platforms provide essential tools for creating comprehensive independent contractor agreements that address modern business needs while ensuring regulatory compliance and risk mitigation.

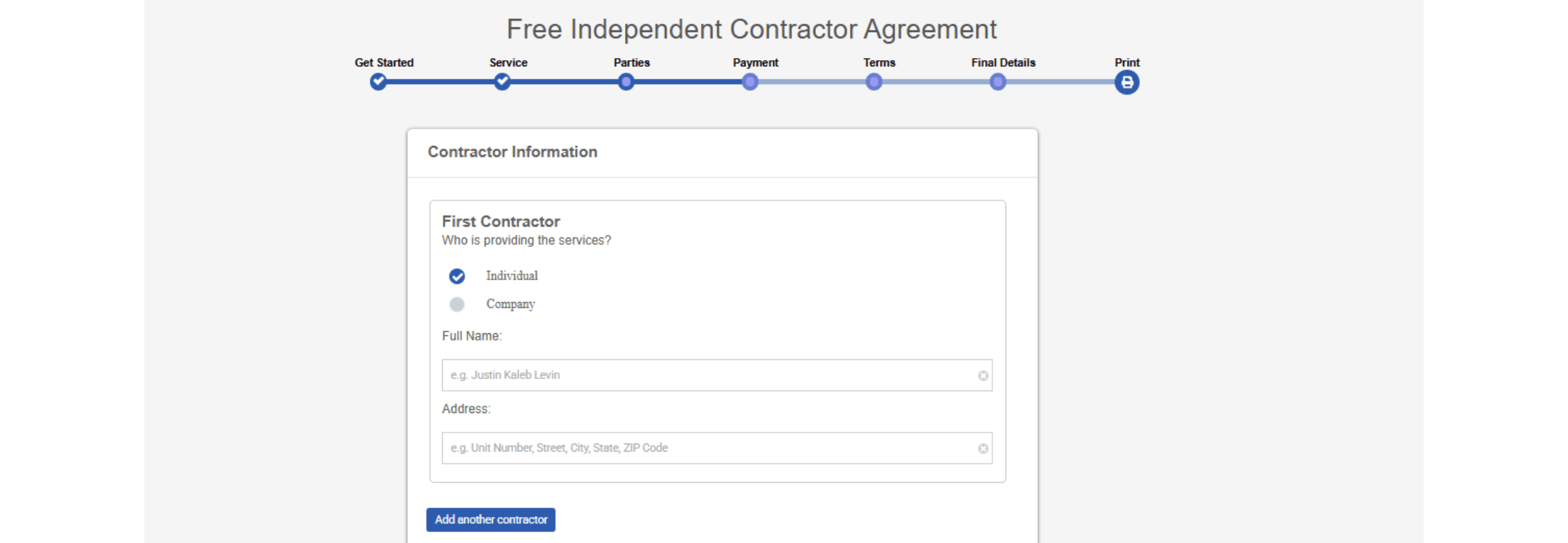

1. Select the template

2. Input job details

Specify the location, scope of work, and give clear information on what the contractor will perform.

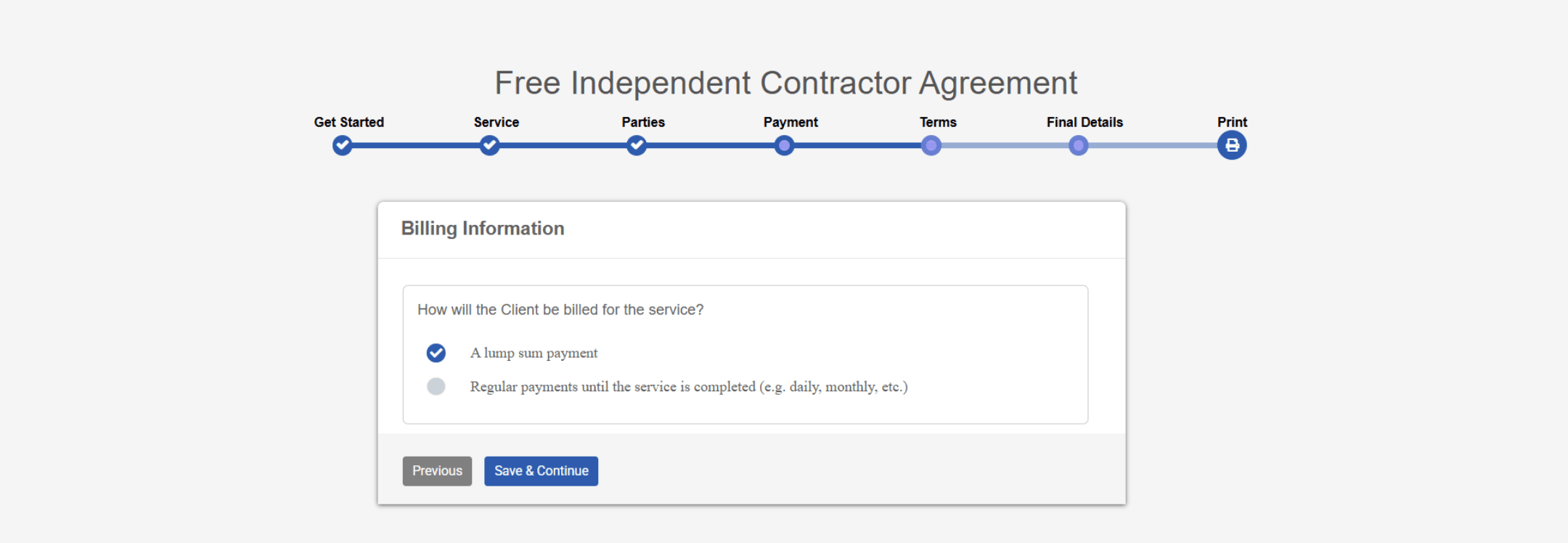

3. Add parties and payment info

Fill in both parties’ names/addresses and enter compensation details, payment structure, and any relevant schedule or expense terms.

4. Customize key clauses

Answer prompts to set confidentiality, intellectual property rights, and define term, termination, and any unique clauses needed.

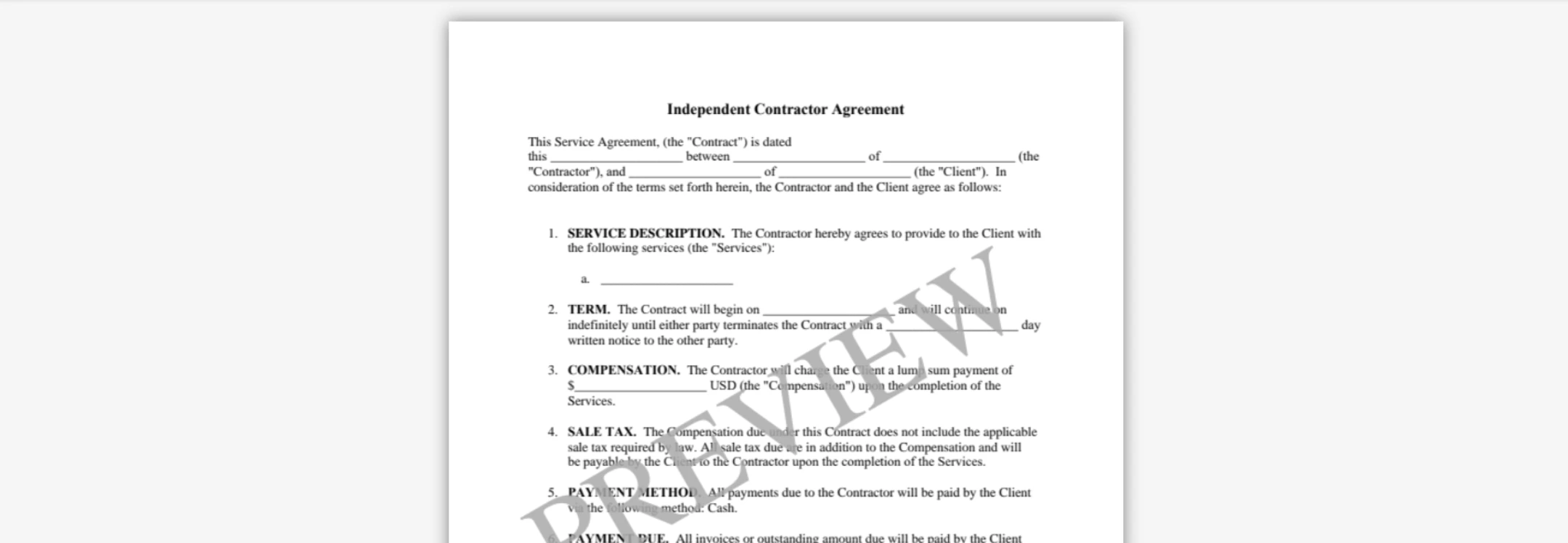

5. Review and finalize

Preview the completed agreement, check all key fields and clauses for accuracy, then generate your ready-to-sign contract.

Benefits of using Ziji Legal Forms' Independent Contractor Agreement

Ziji Legal Forms supports businesses by structuring independent contractor agreements around real risk scenarios rather than generic templates. The platform helps clearly define scope of work, payment terms, confidentiality obligations, and intellectual property ownership, which reduces ambiguity between parties. Termination conditions and dispute related clauses are also addressed upfront, helping businesses avoid costly misunderstandings.

By using a purpose built legal document platform, companies can create agreements that are easier to review, easier to manage, and more consistent with standard U.S. business practices. This structured approach allows businesses to engage independent contractors with greater confidence while maintaining clarity, compliance, and operational control.

Conclusion

Managing risk in independent contractor agreements requires comprehensive understanding of potential challenges combined with proactive implementation of protective strategies and professional documentation standards. The investment in proper risk management pays dividends through reduced disputes, improved compliance, and stronger business relationships with valuable contractor partners.

The evolving regulatory environment demands continuous attention to classification requirements, documentation standards, and industry best practices that protect both businesses and contractors. Professional tools like Ziji Legal Forms provide essential support for meeting these challenges while maintaining operational efficiency and cost effectiveness.

Success in contractor relationship management comes from treating risk mitigation as an integral part of business strategy rather than an administrative burden. Well-structured agreements, clear processes, and professional support create foundations for contractor relationships that drive business success while protecting all parties involved.

Independent Contractor Agreement FAQs

What is an independent contractor agreement also known as?

An independent contractor agreement is also known as the following: consulting service agreement, general service agreement, service agreement, or service contract.

What is an independent contractor agreement?

An independent contractor agreement is an agreement that outlines the terms and conditions of the service relationship between the contractor and the client. The independent contractor is not an employee of the client and generally will determine the process to achieve the client’s goal and target outcome.

What’s the difference between an employment agreement and an independent contractor agreement?

Employment agreement is reserved only for employees and it has specific tax implications and employment rights for the parties. Generally speaking, an independent contractor agreement should be used for contractors that are hired to perform certain services for the client. The contractor is independent from the client and will generally have more control in the work process used to meet the client’s goal, where as the employee’s work are directly under the control of the employer. Moreover, the employee never runs the risk of loss unlike an independent contractor. (e.g. Contractor agrees to provide catering to the client and agrees to having fresh lobster in the meal. The price of lobster more than double in the months leading up to the event so the food cost for the contractor increases from 30% to 55%)

When should I use an independent contractor agreement?

Virtually any service work provided by the contractor to the client will be applicable to the independent contractor agreement.

Some common work where an independent contractor agreement is used are:

- Photographer

- Musician

- Caterer

- Decorator

- Cleaner

- Landscaper

- Consultant

- IT service provider

- Web designer

- Construction and home renovator (e.g. plumber, electrician, carpenter etc)

- Child care worker (e.g. babysitter, nanny, daycare worker etc)

- Instructional provider (e.g. math tutor, music teacher, personal fitness trainer etc)

What should be listed in an independent contractor agreement?

Some general topics that should be covered in an independent contractor agreement are:

- The Parties: The name and address of the contractor and the client.

- The Work: Describe the service the contractor will be performing for the client. Itemize the duties in detail to ensure both sides understand what the expectations are for the agreement so there will not be an ambiguity in the agreement.

- Duration: How long the contract will last, whether it’s a fixed term that has a specific end date, or whether it’s for an indefinite period that has no end date for an ongoing service.

- Payment: List how much the service will cost and how the contractor will be paid, such as whether it’s a lump sum payment or whether it’s a regular periodic payment. Also list what payment method will be used to pay the contractor.

- Terms: What terms that the contractor and the client have agreed to in the contract in dealing with topics such as late payment and interest, work expenses, initial deposit, contract termination etc.

- Confidentiality: Prevents the contractor from sharing sensitive business information and trade secrets of the client.

- Intellectual property: Whether the service perform by the contractor will generate intellectual property rights and decide if the contractor or the client will own those intellectual property rights.

Can an independent contractor agreement be changed after it has been signed?

Yes. Any changes must be approved by both the contractor and the client. Amendments should always be documented in writing and signed by both parties to ensure the updated terms are clear and legally binding.

Is a written independent contractor agreement necessary?

While some jurisdictions may recognize verbal agreements, having a written contract is strongly recommended. A written agreement clearly sets out the rights, responsibilities, and expectations of both parties, reducing the chance of misunderstandings or disputes.

What happens if one party breaches the independent contractor agreement?

If either the contractor or client fails to follow the agreed terms, it may be considered a breach of contract. The non-breaching party may be entitled to remedies such as damages, termination of the agreement, or enforcement of the original terms, depending on the circumstances and applicable laws.

How is payment typically handled in an independent contractor agreement?

The agreement should specify how and when the contractor will be paid—whether as a lump sum, on an hourly basis, or in milestone payments. It should also outline the payment method and any applicable conditions, such as deposits, late fees, or reimbursement for expenses.

Does an independent contractor agreement need to follow local laws?

Absolutely. Regardless of the terms agreed upon, the contract must comply with the laws in the jurisdiction where the work is performed. Any clause that violates mandatory legal requirements—such as licensing rules, tax obligations, or health and safety standards—will generally be unenforceable.

What jurisdictions can use our independent contractor agreement?

You can use our template to create a legal and valid independent contractor agreement for the following jurisdictions:

|

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

District of Columbia

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming |

AL

AK

AZ

AR

CA

CO

CT

DE

DC

FL

GA

HI

ID

IL

IN

IA

KS

KY

LA

ME

MD

MA

MI

MN

MS

MO

MT

NE

NV

NH

NJ

NM

NY

NC

ND

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VT

VA

WA

WV

WI

WY |