TL;DR- Worker classification determines tax obligations, benefit requirements, and legal compliance - misclassification can result in IRS penalties and back taxes

- Independent contractor agreements work best for specialized, project-based work where you need specific expertise without long-term commitment

- Employment contracts suit ongoing roles requiring supervision, integration into company culture, and regular schedule adherence

- IRS uses three main criteria: behavioral control, financial control, and relationship type to determine proper worker classification

- Professional platforms like Ziji Legal Forms provide compliant templates for both employment contract templates and independent contractor agreement templates

Introduction: Why the Distinction Matters

The decision to hire an independent contractor versus an employee represents one of the most consequential choices businesses face when expanding their workforce. This classification goes far beyond simple paperwork - it fundamentally determines tax obligations, legal responsibilities, and the entire structure of your working relationship with the individual.

Misclassification risks carry severe financial penalties. The IRS actively pursues businesses that incorrectly classify employees as independent contractors, imposing back taxes, interest, and substantial fines. The Department of Labor enforces wage and hour violations that can result in overtime back pay, while state agencies may impose additional penalties for benefits violations. Recent enforcement actions demonstrate that companies of all sizes face these risks, from small startups to major corporations.

Understanding proper classification criteria protects your business from costly compliance failures while ensuring workers receive appropriate protections and compensation. The stakes are too high to rely on assumptions or informal arrangements when clear legal frameworks exist to guide proper classification decisions.

Understanding the Key Differences

The fundamental distinction between employees and independent contractors centers on the degree of control and independence in the working relationship. Employment contracts create traditional employer-employee relationships subject to comprehensive oversight and legal protections, while independent contractor agreements establish business-to-business arrangements with self-employed professionals. For a deeper comparison of legal structure, tax implications, and control standards, read our complete guide on Independent Contractor Agreement vs Employment Agreement.

Employee Characteristics

Employees work under direct supervision with employers controlling both what work gets done and how it gets completed. They receive regular paychecks with tax withholdings, qualify for company benefits, and enjoy protections under federal labor laws including minimum wage requirements and overtime pay eligibility.

The employment relationship typically involves ongoing commitment, regular schedules, and integration into company operations. Employers provide the tools, training, and workspace employees need while expecting adherence to company policies and procedures.

Independent Contractor Characteristics

Independent contractors operate as self-employed professionals who maintain control over their work methods while accepting responsibility for their own taxes and benefits. They typically work project-based arrangements, serve multiple clients, and focus on delivering specific results rather than following prescribed processes.

Contractors provide their own tools, handle their own business expenses, and operate with significantly more autonomy in determining when, where, and how they complete their work. Payment occurs through invoicing rather than payroll, with contractors receiving 1099 forms for tax purposes.

When to Hire an Employee

Employment contracts make sense when you need ongoing integration of workers into your organization's daily operations. Consider hiring employees for roles requiring regular supervision, adherence to company policies, or participation in collaborative team-based activities.

Ideal Employee Scenarios

Long-term ongoing roles benefit from employment relationships that provide stability and consistency. Positions involving customer service, operations management, or core business functions typically require the reliability and commitment that employment arrangements offer.

Control over work methods becomes necessary when specific procedures, quality standards, or training requirements must be followed precisely. Employees can be trained in company-specific processes and held accountable for following established protocols in ways that independent contractors cannot.

Team integration requirements favor employment relationships when workers need to collaborate closely with existing staff, participate in company meetings, or contribute to long-term strategic planning. The ongoing nature of employment facilitates better communication and team cohesion.

Employee Benefits and Drawbacks

Advantages include greater loyalty and commitment, easier management and control, consistent availability for ongoing work, and better integration into company culture. Employees often develop deeper knowledge of company operations and can grow with the organization over time.

Disadvantages involve higher costs including benefits, payroll taxes, workers' compensation insurance, and administrative overhead. Employees also create ongoing financial obligations regardless of workload fluctuations and may require more extensive training and management.

When to Hire an Independent Contractor

Independent contractor agreements excel for specialized expertise, project-based work, or situations requiring flexibility without long-term commitment. These arrangements work best when you need specific skills for defined timeframes without ongoing employment obligations.

Ideal Contractor Scenarios

Specialized expertise requirements often justify contractor relationships when your internal team lacks specific technical skills. Web development, graphic design, consulting services, or other specialized professional services typically suit contractor arrangements where expertise matters more than ongoing supervision.

Project-based work with clear deliverables and timelines aligns perfectly with contractor relationships. Marketing campaigns, system implementations, seasonal work, or one-time projects benefit from contractor arrangements that provide specific skills without permanent hiring commitments.

Flexibility needs favor contractor relationships when workload varies significantly or when you need to scale resources up or down quickly. Contractors provide the ability to access talent when needed without the ongoing costs and commitments associated with permanent employment.

Contractor Benefits and Drawbacks

Advantages include lower overhead costs, access to specialized skills, flexibility in workforce management, and payment only for work performed. Contractors often bring fresh perspectives and can start contributing immediately without extensive onboarding.

Disadvantages involve less control over work methods and schedules, no guarantee of long-term availability, potential higher hourly rates, and reduced integration with company culture. Contractors may also prioritize other clients over your projects during busy periods.

Legal and Compliance Considerations

The IRS uses three primary categories to evaluate worker classification: behavioral control, financial control, and relationship type. Understanding these criteria helps ensure proper classification while avoiding costly penalties for misclassification.

IRS Classification Tests

Behavioral control examines whether the business directs how work is performed. Employee indicators include training provided by the company, detailed instructions about work methods, regular performance evaluations, and close supervision. Contractor indicators include worker setting their own schedule, determining work methods, and minimal supervision requirements.

Financial control evaluates the business aspects of the working relationship. Employees typically receive regular wages with expenses reimbursed and tools provided by the company, while contractors set their own rates, handle business expenses, and often work for multiple clients simultaneously.

Relationship type considers the permanence and nature of the working relationship. Employment indicators include ongoing indefinite relationships, benefits provision, and work that forms part of the company's core business operations. Contractor indicators include project-based relationships, no benefits provided, and services supplementary to core business operations.

Documentation Requirements

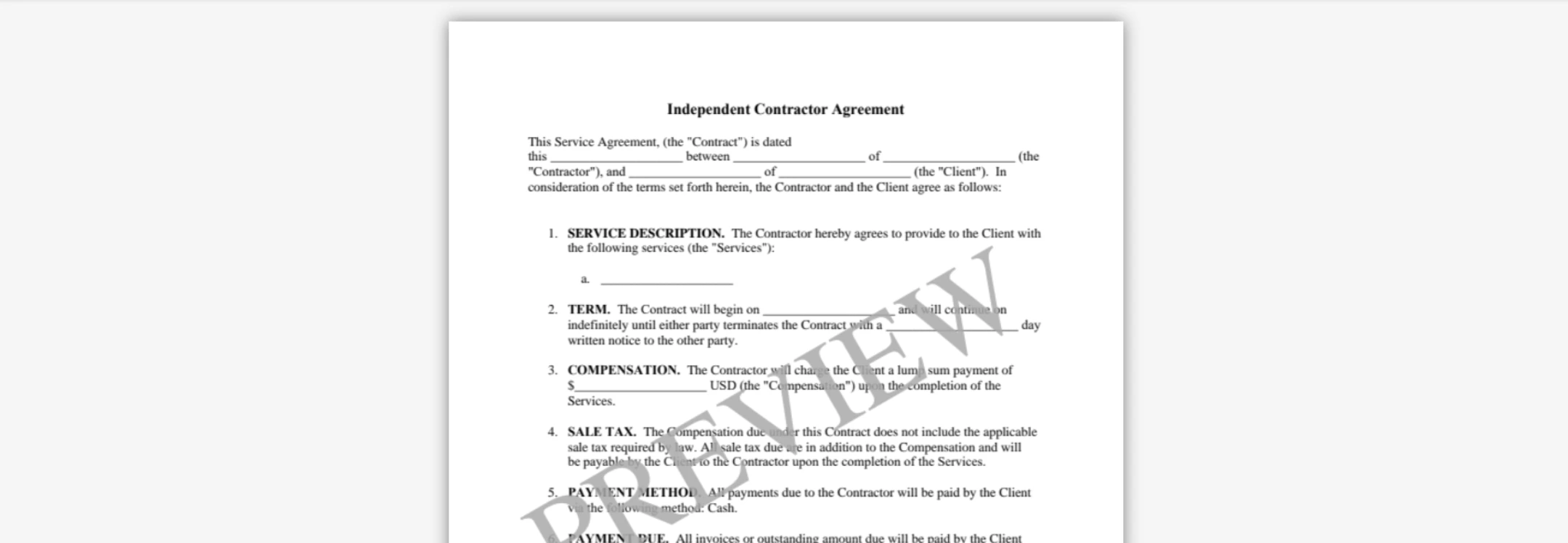

Proper documentation becomes crucial for supporting your classification decisions during potential audits or disputes. Employment contract templates should clearly establish the employer-employee relationship with appropriate language about control, benefits, and ongoing obligations.

Independent contractor agreement templates must establish the contractor's business independence while defining project scope, deliverables, and payment terms. The agreement should reflect the actual working relationship to support contractor classification under federal guidelines.

Using Ziji Legal Forms to Document Your Decision

Whether you need an employment agreement or an independent contractor agreement, Ziji Legal Forms makes the process easy, quick, and accurate:

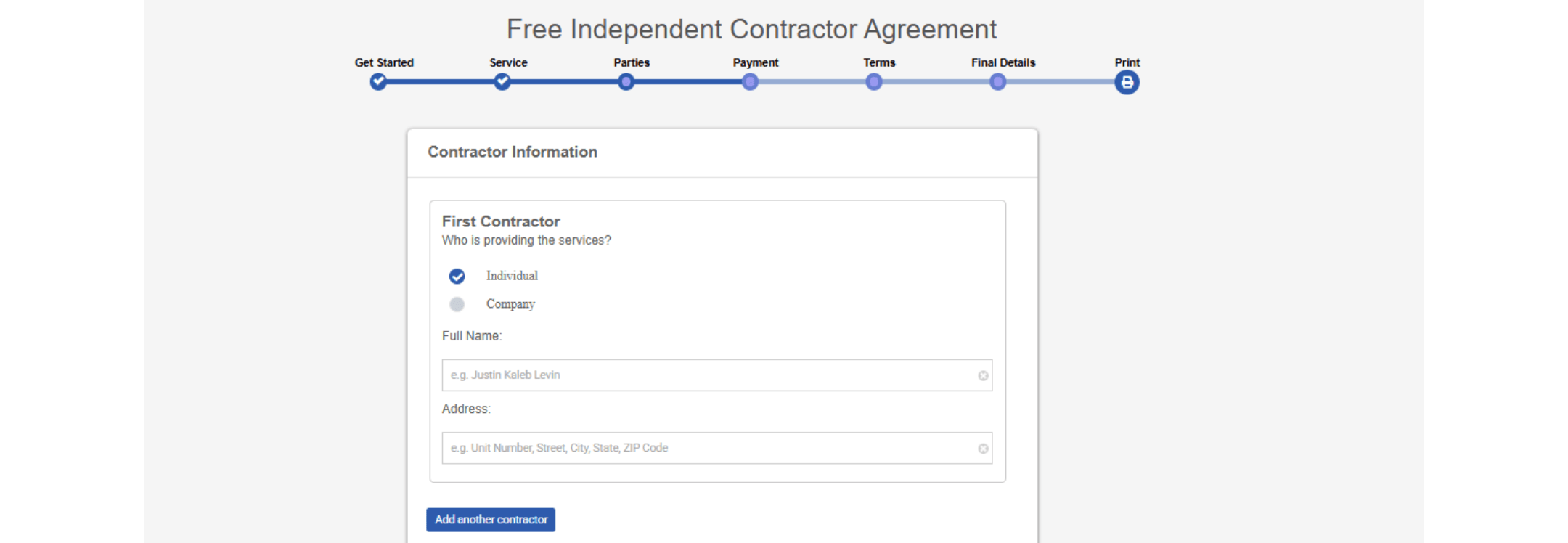

1. Visit Ziji Legal Forms

2. Answer a few guided questions to ensure your agreement is accurate

Fill out a short online questionnaire covering all important details and legal requirements.

3. Preview your agreement

Review the completed agreement to make sure all terms, conditions, and information added is correct.

4. Get it signed by the concerned parties

Download the agreement for digital signatures to ensure it is legally binding and ready for use.

Platform Advantages

- State compliance ensures documents meet local legal requirements without requiring extensive research into varying jurisdictions. Customizable options allow businesses to tailor agreements to specific situations while maintaining legal compliance.

- Lawyer-reviewed templates provide confidence that documents include current legal language and required provisions. Digital signature capabilities streamline the execution process while providing secure storage and easy access to completed agreements.

Best Practices for Classification Decisions

- Evaluate the actual working relationship rather than desired cost savings when making classification decisions. Federal agencies examine the substance of relationships, not just contract labels, when determining proper classification. Ensure your documentation matches the reality of how work will be performed.

- Consider long-term business needs when deciding between employment and contractor relationships. While contractors may seem less expensive initially, factor in the costs of finding, training, and managing multiple contractors compared to investing in employee development and retention.

- Seek professional guidance for complex situations or when classification decisions could have significant financial implications. While routine arrangements often work well with professional templates, unique circumstances may benefit from legal consultation to avoid unintended consequences.

Conclusion

The choice between hiring independent contractors and employees requires careful analysis of your business needs, the nature of the work, and legal classification requirements. Independent contractor agreements work best for specialized, project-based work where flexibility and specific expertise matter most, while employment contracts suit ongoing roles requiring supervision, integration, and long-term commitment.

Success in either arrangement depends on matching your documentation to the actual working relationship while ensuring compliance with federal classification requirements. Professional tools like Ziji Legal Forms simplify this process by providing compliant templates, guidance on proper classification, and customization capabilities that address specific business needs.

Whether you choose employment contract templates or independent contractor agreement templates, the investment in proper documentation protects your business from costly classification errors while ensuring fair treatment for the people who contribute to your success. Clear agreements benefit everyone involved by establishing expectations, protecting rights, and providing frameworks for successful working relationships.

Independent Contractor Agreement FAQs

What is an independent contractor agreement also known as?

An independent contractor agreement is also known as the following: consulting service agreement, general service agreement, service agreement, or service contract.

What is an independent contractor agreement?

An independent contractor agreement is an agreement that outlines the terms and conditions of the service relationship between the contractor and the client. The independent contractor is not an employee of the client and generally will determine the process to achieve the client’s goal and target outcome.

What’s the difference between an employment agreement and an independent contractor agreement?

Employment agreement is reserved only for employees and it has specific tax implications and employment rights for the parties. Generally speaking, an independent contractor agreement should be used for contractors that are hired to perform certain services for the client. The contractor is independent from the client and will generally have more control in the work process used to meet the client’s goal, where as the employee’s work are directly under the control of the employer. Moreover, the employee never runs the risk of loss unlike an independent contractor. (e.g. Contractor agrees to provide catering to the client and agrees to having fresh lobster in the meal. The price of lobster more than double in the months leading up to the event so the food cost for the contractor increases from 30% to 55%)

When should I use an independent contractor agreement?

Virtually any service work provided by the contractor to the client will be applicable to the independent contractor agreement.

Some common work where an independent contractor agreement is used are:

- Photographer

- Musician

- Caterer

- Decorator

- Cleaner

- Landscaper

- Consultant

- IT service provider

- Web designer

- Construction and home renovator (e.g. plumber, electrician, carpenter etc)

- Child care worker (e.g. babysitter, nanny, daycare worker etc)

- Instructional provider (e.g. math tutor, music teacher, personal fitness trainer etc)

What should be listed in an independent contractor agreement?

Some general topics that should be covered in an independent contractor agreement are:

- The Parties: The name and address of the contractor and the client.

- The Work: Describe the service the contractor will be performing for the client. Itemize the duties in detail to ensure both sides understand what the expectations are for the agreement so there will not be an ambiguity in the agreement.

- Duration: How long the contract will last, whether it’s a fixed term that has a specific end date, or whether it’s for an indefinite period that has no end date for an ongoing service.

- Payment: List how much the service will cost and how the contractor will be paid, such as whether it’s a lump sum payment or whether it’s a regular periodic payment. Also list what payment method will be used to pay the contractor.

- Terms: What terms that the contractor and the client have agreed to in the contract in dealing with topics such as late payment and interest, work expenses, initial deposit, contract termination etc.

- Confidentiality: Prevents the contractor from sharing sensitive business information and trade secrets of the client.

- Intellectual property: Whether the service perform by the contractor will generate intellectual property rights and decide if the contractor or the client will own those intellectual property rights.

Can an independent contractor agreement be changed after it has been signed?

Yes. Any changes must be approved by both the contractor and the client. Amendments should always be documented in writing and signed by both parties to ensure the updated terms are clear and legally binding.

Is a written independent contractor agreement necessary?

While some jurisdictions may recognize verbal agreements, having a written contract is strongly recommended. A written agreement clearly sets out the rights, responsibilities, and expectations of both parties, reducing the chance of misunderstandings or disputes.

What happens if one party breaches the independent contractor agreement?

If either the contractor or client fails to follow the agreed terms, it may be considered a breach of contract. The non-breaching party may be entitled to remedies such as damages, termination of the agreement, or enforcement of the original terms, depending on the circumstances and applicable laws.

How is payment typically handled in an independent contractor agreement?

The agreement should specify how and when the contractor will be paid—whether as a lump sum, on an hourly basis, or in milestone payments. It should also outline the payment method and any applicable conditions, such as deposits, late fees, or reimbursement for expenses.

Does an independent contractor agreement need to follow local laws?

Absolutely. Regardless of the terms agreed upon, the contract must comply with the laws in the jurisdiction where the work is performed. Any clause that violates mandatory legal requirements—such as licensing rules, tax obligations, or health and safety standards—will generally be unenforceable.

What jurisdictions can use our independent contractor agreement?

You can use our template to create a legal and valid independent contractor agreement for the following jurisdictions:

|

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

District of Columbia

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming |

AL

AK

AZ

AR

CA

CO

CT

DE

DC

FL

GA

HI

ID

IL

IN

IA

KS

KY

LA

ME

MD

MA

MI

MN

MS

MO

MT

NE

NV

NH

NJ

NM

NY

NC

ND

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VT

VA

WA

WV

WI

WY |