TL;DR

- A beneficiary is anyone or any group (person, charity, trust) named to receive assets in your last will and testament document.

- Clearly identifying primary, contingent, and residuary beneficiaries helps avoid disputes and ensures your wishes are honored.

- Beneficiaries have legal rights to information, timely estate distribution, and the ability to contest the will if needed.

- Update your last will and testament forms regularly and use precise legal names and alternate choices to prevent confusion.

- Ziji Legal Forms provides state-specific last will and testament templates, making it straightforward to name, update, and customize beneficiaries for your estate plan.

Beneficiaries at a Glance

Who Is Not Automatically a Beneficiary?

Legal Rights Every Beneficiary Holds

| Statutory Right | Practical Meaning |

|---|---|

| Notice of probate filing | Executor must inform each beneficiary about the probate proceedings and provide a copy of the last will and testament pdf. |

| Access to estate inventory | Beneficiaries can examine estate assets, debts, and expenses. |

| Timely distribution | Executors are expected to distribute estates within a reasonable time, typically within a year. |

| Right to challenge | Beneficiaries can contest the will on grounds of fraud or incapacity. |

| Right to disclaim | A beneficiary can refuse a gift for tax or personal reasons. |

Main Categories of Beneficiaries

Primary Beneficiary

Contingent Beneficiary

Residuary Beneficiary

Specific and Pecuniary Beneficiary

Additional Beneficiary Designation Options

| Beneficiary Designation | What It Means | Typical Use In a Will |

|---|---|---|

| Charitable Organization | A nonprofit or charity of your choice | Supporting a favorite cause with a legacy gift |

| Class Beneficiaries | Group identified by relationship | “All my children” or “my siblings” share certain assets" |

| Minor Beneficiary via Trust | Gift placed in trust for someone under 18 | Protecting assets until a child/grandchild reaches adulthood |

| Pet Care Trust | Funds for a designated animal’s future care | Setting aside money and naming a trustee for a pet |

| Digital Asset Recipient | Person/entity to manage online/digital assets | Appointing someone for access to digital financial accounts or social media |

| Alternate Charity | Backup charity if the primary can’t inherit | Ensuring charitable intent if the original organization no longer exists |

Why a Residuary Clause Is Essential

Beneficiary Checklist

- Name at least one beneficiary and a backup.

- State full legal names and addresses.

- Specify percentage or “all the rest, residue, and remainder.”

- Indicate distribution timing if a minor inherits.

Putting It Together With Ziji Legal Forms

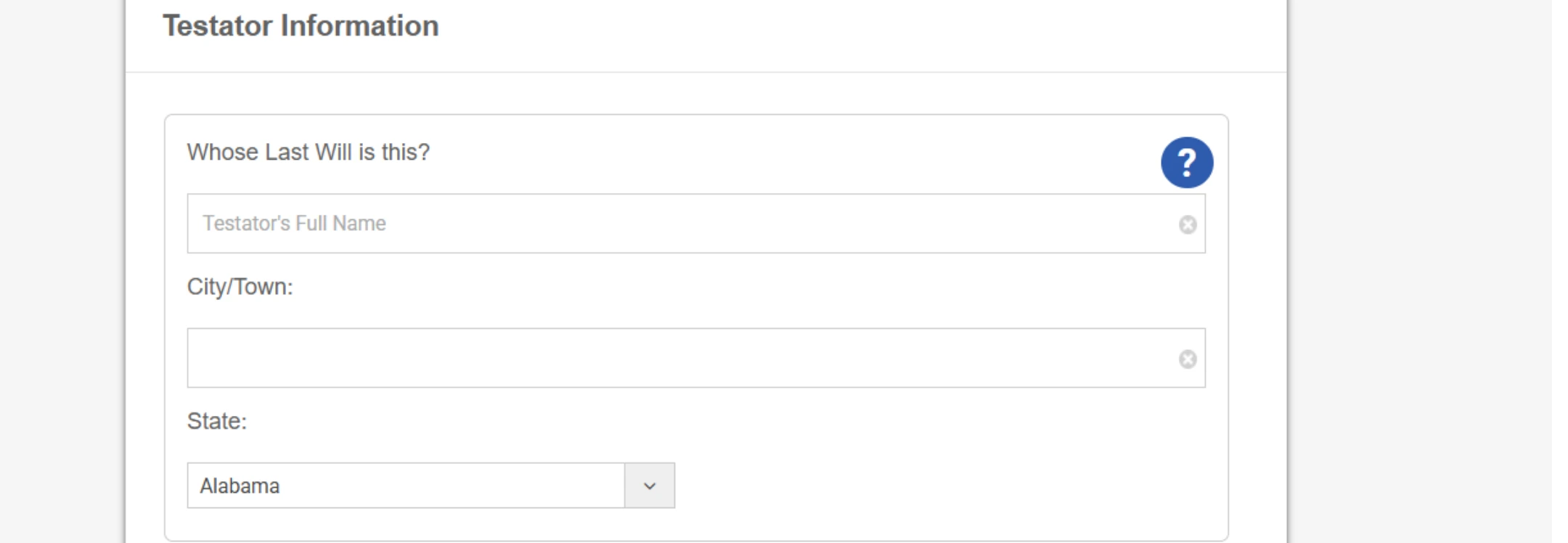

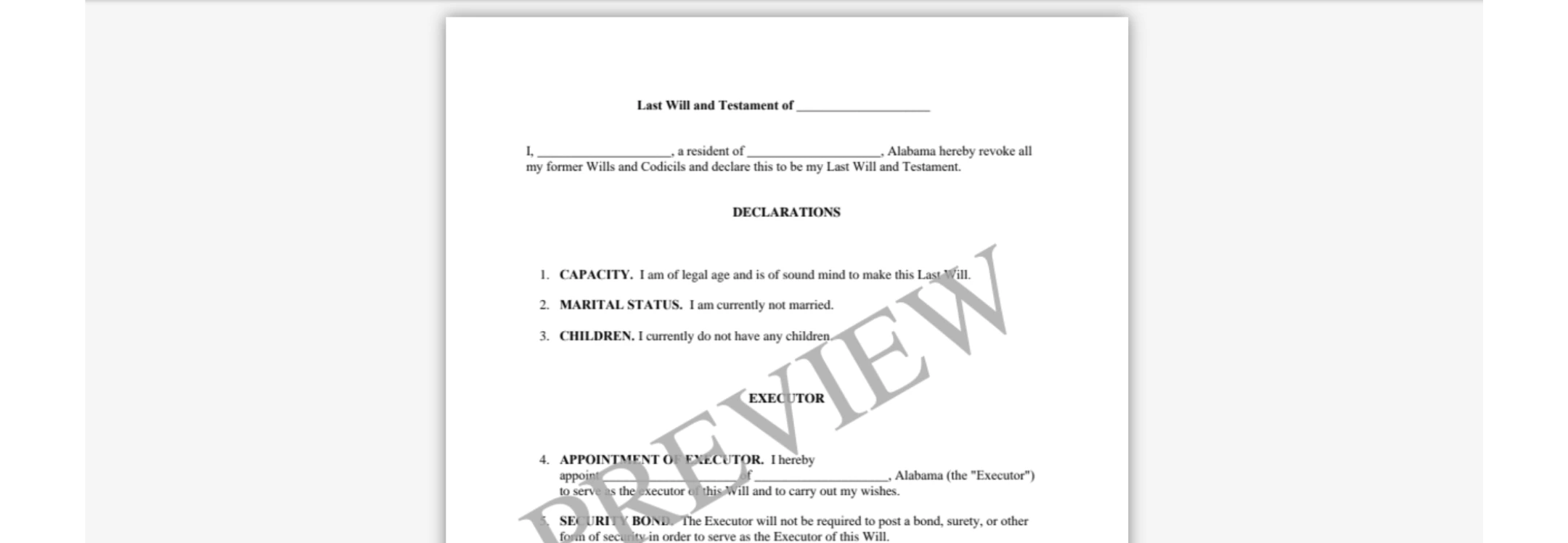

Writing a will can seem daunting, especially if you are new to the process or unsure about the legal details. That is precisely why Ziji Legal Forms exists—to make creating a last will and testament straightforward, quick, and legally reliable. Whether you are drafting your first will or updating a previous one, Ziji Legal Forms provides an easy-to-follow, state-specific process. Ziji Legal Forms streamlines will creation so you can protect your wishes with confidence. Here is how it works:

Select your state to create a compliant last will and testament.

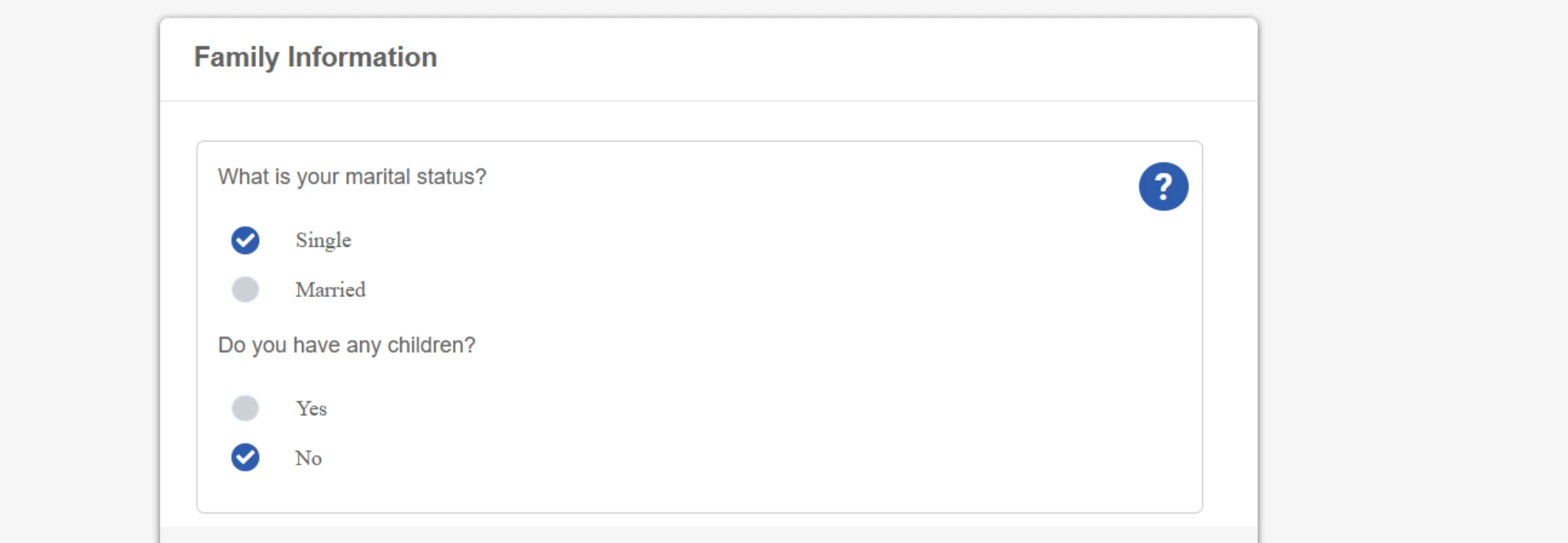

Answer Guided Questions

Who will manage your estate as executor? Who do you want to name as beneficiaries? Which assets do you want to leave to others? Do you need to appoint a guardian for your children?

Review Your Will

Naming Beneficiaries: Practical Tips

Use Legal Names and Identifiers

Use full names along with city of residence or Tax ID for charities to prevent confusion.

Provide Alternates

Always name at least one alternate or contingent beneficiary in case someone is unable or unwilling to inherit.

Update Regularly

Review and update your last will and testament after life events, such as marriage, divorce, or the birth of children. Ziji Legal Forms lets you easily create a new last will and testament form any time.

Coordinate With Non-Probate Assets

Assets with separate beneficiary designations, such as life insurance and retirement accounts already have listed beneficiaries and are generally not included in the will. They will bypass probate. Make sure all beneficiary forms align with your last will and testament template.

Conclusion

Selecting the right beneficiaries is at the core of estate planning. With clear primary, contingent, specific, and residuary designations, you decide how your last will and testament document functions in probate. Ziji Legal Forms removes the guesswork by pairing user-friendly templates with robust clause libraries. Use its free last will and testament forms today to ensure every asset, from family heirlooms to digital currency, ends up just where you intend.

Last Will and Testament FAQs

What is a Last Will and Testament?

A Last Will is a legal document that lets you decide how your assets will be distributed after your death. It also allows you to name guardians for minor children and appoint an executor to carry out your wishes.

Who should create a Will?

Anyone over 18 and of sound mind should have a Will, especially if they have dependents, property, or specific wishes for how their estate should be handled.

What’s the difference between a Last Will and a Living Will?

A Last Will deals with asset distribution after death. A Living Will outlines your medical treatment preferences if you become unable to communicate or make decisions.

Do I need a lawyer to create a Will?

Not necessarily. Online tools like Ziji Legal Forms offer valid, lawyer-reviewed templates that meet state legal requirements if properly signed and witnessed.

Where should I store my Will?

Keep it in a safe but accessible place, and make sure your executor knows where it is. Avoid storing it in a locked safe deposit box unless the executor has access.

How often should I update my Will?

Review your Will after any major life event like marriage, divorce, birth of a child, or acquiring significant assets or at least once every 3–5 years.

What jurisdictions can use our Last Will document?

You can use our template to create a legal and valid Last Will document for the following jurisdictions:

| Alabama (AL) | Alaska (AK) | Arizona (AZ) | Arkansas (AR) | California (CA) |

| Colorado (CO) | Connecticut (CT) | Delaware (DE) | District of Columbia (DC) | Florida (FL) |

| Georgia (GA) | Hawaii (HI) | Idaho (ID) | Illinois (IL) | Indiana (IN) |

| Iowa (IA) | Kansas (KS) | Kentucky (KY) | Louisiana (LA) | Maine (ME) |

| Maryland (MD) | Massachusetts (MA) | Michigan (MI) | Minnesota (MN) | Mississippi (MS) |

| Missouri (MO) | Montana (MT) | Nebraska (NE) | Nevada (NV) | New Hampshire (NH) |

| New Jersey (NJ) | New Mexico (NM) | New York (NY) | North Carolina (NC) | North Dakota (ND) |

| Ohio (OH) | Oklahoma (OK) | Oregon (OR) | Pennsylvania (PA) | Rhode Island (RI) |

| South Carolina (SC) | South Dakota (SD) | Tennessee (TN) | Texas (TX) | Utah (UT) |

| Vermont (VT) | Virginia (VA) | Washington (WA) | West Virginia (WV) | Wisconsin (WI) |

| Wyoming (WY) |