Last Updated: October 18, 2025

TL;DR

- A clear last will helps prevent family disputes by outlining your wishes in detail.

- Key elements include naming an executor, guardians for minors, and specific asset distributions.

- Don't forget to cover digital assets, funeral preferences, and a residuary clause for leftover property.

- Regular updates to your will ensure it reflects major life changes like marriage, divorce, or new children.

- The blog also shows how to create a legally valid will using Ziji Legal Forms’ customizable templates.

Introduction

A properly drafted last will and testament can spare your loved ones from confusion and conflict by clearly stating your final wishes. When a will is vague, incomplete, or outdated, it often becomes a recipe for family strife. In the aftermath of a death, even close-knit families can end up in bitter legal battles over what the deceased “would have wanted,” especially if the will’s instructions are unclear or perceived as unfair. These fights are not only emotionally devastating – they can also be lengthy, expensive, and permanently damaging to relationships.The good news is that a little forethought can prevent most of these disputes. By creating a comprehensive last will and testament document that covers key details, you greatly reduce the chances of misunderstandings or challenges. Clarity and completeness are absolutely crucial. This article will walk you through 9 essential things to include in your will to minimize family conflicts, and then outline steps to make your will contest-proof. We’ll also show how you can easily create a legally valid will online using Ziji Legal Forms, a platform that guides you through the process. By the end, you’ll understand how a well-crafted will can keep the peace among your heirs and ensure your wishes are honored without dispute.

Here are 9 Things to Include in Your Last Will and Testament to Avoid Family Disputes

Clear Identification of the Testator and Intent

One of the foundational elements of any valid will is a clear statement of who is making the will and what the document is. Your will should explicitly identify you (the testator) by your full legal name, address, and possibly other details (like birthdate) to avoid any confusion with someone else. It should also declare that the document is your final will and testament and that you are making it voluntarily, with the intent to distribute your assets according to your wishes. For example, a typical opening clause might read: “I, Jane Doe, a resident of [City, State], being of sound mind and of legal age, hereby declare this to be my Last Will and Testament, revoking all previous wills and codicils.” This kind of language makes it unambiguously clear who the testator is and that you fully intend for this document to serve as your binding will. Including an explicit statement of intent helps prevent claims that the will is a draft or was signed under duress. It also wards off allegations of forgery or fraud.

If your name, personal details, and a declaration of intent are front and center, it’s harder for anyone to claim the will isn’t really yours. By clearly identifying yourself and declaring your intentions, you set a solid foundation that can withstand scrutiny. Essentially, you are saying “This is me, this is what I want, and I mean it.” That leaves little room for would-be challengers to argue otherwise.

Appointment of a Trustworthy and Neutral Executor

Choosing the right executor is crucial for a smooth estate settlement. The executor is the person who will administer your estate. This person is in-charge of collecting assets, paying debts, and distributing property to beneficiaries as your will directs. To avoid family disputes, it’s vital to appoint an executor who is trustworthy and neutral. This should be someone responsible, organized, and impartial. Ideally, they should be able to navigate family dynamics without favoring one beneficiary over another.

Many people default to naming their oldest child or another close family member as executor. But if your family members don’t get along or if the person you’re considering might have a conflict of interest, that choice could lead to problems. For example, naming one sibling as executor over another could stoke resentment or suspicions of bias in administering the last will and testament. Instead, consider whether a neutral third party such as a trusted family friend, a relative by marriage, or even a professional fiduciary might be better. An independent or neutral executor can help ensure that all beneficiaries feel the process is fair, reducing the chances of fights.

Whomever you choose, discuss the role with them in advance to make sure they are willing and able to serve. Outline your wishes and the location of important documents. By picking a capable executor who can remain above family fray, you prevent disputes like accusations that the executor is mismanaging the estate or favoring certain heirs. Instead, your family members can trust that the person in charge will carry out your last will and testament forms objectively and according to law. This is a key step in keeping everyone focused on honoring your wishes rather than arguing among themselves.

Specific Asset Distribution with Detailed Descriptions

One of the most common causes of inheritance disputes is vague or overly general bequests. If your will says something like “I leave all my possessions to my children to share equally,” you might think you’ve covered everything but you could be inadvertently setting the stage for confusion and conflict. What does “possessions” include? Who gets which items specifically? To avoid ambiguity, list specific assets and identify who should receive each one, using detailed descriptions. A well-crafted will itemizes major assets (real estate, bank accounts, investments, vehicles, etc.) and unique or valuable personal items (family heirlooms, jewelry, collectibles) rather than lumping everything together without clarity.

Being specific is crucial because anything left unclear can lead to family members interpreting things in different ways and potentially fighting it out in court. For example, if you have a classic car or a piece of valuable jewelry that isn’t explicitly mentioned in the will, two or more heirs might each assume they were meant to get it.

If you intend an equal division of residual assets (like whatever cash remains after specific gifts), state the formula clearly (e.g., “divide the remainder of my estate equally among my three children, in equal one-third shares”). The more precise you are, the less your beneficiaries will argue over interpretations. By providing a clear roadmap of your asset distribution, you save your family from guessing at your intentions. This level of detail may make your will longer, but it makes it far stronger as a tool to avoid disputes. Each beneficiary will know exactly what you intended them to receive, which helps keep expectations aligned with reality.

Alternate Beneficiaries for Key Assets

Life is unpredictable. What happens if a person you named in your will passes away before you, or if they simply can’t or won’t accept the inheritance? If your will is silent on this scenario, it could lead to parts of your estate falling into legal limbo or being distributed according to state default laws (which might not match your wishes). That uncertainty can also spark disputes among surviving family who each have opinions on what “should” happen. To prevent this, include alternate beneficiaries for important assets and bequests. An alternate (or contingent) beneficiary is essentially a backup inheritor: “If X cannot inherit (due to death or disclaimer), then I give that asset to Y instead.”

Including these contingency beneficiaries is especially important for major assets like real estate, businesses, or large financial accounts. It’s also wise for any bequests to friends or extended family who may be older or in uncertain health. Without an alternate named, a predeceased beneficiary’s share might accidentally end up back in the pool to be split among others or trigger a legal contest. A well-written will should account for these possibilities.

The goal is to prevent confusion or intestacy (where the law, not your will, decides who inherits) by covering “what if” scenarios. When everyone knows there’s a backup plan laid out, there’s little to argue about. Each asset will transfer smoothly either to the primary person you chose or to the alternate you named. This foresight keeps the distribution process clear and dispute-free, even when life doesn’t go as initially expected.

Explanation for Unequal or Excluded Inheritances

One of the most emotionally charged sources of will contests is when an heir feels unfairly treated. For instance, if one child receives a significantly larger share than another, or if someone expected to be included is left out entirely. While you are absolutely within your rights to distribute your estate as you see fit, failing to address the reasoning can leave a cloud of hurt feelings and suspicion. Beneficiaries who feel slighted may assume it was a mistake, or worse, that another family member manipulated you. These feelings often motivate will contests and family feuds. A simple way to mitigate this risk is to include a brief explanation for any unequal or excluded inheritances. You have a couple of options for how to do this.

Some people include a line in the will itself, such as, “I have chosen not to leave anything to my brother Jason Smith, X, for reasons well known to him,” or “I am leaving a larger share to my daughter Jane Smith who has special needs.” Even a one-sentence explanation can signal that the decision was intentional and thought-out, not an oversight or a result of undue influence. Another approach is to write a separate letter of explanation (sometimes called a letter of wishes) to be kept with your will. In this personal letter, you can more freely express your reasons and feelings. For example, explaining that you provided more financial help to one child during your life, or that you love an estranged relative but have decided to exclude them for personal reasons. While this letter isn’t legally binding, it can be tremendously helpful in heading off challenges and providing closure to your family.

From a dispute-prevention perspective, transparency is kindness. It robs a potential will-contester of the argument that you simply “forgot” them or were manipulated, since you’ve shown in your own words that you deliberately made that choice of your own free will. Similarly, if shares are unequal, explaining the rationale (however simple or complex) can reduce perceptions of favoritism or mistake. This doesn’t mean the disappointed heir will be happy, but they may be less likely to resort to a legal battle if they understand your reasoning. It also provides emotional reassurance. A statement of love or acknowledgement can soothe hurt feelings. In sum, including explanations for contentious decisions in your last will and testament forms (or in an attached letter of wishes) is a thoughtful step to preempt conflicts and help your family accept your decisions.

Personal Property Memorandum (if applicable)

Not everything you own is a bank account or a house – often, the most beloved and fought-over items are personal possessions with sentimental value: Grandma’s china set, a favorite painting, photo albums, etc. Listing every single personal item in your will can make the will unwieldy and hard to update, yet leaving those items unaddressed can lead to family squabbles. The solution in many states is to use a Personal Property Memorandum, which is a separate document referenced by your will that details who should get specific personal items. Essentially, your will can say, “I may leave a written statement or memorandum detailing the disposition of certain items of tangible personal property; if such a document is found, I direct that its instructions be followed.” Then, in that personal property memorandum (which you can write and update outside the will), you can list out items and the intended recipients.

The beauty of this approach is flexibility. A personal property memorandum allows you to create a detailed list of personal gifts without having to formally amend your will each time you want to make a change. For example, you could keep an ongoing list of items like “Grandfather’s gold pocket watch to my son, James; Blue porcelain vase to my sister, Maria; Wedding photo album to my daughter, Ella,” and so on. You can update this list as you acquire or gift items during your life. It’s important to describe each item clearly (include identifying details or even attach a photo) and to use the full names of the recipients, so there’s no confusion about who or what you meant. The will must reference the memorandum for it to be legally effective, and the memorandum should be signed and dated.

Including a personal property memorandum can significantly reduce fights over sentimental items, which are often the hardest assets to value and divide. Without guidance, family members might squabble or harbor resentment over who gets what keepsake. But with a memo in place, it’s clear that, say, the vintage guitar goes to the person you named because that was your written wish. This also keeps your will from getting cluttered with dozens of small bequests. You reserve the will for the big things and handle the smaller items in the memo. If your estate includes many personal treasures or heirlooms, consider preparing a personal property memorandum as an addendum to your will. It’s a straightforward tool that expands your will’s detail and ensures even the little things are given to the right people, minimizing the chance of any hard feelings or disputes over those items. However, not every state recognizes personal property memorandum. It is best to consult a local attorney and relevant state statutes to ensure you can use personal property memorandum in conjunction with your will. The safer alternative is always to list all gift in the will itself without using a personal property memorandum.

Guardianship Provisions with Contingency Plans

If you have minor children, or other dependents under your care, such as a child with a disability, naming guardians in your will is absolutely essential. In fact, from a family dispute standpoint, failing to designate a guardian is one of the most consequential omissions you can make. It means you are leaving the decision of who will raise your children to the courts and the potential tug-of-war of relatives. To avoid a traumatic guardianship battle in the event of your untimely passing, your will should clearly appoint a primary guardian for your minor children, as well as an alternate guardian in case your first choice is unable or unwilling to serve. Be sure to discuss your guardianship choices with those individuals ahead of time to confirm they’re on board with the responsibility.

By naming a guardian, and backup guardian, you accomplish two things: you provide stability and certainty for your children, and you prevent family members from later feuding over who should take care of the kids. Imagine the scenario if no guardian is specified. Multiple grandparents, aunts or uncles might each think they’re the best choice and even take the matter to court, leading to a painful family rift.

In writing your guardianship provision, include enough detail. State the full name of the person you want as guardian of the person (for personal care of the child), and if appropriate, a guardian of the estate (for managing the child’s property, which often is the same person but they could be different). Also, specify any conditions or special instructions. For example, you might name a married couple as co-guardians, or you might say, “I appoint my sister, Jane Smith, as guardian. If Jane is unable to serve, I appoint my friend, Robert Shaw, as alternate guardian.” Including the alternate is critical; just like with other bequests, you want a contingency plan. Additionally, consider adding a short statement of why you chose these individuals or how you want your children to be raised (education, religion, etc.), if that’s important to you. Though not legally binding, it provides guidance.

Remember that without your input, a court will decide guardianship based on petitions it receives, and that process can pit family members against each other. By making the decision yourself in a last will and testament format that includes guardianship, you remove uncertainty and prevent potential family disputes in one of the most sensitive areas imaginable.

No-Contest Clause (In Terrorem Clause)

A no-contest clause (Latin name in terrorem clause, meaning “in fear”) is a provision you can include in your will to discourage beneficiaries from challenging it. In simple terms, a no-contest clause says that if a beneficiary contests the will, they forfeit whatever you left them, effectively disinheriting themselves. The purpose is to put some teeth behind your will: anyone who might be unhappy with their share knows that if they try to fight it in court, they risk getting nothing at all. This can be highly effective in deterring frivolous or spiteful challenges to your will, because beneficiaries will “think twice” before launching a lawsuit that could leave them worse off than if they had just accepted your terms.

Including a no-contest clause is especially useful if you suspect a particular heir might be inclined to sue (for example, a child who received a smaller portion, or a relative you chose to exclude). It essentially forces them to choose: accept the gift you did leave, or contest and potentially walk away with nothing. For instance, your will could state, “If any beneficiary under this will contests the validity of any part of this will, then that beneficiary shall receive no part of my estate and shall be treated as if they predeceased me.” With such a clause, someone who is unhappy but stands to inherit, say, $10,000, knows that filing a contest could result in losing that $10,000 entirely if they contest the will. That risk alone can be enough to deter most challenges from being filed.

A no-contest clause only works as a deterrent if the person has something to lose. That’s why some estate planners suggest leaving even a nominal amount to someone you’re disinheriting, so that the clause is hanging over that bequest. For example, if you suspect a disinherited child will contest, you might leave them a small sum (or a specific item) and then include the no-contest clause they then risk that small inheritance if they go to court. On the other hand, if you truly want to leave them nothing, a no-contest clause won’t stop them since there’s no inheritance to forfeit as a potential deterrent.

In summary, a no-contest clause can be a powerful addition to your will to preserve your wishes. It sets a high stakes penalty for fighting the will, which can keep even disgruntled family members in line with your plan. Use it thoughtfully and ensure it aligns with your state law. While it’s not a guarantee against a will contest, it tilts the odds heavily in favor of your will standing as written, because potential challengers will be very wary of risking their own inheritance by mounting a challenge.

Final Message or Statement of Intent

Lastly, consider including a personal final message in your will. A statement of wishes, values, or affection that isn’t about who gets what, but about leaving your loved ones with words of closure. This section is optional from a legal standpoint and often people choose to express these sentiments in a separate letter rather than in the will itself, but it can be incredibly meaningful and dispute-diffusing. A final message or statement of intent is your chance to speak directly to your family and friends, to reinforce your hopes and love for them, and to clarify the spirit behind your decisions.

For example, you might write a short paragraph saying, “Above all, I want to thank my family for the love we’ve shared. I have done my best to distribute my assets in a way that I believe is fair and reflective of each of your needs and the help I’ve given during my life. I love you all and hope you will support each other. It is my sincere wish that no one feel slighted or unloved – each of you meant the world to me.” These kinds of statements can preempt a lot of hard feelings. If someone was left a smaller share, hearing from you directly that you still valued them can ease the sting. If you made unconventional choices (like leaving a charitable gift or providing more for someone with greater need), explaining your positive intent can foster understanding. Essentially, you are addressing the emotional aspect of your estate plan.

Including a heartfelt message can also discourage challenges indirectly: it’s harder to contest a will when the person’s own words plainly show they were acting out of love and fairness, not confusion or coercion. It humanizes the document. Some people even use a video message for added personal touch (though the written word in the will or accompanying letter is the official record). Keep in mind, a final statement in the will becomes public record when the will goes to probate, so if you prefer privacy, a separate letter delivered to your family might be better. But either way, do communicate your intent. Many family disputes over wills are fueled by feelings of betrayal or confusion. By proactively addressing your decisions and emphasizing your care for all parties, you take the air out of those sails. Your beneficiaries are reminded that the distributions were made with consideration and that they are loved. That emotional reassurance can be the difference between relatives accepting your will versus resenting it. In short, a final message is a humane touch that costs nothing but can yield a legacy of peace and understanding.

Five Steps to Prevent Someone from Contesting a Will

Even if your will includes all the right provisions and clarity, you might still worry about a determined individual trying to challenge it. Will contests are not extremely common, but they do happen – typically on grounds like lack of mental capacity, undue influence, or improper execution. Beyond drafting a thorough will, there are additional proactive steps you can take to make your will “contest-proof” or at least very hard to successfully contest. The following are five steps, recommended by estate experts, to further prevent someone from contesting your will:

1. Obtain Medical Confirmation of Capacity at Signing

One frequent claim in will contests is that the deceased (you) lacked testamentary capacity. In other words, that you were not of sound mind when making the will. You can preempt this by proving your capacity at the time of signing. Consider getting a letter or affidavit from a doctor (or mental health professional) around the time you execute your will, stating that you are in good mental health and fully understand what you’re doing. Additionally, choose witnesses who can later testify to your alertness and understanding. Witnesses should be able to attest that you knew what the will said and its consequences when you signed it. Taking these measures creates strong evidence that you met the legal capacity requirement, making it very difficult for anyone to claim otherwise.

2. Store a Letter of Wishes or Explanation with Your Will

As mentioned earlier, a letter of wishes can explain your decisions, especially any unusual or unequal provisions. From a contest perspective, such a letter kept alongside your will is invaluable. If a disinherited person tries to argue that you were under undue influence or forgot them by mistake, your own written words can refute that. In your letter, clearly state that you made decisions freely and thoughtfully, and perhaps why. For example, “I am of sound mind and I have chosen to leave a larger share to my daughter who has greater need, and less to my son who is financially secure. This is my deliberate decision.” This kind of explanation undercuts a contest before it even begins. It’s not legally binding, but it can be shown to a judge to demonstrate your intent and state of mind. It’s essentially extra insurance that your true wishes are understood and respected.

3. Register and Safely Store Your Will

Another practical step is ensuring the original signed will is kept safe and accessible to your executor after your death. If a will is lost, destroyed, or tampered with, that opens the door to contests and confusion. For example, someone might try to claim you revoked it, or push an older will or copy with changes. Store your will in a secure location like a fireproof safe at home, a safe deposit box (just make sure someone trusted can access it when needed), or lodged with your attorney. Some states allow you to file your will with the probate court for safekeeping during your lifetime which is typically sealed until death. Whichever method you choose, let your executor and key family members know where the will is stored. Additionally, explicitly revoke any prior wills in the text of your latest will (standard language in most wills) and destroy any old copies. This way, there’s no confusion about which document is authoritative. Proper storage and registration, if available, prevents situations where an unhappy relative might conceal a will or submit a fraudulent one. A clearly valid, original will that surfaces immediately upon your death leaves little opportunity for contests. The facts of the will’s existence and terms are solid and cannot be easily challenged.

4. Keep Your Will Updated and Document Changes

As your life circumstances change, update your will accordingly rather than letting it become stale or full of outdated provisions. Regular updates ensure your will always reflects your current intent, which is harder to contest. Also, if you’ve updated your will multiple times over the years, it shows a pattern of decision-making that will contests can’t easily disrupt (it’s tough to argue you lacked capacity if you’ve been fine-tuning your estate plan consistently and coherently). Each time you update, use the same formalities (witnesses, etc.) and include a clause reaffirming that you are of sound mind. Some attorneys even attach a brief memo or have witnesses sign an affidavit about your capacity at each update. By revoking previous wills and clearly dating new ones, you eliminate the risk of dueling wills or confusion. And if a major family event happens (marriage, divorce, birth, etc.), definitely update the will. It’s often contests related to such changes (e.g., an accidentally omitted child, or an ex-spouse still named) that land in court. A current, well-maintained will deprives potential challengers of the argument that it no longer reflected your true intentions or that something was amiss. It shows you were actively in control of your estate planning.

5. Communicate Your Plan to Family and Beneficiaries

This step is more personal but extremely effective: Where possible, have open conversations with those impacted by your will. If your children and other close relatives understand your estate plan and the reasoning behind it before you’re gone, they are far less likely to be shocked into contesting it later. Discussing your will’s general outline. You don’t necessarily have to divulge every dollar, but do convey the broad strokes and that can help clear the air. You might explain, for instance, “I'm providing for your sister’s kids’ education in our will, which means her share is a bit larger, but I’ve also made sure you’re taken care of,” or “I’ve left the house to John because he’s lived there and maintained it, while you will receive the vacation cabin,” etc. These talks allow for questions or emotions to be addressed while you are there to answer. It can prevent the “nasty surprise” factor that often triggers contests. Not everyone is comfortable doing this. Family dynamics vary, but even writing your intentions in a personal letter as mentioned earlier can help. The key is to ensure no one entitled to inherit is completely blindsided by the contents of the will. When beneficiaries know what to expect and why, they may not love every detail, but they’re more likely to accept it without resorting to legal action. You’re effectively removing the fuel (suspicion, confusion, indignation) that might potentially feed the contesting of you will. In addition, if you communicate your wishes clearly, it helps negate any later claims that you were influenced by one heir to favor them; multiple people will have heard directly from you what you wanted, making it harder for anyone to rewrite history after you’re gone.

By following these five steps in conjunction with drafting a clear, inclusive will, you create a nearly ironclad estate plan. You’ll have satisfied legal formalities, documented your sound mind and intent, discouraged litigation through a no-contest clause, and prepared your loved ones emotionally. While no plan can guarantee zero disagreements, you will have dramatically reduced the avenues and incentives for a will contest. The result is that your last will and testament is far more likely to be carried out exactly as you wrote it, with your family respecting your wishes rather than battling over them.

How to Make a Legally Valid Will with Ziji Legal Forms

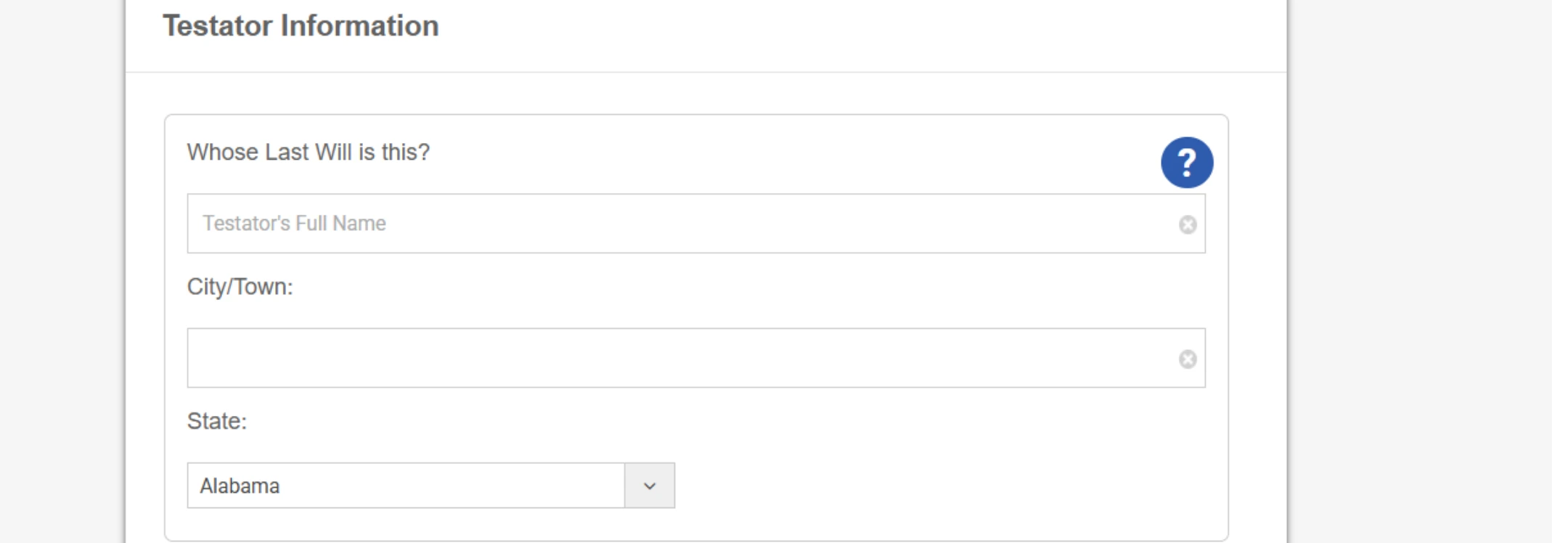

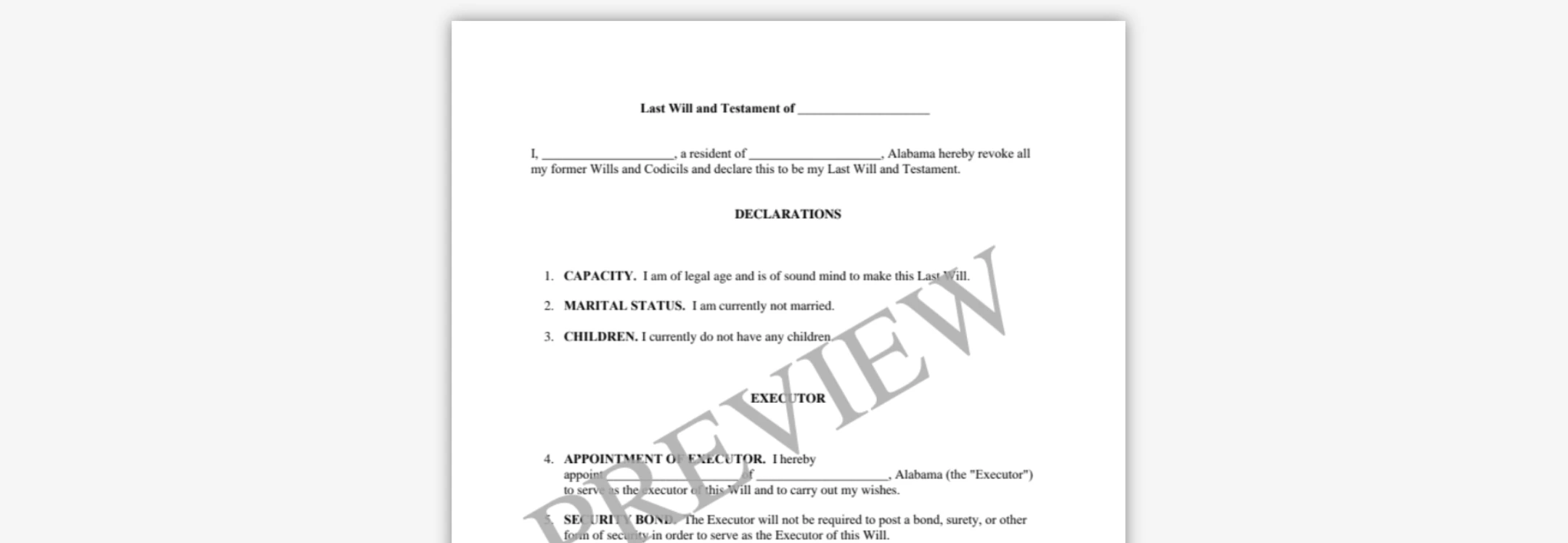

Now that we’ve covered what to include in a will and how to fortify it against disputes, you might be wondering about the practical process of making your own will. The idea of hiring a lawyer and dealing with legal jargon might feel daunting or costly. The good news is that services like Ziji Legal Forms offer an accessible way to create a legally valid last will and testament online. In fact, we provide a free trial to last will and testament forms that you can customize through a guided questionnaire. It’s designed to be easy for anyone, even if you have no legal background. Let’s walk through how you can make your will with Ziji Legal Forms in a few simple steps:

1. Select your state to generate a compliant last will and testament.

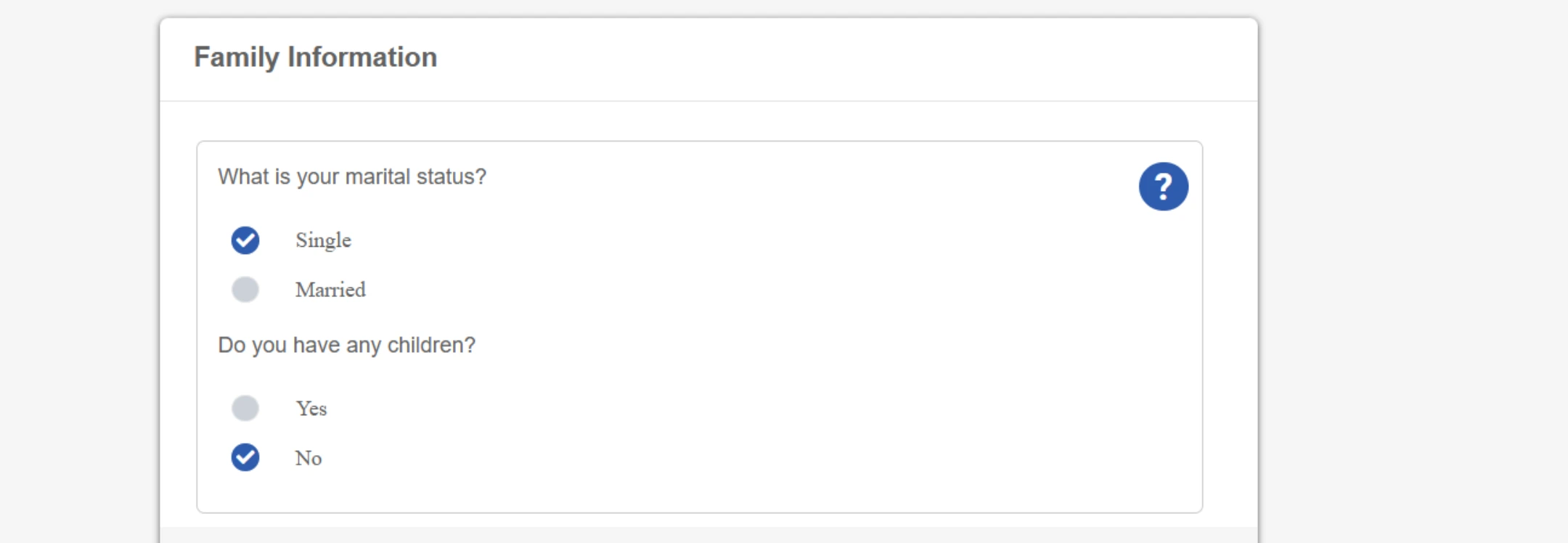

2. Answer Guided Questions

Instead of filling in legal forms from scratch, Ziji Legal Forms prompts you with easy-to-understand questions like:

- Who will be the executor of your estate?

- Who are your beneficiaries?

- What assets do you want to distribute?

- Do you need to appoint a guardian for children?

These questions are designed for non-lawyers, so you don’t need any legal background to complete your document as you go through the questionnaire.

3. Review Your Will

Once you’ve entered your information, the platform will automatically generate a customized, properly formatted last will and testament document. You can review all the details, make edits, and ensure everything looks right before moving forward.

- Print, sign, and store safely after downloading your will, simply follow the platform’s instructions to make it legally valid. This usually involves:

- Printing the document

- Signing in the presence of two witnesses

- Storing it in a safe location

Some states may require notarization, and Ziji Legal Forms will guide you accordingly based on your location.

Conclusion

Crafting a will that truly avoids family disputes comes down to one key theme: be clear and comprehensive. By including the nine elements we’ve outlined; from identifying yourself and your intent, to spelling out asset distributions and backups, to addressing emotional sticking points like unequal shares, you take control of your narrative and prevent others from having to interpret it later. A well-prepared last will and testament answers questions before they’re asked: Who is in charge of the estate? Who gets this asset? What if someone is not around? Why did I make this choice? When your will provides those answers explicitly, there is little room for conflict or litigation. Your family can focus on healing and remembrance, rather than wondering, or worse, arguing over what you “really meant” or who should do what.

Completeness and clarity are your best defense against the common causes of will disputes. It’s worth the effort now while you are alive and well to think through these details and put them on paper. As we’ve seen, even the most loving families can be tested by the stress of a loss and the complexities of an estate. By using the strategies in this guide (and the 5 extra steps to fortify your will), you are essentially locking the door to many potential battles. You’re ensuring that your voice is heard loud and clear through your will, even when you’re no longer here to speak. This not only preserves harmony among your loved ones but also gives you peace of mind that your wishes will be honored.

For those feeling overwhelmed about where to start, services like Ziji Legal Forms make the process practically stress-free. Their templates, which are created by lawyers, provide the structure and legal phrasing, while you provide the personal details and decisions. The end result is a customized will, properly formatted and ready to sign, without the usual barriers of cost or complexity. There’s no need to procrastinate; you can create your will in an afternoon with guided support and ensure it covers everything it should.

In conclusion, a dispute-free estate isn’t guaranteed by wealth or luck, it’s achieved by good planning. Your last will and testament is your final love letter to your family, and the more thoughtfully it’s written, the more lovingly it will be received. By including all necessary provisions and anticipating possible challenges, you protect your family from turmoil. And with modern tools like Ziji Legal Forms, you have no reason to leave this task for “later.” Take action now to spell out your wishes. Your future self – and your family – will thank you for the foresight and care you put into your will, making a difficult time a little easier and free of needless ambiguity and conflict. So take charge and create your will or update it if you already have one. Your loved ones deserve it.

Last Will and Testament FAQs

What is a Last Will and Testament?

A Last Will is a legal document that lets you decide how your assets will be distributed after your death. It also allows you to name guardians for minor children and appoint an executor to carry out your wishes.Who should create a Will?

Anyone over 18 and of sound mind should have a Will, especially if they have dependents, property, or specific wishes for how their estate should be handled.What’s the difference between a Last Will and a Living Will?

A Last Will deals with asset distribution after death. A Living Will outlines your medical treatment preferences if you become unable to communicate or make decisions.Do I need a lawyer to create a Will?

Not necessarily. Online tools like Ziji Legal Forms offer valid, lawyer-reviewed templates that meet state legal requirements if properly signed and witnessed.Where should I store my Will?

Keep it in a safe but accessible place, and make sure your executor knows where it is. Avoid storing it in a locked safe deposit box unless the executor has access.How often should I update my Will?

Review your Will after any major life event like marriage, divorce, birth of a child, or acquiring significant assets or at least once every 3–5 years.What jurisdictions can use our Last Will document?

You can use our template to create a legal and valid Last Will document for the following jurisdictions:| Alabama (AL) | Alaska (AK) | Arizona (AZ) | Arkansas (AR) | California (CA) |

| Colorado (CO) | Connecticut (CT) | Delaware (DE) | District of Columbia (DC) | Florida (FL) |

| Georgia (GA) | Hawaii (HI) | Idaho (ID) | Illinois (IL) | Indiana (IN) |

| Iowa (IA) | Kansas (KS) | Kentucky (KY) | Louisiana (LA) | Maine (ME) |

| Maryland (MD) | Massachusetts (MA) | Michigan (MI) | Minnesota (MN) | Mississippi (MS) |

| Missouri (MO) | Montana (MT) | Nebraska (NE) | Nevada (NV) | New Hampshire (NH) |

| New Jersey (NJ) | New Mexico (NM) | New York (NY) | North Carolina (NC) | North Dakota (ND) |

| Ohio (OH) | Oklahoma (OK) | Oregon (OR) | Pennsylvania (PA) | Rhode Island (RI) |

| South Carolina (SC) | South Dakota (SD) | Tennessee (TN) | Texas (TX) | Utah (UT) |

| Vermont (VT) | Virginia (VA) | Washington (WA) | West Virginia (WV) | Wisconsin (WI) |

| Wyoming (WY) |