TL;DR- Your last will and testament is not a "set it and forget it" document and requires regular updates as your life circumstances change

- Major life events requiring will updates include marriage, divorce, birth of children, death of beneficiaries, relocating to new states, and significant financial changes

- Review your will every 3-5 years or immediately after significant life events to ensure it reflects your current wishes and circumstances

- Use a codicil for minor changes or create a new will for major updates, ensuring proper signing, witnessing, and state compliance

- Modern considerations like digital assets, cryptocurrency, and changing tax laws also necessitate regular will reviews and updates

- Ziji Legal Forms provides customizable last will and testament templates that can help you create legally valid Wills in minutes

Introduction

Your last will and testament represents far more than a one-time legal formality. This critical document must evolve alongside your life, reflecting changes in your family structure, financial situation, and personal wishes. Treating your will as a static document can create serious problems for your loved ones when they need it most.

The risks of maintaining an outdated will extend beyond simple inconvenience. Wrong beneficiaries may receive assets intended for others, creating family disputes and potential legal challenges. Probate proceedings can become complicated when executors named in your will are no longer available or appropriate for the role. Children may lack proper guardianship provisions, and valuable assets might be distributed according to outdated intentions rather than your current preferences.

Understanding when and why to update your will ensures your final wishes are honored while protecting your family from unnecessary complications during an already difficult time. Regular reviews and timely updates transform your will from a forgotten document into a living reflection of your current life and values.

Major Life Events That Require Updating Your Will

Certain life events fundamentally alter your family structure, financial obligations, or legal responsibilities in ways that make will updates not just advisable but essential for proper estate planning.

Marriage or Divorce

Marriage brings immediate changes to your legal obligations and inheritance rights that require prompt will updates. Many states automatically revoke portions of existing wills upon marriage, particularly if the new spouse isn't mentioned in the document. Adding your spouse as a beneficiary, updating executor designations, and revising guardianship provisions for any children become immediate priorities.

Divorce proceedings trigger equally important updates as you'll likely want to remove your former spouse from beneficiary designations and executor roles. While some states automatically void provisions for divorced spouses, relying on automatic revocation can create ambiguity. Explicitly updating your last will and testament template ensures clear intentions and prevents your assets from accidentally going to unintended recipients.

Remarriage situations often involve complex blended families requiring careful consideration of children from previous relationships, step-children, and new spouse rights. Balancing these competing interests requires thoughtful will drafting that addresses everyone's needs while reflecting your current family priorities.

Birth or Adoption of Children and Grandchildren

New children fundamentally change your estate planning priorities, requiring immediate will updates to include guardianship provisions, inheritance allocations, and educational funding considerations. Without prompt updates, newly born or adopted children may be inadvertently excluded from your estate distribution.

Guardianship designations become critically important when minor children are involved. Your will should name primary and backup guardians who share your values and can provide appropriate care. Include detailed instructions about your preferences for the children's upbringing, education, and religious instruction to guide the guardians' decisions.

Grandchildren considerations may prompt will updates even if your own children are adults. Many grandparents want to provide educational funding, establish trust arrangements, or ensure grandchildren receive specific family heirlooms or sentimental items. These provisions require explicit inclusion in updated will documents.

Moving to a New State

State law variations can significantly impact your will's validity and effectiveness when you relocate. Different states have varying requirements for will execution, witness procedures, executor eligibility, and spousal inheritance rights that may affect your existing document's enforceability. For example some states do not recognize hand written holographic wills. So while generally speaking, your will stays valid as long as it was valid in the state that it was created in, it is prudent to review your estate plans and update it.

Executor eligibility rules differ between states, with some requiring executors to be state residents or imposing additional requirements on out-of-state executors. If your chosen executor lives in your former state, they may need to appoint local co-executors or meet bonding requirements that could complicate estate administration.

Community property considerations become important when moving between community property and common law states. These different property ownership systems can affect how your assets are treated during estate distribution, potentially requiring will modifications to achieve your intended results.

Significant Financial Changes

Substantial wealth increases from inheritance, business success, or investment gains may trigger estate tax considerations that require sophisticated planning strategies. Your simple will might need updating to include trust provisions, charitable giving arrangements, or other tax-minimization techniques.

Asset acquisitions such as real estate, business ownership, or valuable collections should be explicitly addressed in your will to ensure proper distribution. New assets may require specific handling instructions or professional management that your current will doesn't contemplate.

Debt considerations also require attention, as significant new obligations can affect your estate's ability to fulfill bequests. Your will should address how debts will be handled and whether specific assets should be used for debt payment before distribution to beneficiaries.

Other Situations to Revisit Your Will

Beyond major life events, several other circumstances should prompt careful review and potential updates to your last will and testament documents.

Changes in Tax Laws and Estate Laws

Federal tax law modifications can significantly impact estate planning strategies, particularly regarding estate tax exemptions, gift tax rules, and generation-skipping transfer taxes. Recent years have seen substantial changes in these areas that may affect your estate's tax obligations and distribution strategies.

State law changes regarding inheritance taxes, probate procedures, or will requirements can impact your estate plan's effectiveness. Regular reviews with estate planning professionals help ensure your will remains compliant with current legal requirements and takes advantage of beneficial law changes.

Charitable giving opportunities may arise from tax law changes that make certain charitable strategies more attractive. Updated wills can incorporate these strategies while supporting causes important to you and providing tax benefits for your estate.

Digital Assets and Modern Considerations

Cryptocurrency holdings have become increasingly common and valuable, requiring specific provisions in your will for access and distribution. Unlike traditional assets, cryptocurrency requires special handling for wallet access, private key management, and transfer procedures that standard will language may not address adequately.

Online accounts and digital assets including social media profiles, email accounts, cloud storage, and digital content libraries need explicit provisions for access and management. Without clear instructions, executors may struggle to access or manage these assets, potentially losing valuable information or content.

Intellectual property rights for digital content, online businesses, or creative works require specific attention in modern wills. These assets may continue generating income after your death, requiring management instructions and distribution provisions that reflect their unique characteristics.

Relationship Changes

Family estrangement situations may prompt will updates to exclude individuals who were previously included as beneficiaries. Clear documentation of your intentions helps prevent legal challenges from disinherited family members who might claim oversight or mistake.

Reconciliation circumstances might lead to reinstating previously excluded family members or updating provisions to reflect renewed relationships. These sensitive situations require careful consideration and often benefit from family discussions about your intentions.

Blended family dynamics continue evolving long after remarriage, as step-relationships develop and change over time. Regular will reviews ensure your document reflects current family relationships and provides appropriately for all family members according to your current wishes.

How Often Should You Review Your Will?

Regular review schedules help ensure your will remains current and effective. Estate planning professionals generally recommend comprehensive will reviews every three to five years, even when no major life events have occurred, to address gradual changes in circumstances or legal requirements.

Accelerated review needs apply when life circumstances are changing rapidly, such as during business ownership transitions, health challenges, or major family changes. More frequent reviews ensure your will keeps pace with evolving situations that could affect estate planning needs. Self-assessment considerations can help determine when will reviews are needed. Questions about whether your current beneficiaries still reflect your wishes, whether your executor choices remain appropriate, and whether your asset distribution plans align with current values can guide review timing decisions.

Quick Review Checklist

Personal information accuracy should be verified regularly, including names, addresses, and contact information for all parties mentioned in your will. Changes in beneficiary circumstances, such as marriage, divorce, or relocation, should be noted and addressed.

Asset and beneficiary alignment requires checking whether your current assets match those described in your will and whether beneficiary designations reflect your current intentions. New assets should be explicitly included, and outdated references should be removed or updated.

Executor and guardian suitability needs regular evaluation to ensure your chosen individuals remain appropriate for their designated roles. Consider their availability, health, financial stability, and continued willingness to serve in these important positions.

How to Update Your Will Correctly

Codicil versus new will decisions depend on the scope and complexity of changes needed. Minor modifications like changing an executor or adding a small bequest can often be addressed through codicils, while major changes typically warrant creating entirely new wills for clarity and completeness.

Codicil advantages include lower cost and faster execution for simple changes. Codicils work well for single modifications that don't affect other will provisions, such as updating contact information or making minor bequest adjustments.

New will benefits include comprehensive updates that ensure internal consistency and eliminate potential conflicts between original will provisions and multiple amendments. Complex changes involving multiple provisions typically benefit from complete will replacement rather than layered amendments. However, with the affordability of online wills creation at Ziji Legal Forms, updating your will to reflect changing life circumstances is no longer a financial burden and with the ease of use, it makes sense to create and update your will to protect your legacy.

Legal Requirements and Compliance

Proper execution procedures must be followed regardless of whether you create a codicil or new will. This includes appropriate signing ceremonies with required witnesses, proper dating and identification of documents, and compliance with state-specific legal requirements.

Witness and notarization requirements vary by state but typically require at least two competent witnesses who are not beneficiaries. Some states also require or recommend notarization for added legal protection. Understanding your state's specific requirements ensures your updates will be legally valid.

Document storage and communication considerations include safely storing original documents, providing copies to executors and key family members, and ensuring relevant parties know about updates. Proper documentation management prevents confusion and ensures your updated will can be located when needed.

Avoiding Common Update

Mistakes can invalidate will updates if legal requirements aren't properly met. While simple changes might seem straightforward, improper execution can create legal problems that negate your intended updates. Professional assistance often provides valuable protection against these risks.

Coordination issues between different estate planning documents can create conflicts if wills, trusts, and beneficiary designations aren't properly aligned. Comprehensive updates should address all related documents to ensure consistency across your entire estate plan.

Communication oversights occur when family members or executors aren't informed about will changes. While you're not required to share will contents, informing key parties about updates can prevent surprises and misunderstandings during estate administration.

How to Make Create Your Will with Ziji Legal Forms

Professional platforms like Ziji Legal Forms provide accessible, reliable tools for creating last will forms that reflect your evolving circumstances and legal requirements.

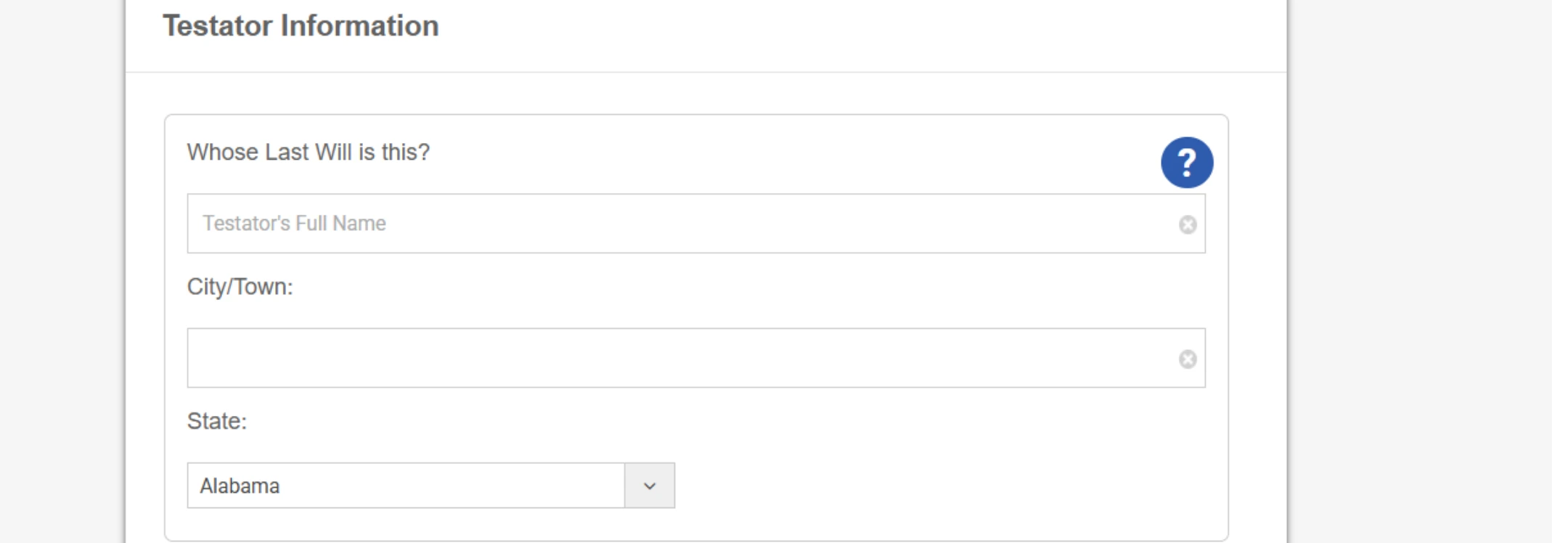

1. State Select

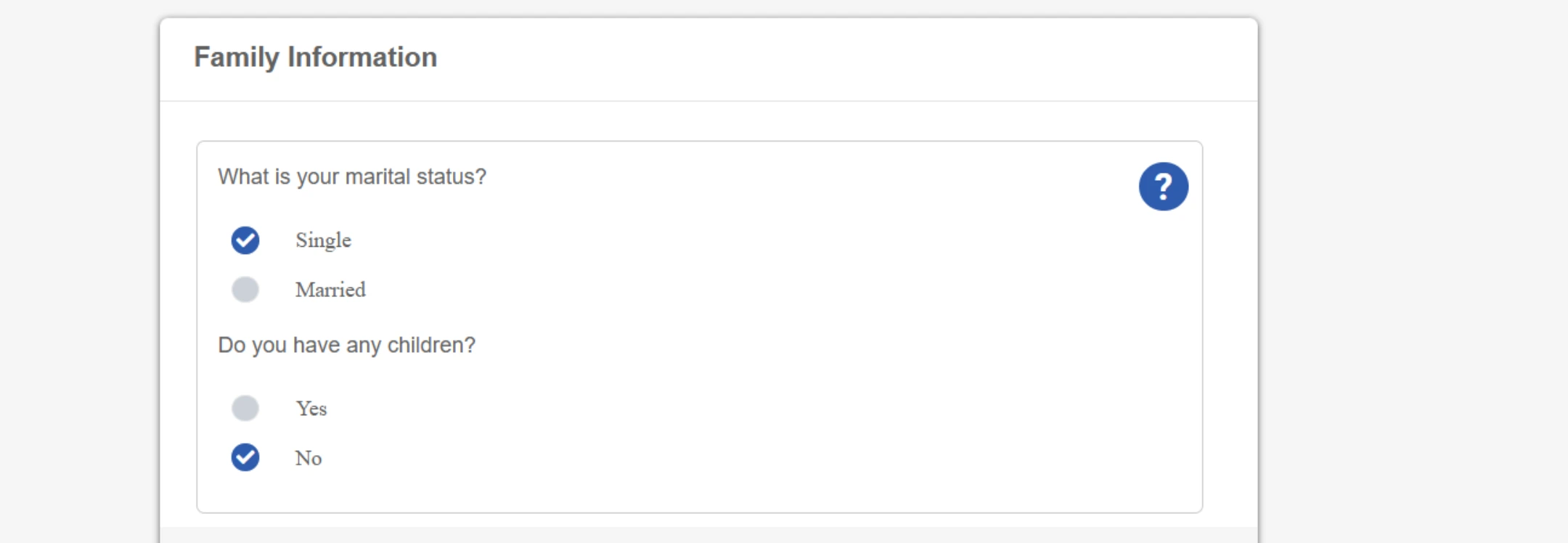

2. Answer Guided Questions

Instead of filling a legal form from scratch, Ziji Legal Forms prompts you with simple questions to create your document. These questions are designed for non-lawyers, so you don’t need any legal background to create your document.

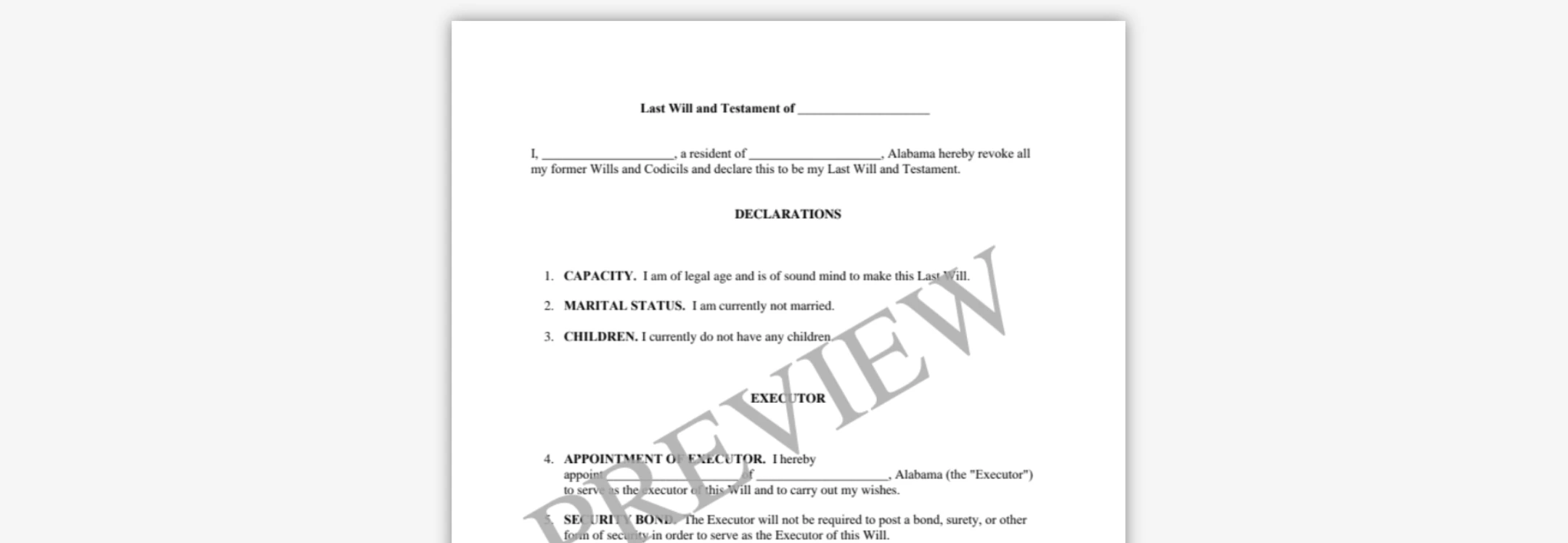

3. Review Your Will

Once you’ve entered your information, the platform will automatically create a customized, properly formatted last will and testament document. You can check the details, make revisions, and ensure the document looks right before moving forward.

Benefits of Using Ziji Legal Forms for Creating Your Will

Ziji Legal Forms makes creating or updating a will simple, secure, and affordable by offering state-specific templates that follow current legal standards. Its user-friendly platform guides you through each step, helping you customize your will, add or change beneficiaries, update guardianship instructions, and cover digital assets. This reduces the risk of costly errors or omissions, ensuring your wishes are clearly documented and easily accessible for loved ones.

Conclusion

Your last will and testament must function as a living document that evolves with your changing life circumstances, family relationships, and financial situation. Regular reviews and prompt updates ensure this critical document accurately reflects your current wishes while providing maximum protection for your loved ones.

The combination of major life events and gradual circumstantial changes requires ongoing attention to will maintenance rather than treating estate planning as a one-time event. Professional tools like Ziji Legal Forms make this maintenance manageable and affordable while ensuring legal compliance and professional quality results.

Taking proactive steps to keep your will current demonstrates care for your family's future while protecting against the complications and disputes that outdated estate planning documents can create. Regular reviews and timely updates transform your will from a forgotten document into an effective tool for achieving your estate planning goals and protecting the people you care about most.

Last Will and Testament FAQs

What is a Last Will and Testament?

A Last Will and Testament is a legal document that you can use to outline your wishes relating to the distribution your assets and to provide for your loved ones after your death. It is essentially a clear set of estate planning instructions provided to the executor as to how your assets will be distributed and who amongst your family and friends will receive a part of your estate.

A typical Last Will and Testament will cover the following topics, all of which can be customized by Ziji Legal Form’s Last Will and Testament template:

- Appointment of Executor: This allows you to name an executor, the person who is responsible in carrying out your instructions in the Last Will.

- Distribution of Assets: This will specify how your estate and assets will be divided amongst the beneficiaries including the leaving of specific gifts or inheritances.

- Appointment of Guardianship of Minor Children: If you have any minor children, then you can designate a guardian who will look after the care and well being of your minor children in the event of your death.

- Appointment of Caretaker of Pets: If you have any pets, you can designate a guardian who will look after your pet.

- Debts and Taxes: This allows you to address the payment of outstanding debts, taxes, and funeral expenses before distribution of your assets to the beneficiaries.

- Last Requests: This allows you to specify any final instructions relating to funeral, burial preferences, or even deal with the forgiveness of debt owed to you.

Why is it important to have a Last Will?

Having a Last Will allows you to control what happens to your assets after death and it removes any ambiguity as to how your assets will be distributed. When a person dies intestate, it means the person died without a valid will, the state laws will dictate who gets the assets and how much of the assets they receive. If you have no surviving family member or a will, your assets may even be absorbed by the state. Therefore, it is very important to have a valid Last Will to ensure your assets are distributed according to your wishes and having such explicit instructions will also prevent confusion or dispute relating to your estate after your death. Anyone over the age of 18 and is of sound mind can create a Last Will to ensure no ambiguity exists regarding their estate after death.

Is a Last Will different from a Living Will?

While they may sound similar but they serve very different purposes. A Last Will deals with the distribution of your estate after your death. Basically, a Last Will is a set of explicit instructions as to who gets what that is carried out by the executor you have chosen in your will. However, a Living Will deals with how your health care preferences are handled when you are incapacitated. If you are unconscious after an accident and cannot give consent, the Living Will allows you to provide guidance to your family what types of treatments will you accept. For example, whether to accept a CPR treatment, get a blood transfusion, or how long you wish to stay on a ventilator should you remain in a coma etc. In short, a Last Will deals with how your assets are distributed after death, while a Living Will deals with what types of medical treatments are acceptable to you when you are unable to give your consent.

Who is the testator?

You, the person who is writing and making a will is referred to as the testator. In the past, a female testator is referred to as a testatrix. However, in modern times, the word testator is commonly used to refer to both male and female testators.

Who is the executor?

The executor is the person appointed by the testator and he/she is responsible for administering the estate and for carrying out the last wishes of the testator according to the instructions left in the will. The executor must at least 18 years of age and of sound mind. The executor should be an individual who lives in the same state as the testator.

Who is the guardian appointed by the testator?

The guardian is the person appointed by the testator to look after any minor children of the testator in the event of the testator’s death.

What is executor bond?

An executor bond, also known as an estate bond or probate bond, is a type of surety or fiduciary bond that guarantees if the executor misappropriates the testator’s assets or makes a mistake in handling the assets, the beneficiaries will be reimbursed by the bond company. Because of the cost associated with getting the executor bond, some testators may choose to waive this requirement for the executor that they trust. However, it is always prudent to require an executor bond from the executor to ensure the testator’s wishes will be fulfilled.

Who is the trustee?

The trustee is the person appointed by you, the testator, and who has a fiduciary duty to manage and administer your minor children's trust assets until they become adults. The trustee is responsible for managing the assets in the trust and make distributions for the minor children's benefits (e.g. education, health care, physical well being and support etc.). Once your children reach the age of 18, typically the proceeds of the trust assets are paid out in full to them by the trustee and the trustee's role will end.

What is a specific gift?

A specific gift or specific bequest, refers to any specific property that is given to a beneficiary in a will. This is typically what comes to mind when most people think of giving away their estate in a will. For example, it can be a coin collection, a piece of artwork, or jewelry etc.

Note that you as the testator cannot give away certain gifts that you do not have full ownership. For example, you cannot give away spousal property or real estate that you and your spouse jointly own. You also cannot give financial instruments such as life insurance policy, annuities, or pension fund proceeds that already have a designated beneficiary.

In order to ensure your will is complete and will reflect your full wishes in the distribution of your estate, it is prudent to name an alternative beneficiary for each gift you leave in your will, in case the original beneficiary dies before you.

What is a wipeout clause in a will?

A wipeout clause is sometimes called a "total wipeout clause", "total failure clause", "catch-all clause", or a "fail safe clause". This provision basically states if the named beneficiaries and eligible heirs die before the testator, the estate will go to the wipeout beneficiary instead. This wipeout beneficiary can be a close family relative/friend, or a charity or organization that is important to the testator. The testator can name more than one wipeout beneficiary.

Can I use a Last Will to care for my pets?

Pets are an important part of your family and you certainly can use a Last Will to look after them. You, as the testator, can designate a caretaker to look after your pets. You can use our Ziji Legal Forms Last Will template to draft any clause to ensure your pets will be cared for after your death. For example, you can designate a part of your estate to be used for the care and well being of your pets to ensure their food, grooming, and medical needs are looked after.

Who are the witnesses and do I need to notarize my Last Will?

In most jurisdictions, you do not need to notarize your Last Will for it to be valid. However, you must sign the Last Will with two witnesses in your presence and in the presence of each other. In other words, the two witnesses must watch you sign the Last Will together, and they should watch each other sign the will as the witness in the same room. Typically, witnesses should not be a beneficiary in the Last Will and they must be of sound mind that is at least 18 years of age. Notarizing the will may accelerate the probate process in court but it is certainly not required for a valid Last Will.

What is probate?

Probate is basically a process through the court in which your Will is validated and then administered after death.

What is an affidavit and why is it often signed with the Will?

The affidavit, sometimes called an affidavit of execution, is a sworn statement. It involves having the signee declaring that the jurisdiction’s signing and witnessing requirements were followed. Once this affidavit is signed and notarized, the court will assume the Will is a “self-proved will” during probate which means the validity of the Will won’t be questioned unless credible evidence is introduced proving otherwise.

Why is it prudent to sign an affidavit with the Will?

If the aforementioned affidavit is not signed, the witness who did not sign the affidavit may be required to appear in probate court to attest that he or she was a witness and that the signing requirements were followed. So, while it is not a requirement to sign this affidavit to have a valid will, it is prudent to so, since it will save time and money during the probate process and the executor will not have to track down the witnesses to attend probate court.

Where should you store your Will?

Store your signed Will and Affidavit in a safe place. While it may be tempting to put the documents inside your safety deposit box in the local bank, but that is not a good idea. Without going through the probate process, which requires your Will, your executor will not have access to your safety deposit box. Store the documents somewhere secure that your executor will have access to after your passing and inform your executor where the documents are kept.

How often should I update my Last Will?

It’s recommended to review and update your Last Will every few years or whenever there is a significant life event, such as marriage, divorce, the birth of a child, or the acquisition of substantial assets. This ensures that your Will remains accurate and reflective of your current wishes.

Is an online Last Will legally valid?

Yes, an online Last Will can be legally valid as long as it meets the legal requirements of your jurisdiction, including being properly signed and witnessed. At Ziji Legal Forms, our templates are designed by our legal staff that complies with legal standards to ensure your Will is valid.

Can I name multiple executors in my Will?

Yes. You can appoint more than one executor to administer your estate. This can provide backup in case one executor is unable or unwilling to serve. It’s important to clarify whether the executors must act jointly or if they can act independently to avoid confusion.

Can I include digital assets in my Will?

Absolutely. Digital assets, such as online accounts, social media profiles, cryptocurrency, and digital photos or files, can be addressed in your Will. You should provide clear instructions on access, management, or distribution of these assets to ensure your wishes are followed.

Can I provide for stepchildren or non-biological children in my Will?

Yes. You can include stepchildren, adopted children, or other non-biological children as beneficiaries in your Will. It’s important to clearly identify them by name and relationship to avoid confusion or disputes, and consider naming alternate beneficiaries in case any named individuals predecease you.

Can my Will include charitable donations?

Yes. You can leave specific gifts or a portion of your estate to charities, nonprofits, or organizations that are meaningful to you. Clearly naming the organization and the amount or asset to be donated ensures your philanthropic wishes are honored.

What happens if I die without a Will?

If you pass away intestate—without a valid Will—state laws will determine how your assets are distributed. This may result in your estate being divided among relatives according to statutory formulas, which may not align with your personal wishes. In some cases, assets may even go to the state if no legal heirs are identified.

What jurisdictions can use our Last Will document?

You can use our template to create a legal and valid Last Will document for the following jurisdictions:

|

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

District of Columbia

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming |

AL

AK

AZ

AR

CA

CO

CT

DE

DC

FL

GA

HI

ID

IL

IN

IA

KS

KY

LA

ME

MD

MA

MI

MN

MS

MO

MT

NE

NV

NH

NJ

NM

NY

NC

ND

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VT

VA

WA

WV

WI

WY |