- A service agreement establishes relationships where providers deliver specific results or services with flexibility in how work is completed

- An independent contractor agreement formalizes business relationships with self-employed workers who control work methods while remaining responsible for taxes

- Service agreements focus on deliverables and outcomes while contractor agreements emphasize work independence and classification protection

- Key differences include control levels, tax implications, benefit eligibility, and legal compliance requirements for misclassification prevention

- Ziji Legal Forms offers distinct templates for both agreement types, ensuring proper documentation that protects all parties while maintaining legal compliance

Introduction: Distinguishing Two Important Business Relationships

The Core Difference Between the Two Agreements

Service Agreements Focus on Results

Independent Contractor Agreements Emphasize Independence

Service Agreements Explained

What Service Agreements Cover

Key Elements of Service Agreements

Who Uses Service Agreements

Independent Contractor Agreements Explained

Legal Classification Importance

Core Elements of Contractor Agreements

Key Differences Between Service Agreements and Contractor Agreements

Control and Independence

Tax Implications and Responsibilities

Benefits and Employment Protections

Relationship Duration and Nature

Legal Framework and Compliance

How Courts Interpret Service Agreements vs Contractor Agreements in Disputes

Creating Agreements Using Ziji Legal Forms in 5 Easy Steps

1. Choose template

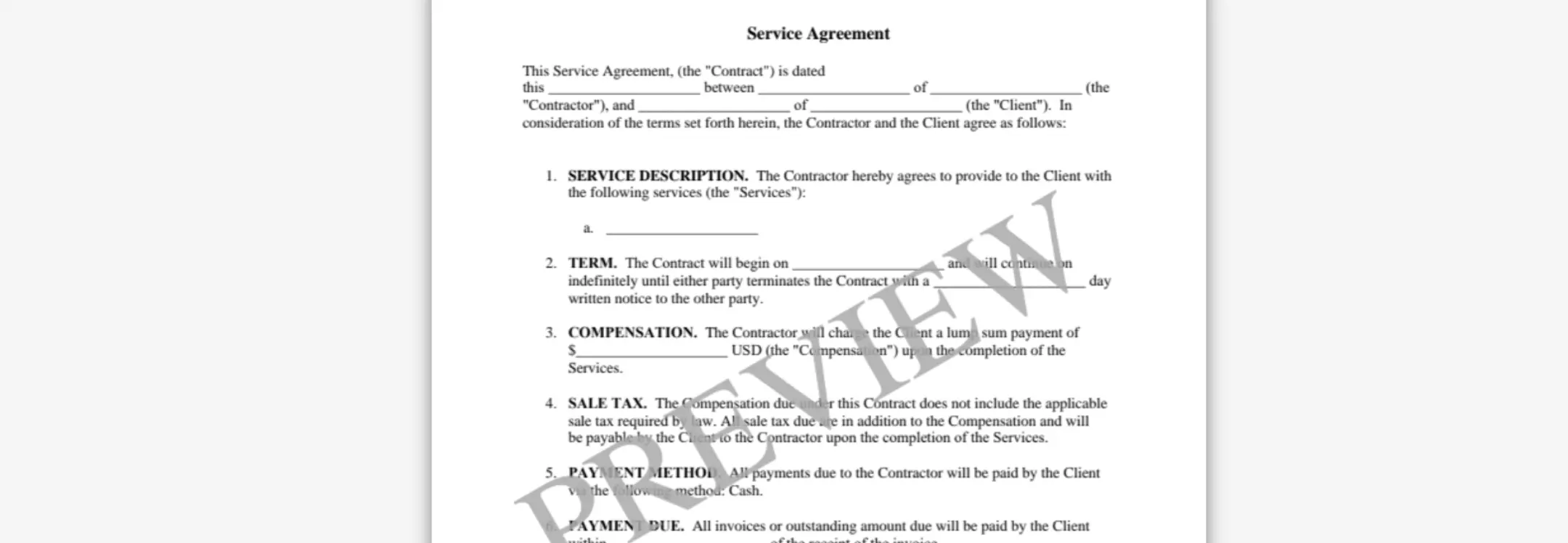

Access Ziji Legal Forms' Business section and select the appropriate Template for your type of service. You will find both, the Service Agreement Template and Independent Contractor Agreement Template

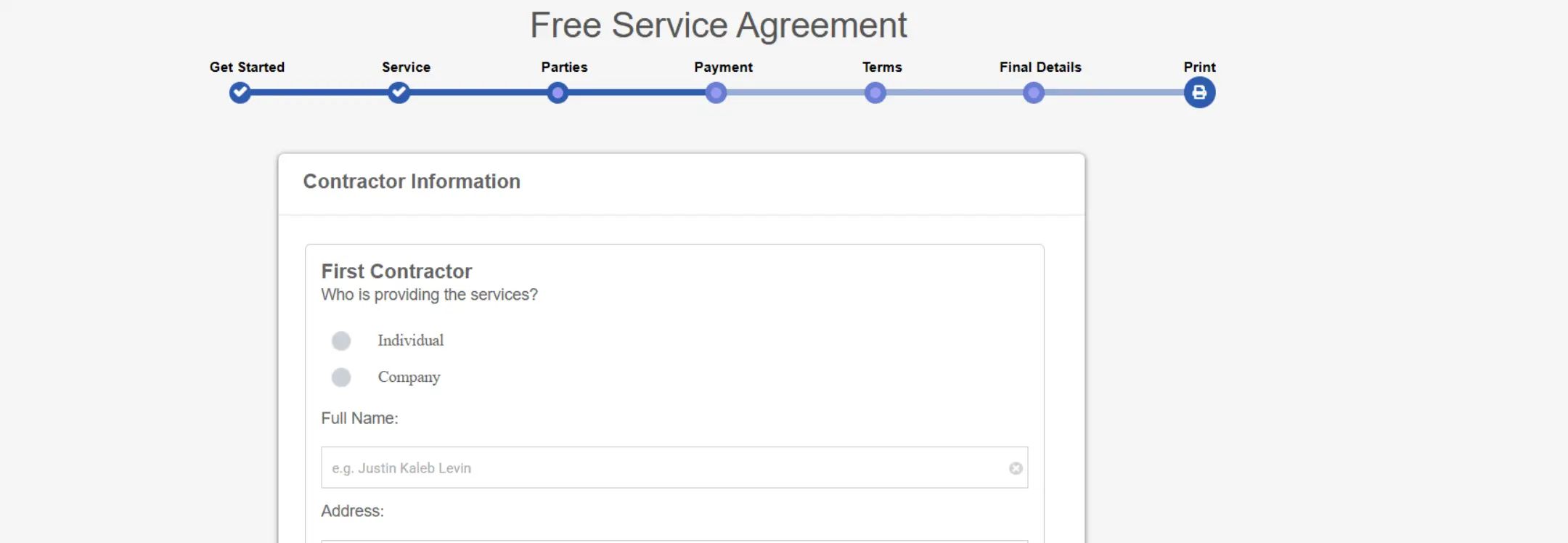

2. Add Party Details

Enter the full legal names, business information, and contact details of both the service provider and client to clearly identify all parties.

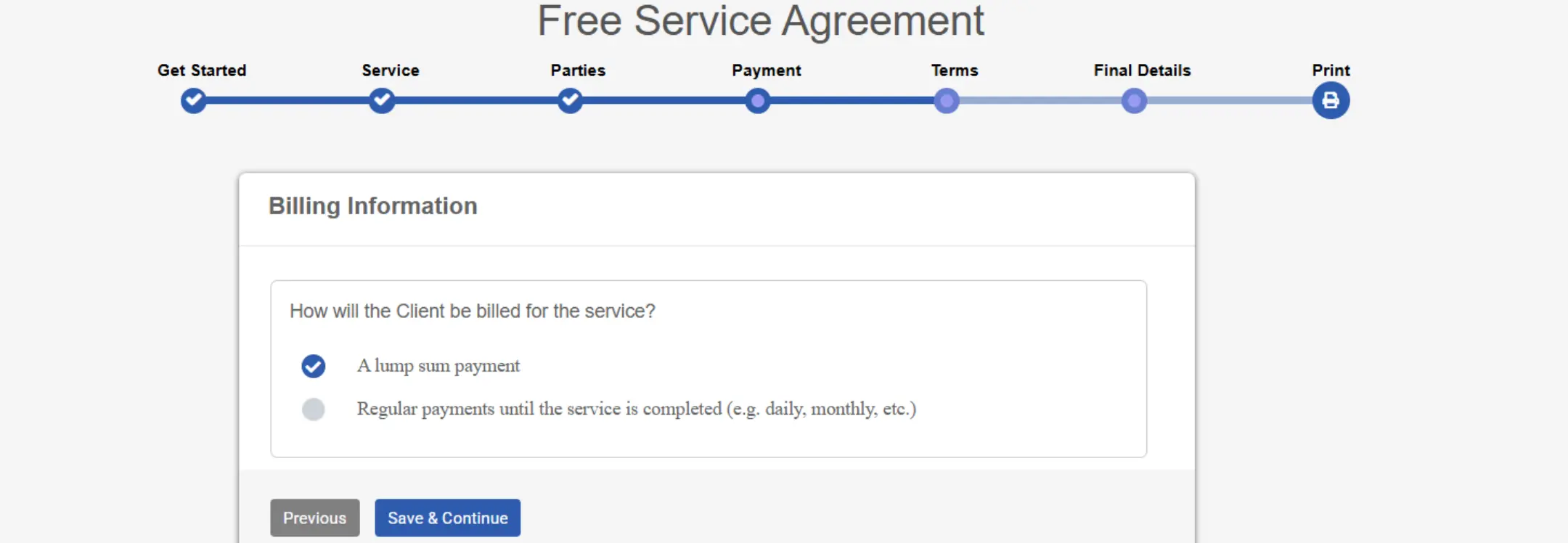

3. Add Payment Details

Specify service fees, payment schedule, invoicing procedures, and any late payment terms to ensure clear financial agreement

4. Add Term Details

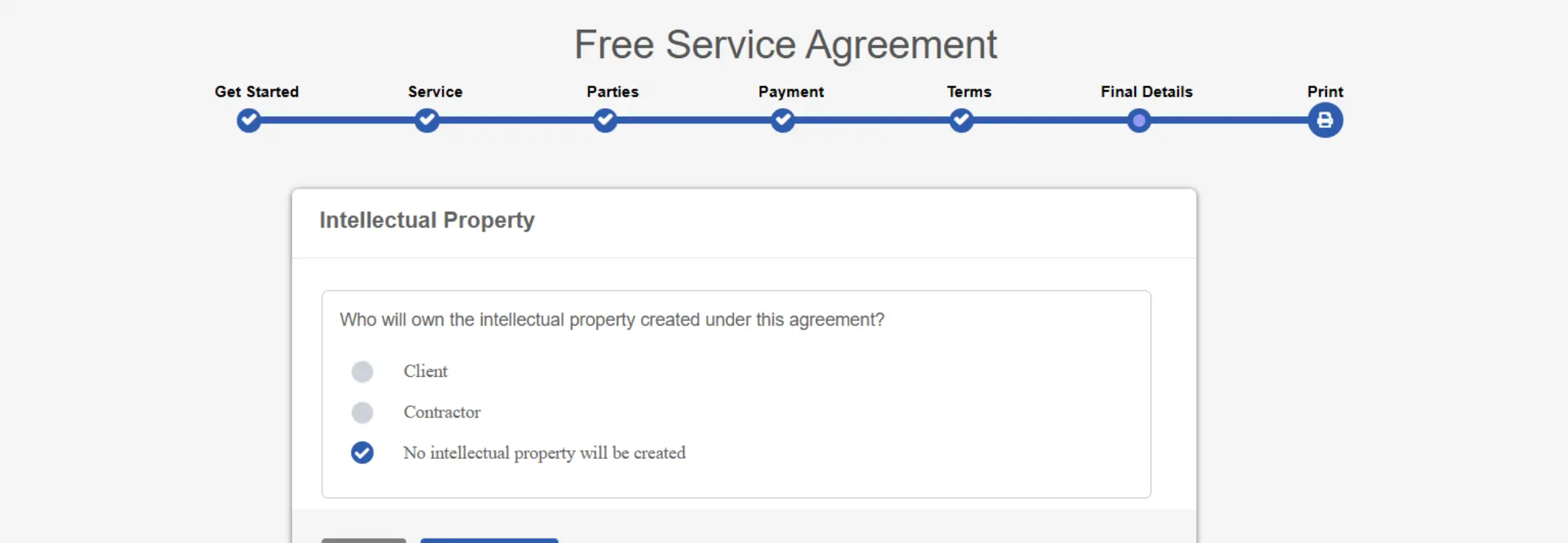

Define the scope of services, delivery timelines, confidentiality terms, termination conditions, and any industry-specific clauses relevant to your engagement.

5. Preview and print

Review the completed agreement thoroughly to confirm accuracy, then download it as a PDF or Word document for signing by all parties.

Avoiding Common Mistakes with Both Agreement Types

- Unclear or vague scope language creates disputes about whether contracted work was completed satisfactorily. Be specific about deliverables, quality standards, quantities, and exactly what services are included or excluded from the agreement.

- Failing to establish contractor independence in contractor agreements undermines proper classification and creates misclassification risk. Explicitly confirm the contractor maintains control over work methods, can work for other clients, and provides their own resources and tools.

- Inadequate payment documentation in service agreements creates billing disputes and collection problems. Specify exact fees, payment schedules, invoicing requirements, and procedures for handling late payments.

- Missing intellectual property provisions causes disputes about who owns work created during the engagement. Clarify ownership of deliverables, client materials, and contractor methodologies or pre-existing tools.

- Incomplete tax documentation in contractor agreements creates IRS compliance issues. Ensure agreements clearly establish the contractor's self-employed status, responsibility for taxes, and that no tax withholding will occur.

Conclusion: Choose the Right Agreement for Your Situation

Service agreements and independent contractor agreements serve different purposes in business relationships. Service agreements emphasize deliverables and outcomes while contractor agreements establish legally defensible independent contractor status.

Using Ziji Legal Forms' specialized templates for each agreement type ensures proper documentation, legal compliance, and protection for all parties involved in professional business relationships.

Which Agreement Is Better for Scaling Businesses and Startups

For growing businesses and startups, choosing the right agreement impacts flexibility, compliance, and cost control. Service agreements are often preferred when outsourcing defined outcomes such as marketing, IT support, or consulting because they emphasize deliverables rather than labor structure. This helps businesses scale without creating employment-like dependencies.

Contractor agreements are better suited when individuals are hired for ongoing, skill-based work that requires autonomy and minimal oversight. However, improper use can trigger worker misclassification risks as teams grow. Startups should also consider investor scrutiny, as unclear contracting practices can surface during due diligence. Selecting the right agreement early helps avoid renegotiation, compliance corrections, and operational friction later.

Service Agreement FAQs

What is a service agreement also known as?

A service agreement is also known as the following: consulting service agreement, general service agreement, independent contractor agreement, or service contract.

What is a service agreement?

A service agreement is an agreement that outlines the terms and conditions of the service relationship between the contractor and the client. The independent contractor is not an employee of the client and generally will determine the process to achieve the client’s goal and target outcome.

What’s the difference between an employment agreement and a service agreement?

Employment agreement is reserved only for employees and it has specific tax implications and employment rights for the parties. Generally speaking, a service agreement should be used for contractors that are hired to perform certain services for the client. The contractor is independent from the client and will generally have more control in the work process used to meet the client’s goal.

When should I use a service agreement?

Virtually any service work provided by the contractor to the client will be applicable to the service agreement. Some common work where a service agreement is used are:

- Photographer

- Musician

- Caterer

- Decorator

- Cleaner

- Landscaper

- Consultant

- IT service provider

- Web designer

- Construction and home renovator (e.g. plumber, electrician, carpenter etc)

- Child care worker (e.g. babysitter, nanny, daycare worker etc)

- Instructional provider (e.g. math tutor, music tutor, personal fitness trainer etc)

What should be listed in a service agreement?

Some general topics that should be covered in a service agreement are:

- The Parties: The name and address of the contractor and the client.

- The Work: Describe the service the contractor will be performing for the client. Itemize the duties in detail to ensure both sides understand what the expectations are for the agreement so there will not be an ambiguity in the agreement.

- Duration: How long the contract will last, whether it’s a fixed term that has a specific end date, or whether it’s for an indefinite period that has no end date for an ongoing service.

- Payment: How the contractor will be paid, such as whether it’s a lump sum payment or whether it’s a regular periodic payment. Also list what payment method will be used to pay the contractor.

- Terms: What terms that the contractor and the client have agreed to in the contract in dealing with topics such as late payment and interest, work expenses, initial deposit, contract termination etc.

- Confidentiality: Prevents the contractor from sharing sensitive business information and trade secrets of the client.

- Intellectual property: Whether the service perform by the contractor will generate intellectual property rights and decide if the contractor or the client will own those intellectual property rights.

Can a service agreement be changed after it’s signed?

Yes, but any modifications must be agreed to by both the contractor and the client. Changes should always be put in writing and signed by both parties to avoid misunderstandings and to make sure the updated terms are legally binding.

Is a written service agreement always required?

While verbal agreements may be legally valid in some situations, having a written service agreement is strongly recommended. A written contract clearly sets out the rights, duties, and expectations of each party, which helps prevent disputes and provides a record if a disagreement occurs.

What happens if one party breaches the service agreement?

If either the contractor or the client fails to follow the agreed terms, this could be considered a breach of contract. The non-breaching party may be entitled to remedies such as payment for losses, cancellation of the agreement, or enforcing the original terms—depending on the situation and applicable laws.

How does intellectual property ownership work in a service agreement?

The contract should specify whether any intellectual property created during the work belongs to the contractor or the client. Without clear terms, disputes may arise over ownership of things like designs, written materials, software, or creative works produced during the project.

Do service agreements need to comply with local laws?

Absolutely. Regardless of what is written in the agreement, it must follow the laws and regulations of the jurisdiction where the work is being performed. If a clause conflicts with statutory requirements—such as licensing, payment timelines, or safety standards—it will generally be considered invalid.

What jurisdictions can use our service agreement?

You can use our template to create a legal and valid service agreement for the following jurisdictions:

| Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming | AL AK AZ AR CA CO CT DE DC FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY |