Last Updated: February 23, 2026

TL:DR

- Creating a bill of sale is a smart step whenever you buy or sell valuable personal property such as a car, boat, or equipment.

- A bill of sale form documents the transaction and protects both buyer and seller by serving as legal proof of the change in ownership. However, people often make mistakes when drafting or using a bill of sale template on their own. These errors can lead to disputes, invalid documents, or even legal trouble down the road.

- In this comprehensive guide, we will discuss ten common mistakes to avoid when creating a bill of sale, explain why each mistake is problematic, and show how to do things correctly instead.

- We’ll also include an overview of how to create a bill of sale using Ziji Legal Forms, and wrap up with key takeaways.

- By the end, you’ll know how to write a bill of sale form that is thorough, legally sound, and tailored to your needs, whether you’re drafting a car bill of sale or a bill of sale for any other property.

Introduction

Drafting a bill of sale may seem straightforward – it’s essentially a receipt for a sale, right? In reality, a proper bill of sale is more than a generic receipt. It must include specific details and legal language to serve as valid proof of the transaction. Many individuals download a bill of sale template or write one from scratch, only to overlook important elements. Mistakes like leaving out key information, using an outdated form, or failing to sign correctly can render your bill of sale ineffective.

In the United States, bills of sale are commonly used for private sales of vehicles, equipment, and other valuable personal property. While requirements can vary (for example, some states might have their own preferred forms or notarization rules), the focus of this article is on general best practices and pitfalls to avoid – state-specific nuances will not be covered. Our goal is to help you create a clear, complete, and legally binding document no matter where you are in the U.S.

First, we’ll clarify some key terms you should know. Then we’ll dive into the ten mistakes to avoid when creating a bill of sale, providing examples and tips to ensure you do it right. Finally, we’ll show how Ziji Legal Forms can simplify the process of generating a customized bill of sale, and we’ll conclude with a professional summary. Let’s begin by defining a few important terms related to bills of sale.

Definitions of Key Terms

Before discussing mistakes, it’s important to understand some basic terms that will appear throughout this guide:

Bill of Sale

A legal document recording the sale of an item from a seller to a buyer. It serves as proof of the transaction and typically includes details like the item description, the date of sale, the purchase price, and the names of the buyer and seller. A bill of sale signifies the transfer of ownership and can protect both parties if disputes arise later.

Buyer and Seller

The two parties involved in the sale. The buyer is the person or entity purchasing the item, and the seller is the person or entity transferring (selling) the item. Both the buyer and seller’s full names and contact information should appear on the bill of sale for identification and record-keeping.

Consideration

In legal terms, consideration means something of value exchanged between the parties. In a bill of sale, the consideration is usually the purchase price, the amount of money paid for the item. It could also be another item of value in the case of a trade. The bill of sale should clearly state the consideration given. For example, “Buyer agrees to pay $5,000 for the vehicle”

As-Is Sale

A term indicating that the item is sold in its current condition, with no guarantees or warranties from the seller. An “as-is” clause in a bill of sale means the buyer accepts the item with all existing faults, if any, and the seller is not responsible for any problems discovered after the sale. Including an as-is statement helps disclaim implied warranties and can prevent the buyer from demanding repairs or refunds later.

Odometer Disclosure

In the context of a car bill of sale or other vehicle sale, this is a statement of the vehicle’s mileage at the time of sale. Federal law requires an odometer disclosure for most vehicle sales to combat fraud. As of 2021, sellers must provide a mileage statement, for any vehicle model year 2011 and newer under, for 20 years. For 2010 model or older vehicles, the requirement for the disclosure period is 10 years. The odometer reading is usually recorded on the title transfer documents or a separate form, but it’s wise to include it in the bill of sale as well for completeness.

Notarization

The process of having a notary public officially witness the signing of the document. A notary public is a state-authorized official who verifies the identities of the signers and confirms that they signed willingly and under their true identity. When a document is notarized, the notary affixes a seal or stamp and signature. Notarization isn’t always required for a bill of sale (requirements vary by state and the type), but having the form notarized can add an extra layer of authenticity and help prevent disputes about the legitimacy of the signatures.

Personal Property

This is any movable property that is not real estate such as land or buildings. Personal property includes vehicles, electronics, furniture, livestock, and so on. A bill of sale deals with personal property transactions, as opposed to real property transactions which are documented with deeds. In legal terms, personal property is essentially any owned item that is movable and not attached to land.

Here are a 10 common mistakes to avoid while creating a Bill of Sale document.

Leaving Out Essential Information

Mistake

The first and perhaps most serious mistake is failing to include all the essential details of the transaction in the bill of sale. A bill of sale that omits critical information, such as the names of the parties, the date, purchase price, or a clear description of the item, may be considered incomplete or invalid. For instance, if you forget to list the sale date or the buyer’s name, the document might not serve its purpose as proof of the sale. Missing information can also lead to disputes – for example, if the item isn’t described well, the buyer could later claim the wrong item was delivered.

Why it’s a problem

A bill of sale is meant to “adequately record the transaction” to prevent future disputes. If key details are missing or unclear, you lose that protection. Imagine a scenario where you sell a used laptop but don’t include the serial number or a good description. The buyer might later contest that the laptop received is not the one they paid for. Or, consider if the seller’s or buyer’s name is misspelled or absent – it could be difficult to prove who was involved in the sale. In some cases, government agencies or insurers may reject a bill of sale that doesn’t have the necessary information. For example, many states require a properly completed bill of sale (with names, addresses, date, price, etc.) when registering a sold vehicle or for tax purposes.

How to avoid it

Always double-check that your bill of sale form includes all pertinent details of the deal. At minimum, include:

- Names and addresses of both the seller and buyer: Use full legal names and a current address for each party. This identifies who is involved and provides contact info if issues arise.

- Date of the sale: The exact date (and ideally the city/state of sale) should be recorded. The date is important for establishing when ownership transferred (useful for tax, registration, or liability reasons).

- Detailed description of the item: Clearly describe what is being sold. Include make, model, year, serial numbers or VIN (Vehicle Identification Number) for cars, hull ID for boats, or any unique identifiers. Also note characteristics like color, size, and condition (more on condition in the next mistake). The description should be specific enough that the item can be uniquely identified.

- Purchase price and payment terms: State the amount of money (or other consideration) being paid. Write the price in both numerals and words to avoid ambiguity. If the transaction involves a trade or any non-cash payment, specify the details. For example, “Buyer will pay $2,000 and exchange a 2015 MacBook Pro as additional consideration”. If the payment was already made in full, you can note it as “paid in full.” If there are any payment plans or installments, those terms should be written out.

- Signatures: Ensure space for the signature of the seller at minimum. Ideally, both buyer and seller will sign, even if not strictly required by law in all jurisdictions, because signatures are what make the document legally enforceable as evidence of agreement. We will discuss signature mistakes in detail later, but remember to leave room for printed names and dates along with signatures.

By including all of the above, you create a complete record. It’s wise to use a checklist of required information when drafting a bill of sale so nothing gets omitted. If you use a prepared bill of sale template, fill in all blanks and do not delete any sections that ask for essential info. An incomplete bill of sale is almost as bad as having none at all – it won’t fully protect you or could be challenged by the other party or a third party. Take the time to get the details right up front.

Providing a Vague or Inaccurate Item Description

Mistake

Another common error is not describing the item being sold with enough precision, or accidentally writing incorrect details. A vague or inaccurate item description can lead to confusion and conflict. For example, saying “one vehicle sold as is” is far too vague – it doesn’t identify the car. Or, writing the wrong VIN number for a car, or misspelling the product name/brand, could effectively describe a different item than intended. Some people copy a generic description from an online bill of sale form and forget to customize it to their item, which is a serious mistake.

Why it’s a problem

The description of the property is a core part of a bill of sale – it ties the document to the actual item. If the description is unclear or wrong, the bill of sale might not serve as reliable proof of what was transferred. For instance, if you sell a used car and the bill of sale has a typo in the VIN or omits the VIN entirely, the buyer may have trouble using it for title or registration purposes, and you as the seller might remain on record as the owner. Inaccurate descriptions can also be seen as misrepresentation. If a seller fails to mention a distinguishing feature or damage, a buyer could later claim the item wasn’t as described. Even if the omission was an honest mistake, it opens the door to mistrust and potential legal claims. At the very least, any ambiguity in the description could delay processes like insurance claims or prove ownership if challenged.

How to avoid it

Be specific and truthful in describing the item. Include all relevant identifying information. For vehicles, for example, list the make, model, year, body style, color, VIN, and current mileage on the odometer. For other items, include serial numbers, model numbers, or any unique markings. If the item has accessories or parts included in the sale like, “including the trailer and spare tire” for a boat sale, or “including charger and case” for a laptop sale, list those as well. The goal is that someone reading the bill of sale later can unmistakably identify the exact item that was sold.

It’s also critical to ensure accuracy. Double-check all numbers and spelling. Copy VINs or serial numbers carefully from the item or its title paperwork – a single digit off can cause big headaches. If possible, have both parties verify the description together. For example, when selling a car, both buyer and seller should look at the VIN on the vehicle and compare it to the bill of sale text before signing.

Additionally, note the condition of the item as part of the description. If the item is new, used, or has any defects or damage, you can mention that. For example, “2008 Gibson Les Paul guitar – used, good condition with minor scratch on body”. Being transparent about condition not only builds trust but can also prevent the buyer from later claiming that a defect was hidden. In fact, for valuable items like antiques or collectibles, specifying the condition in writing is strongly recommended. This leads to our next mistake, which deals with warranties and “as-is” terms.

Forgetting to Include Warranty Disclaimers or “As-Is” Terms

Mistake

Many people draft a bill of sale and forget to address the item’s warranty status – essentially, whether the sale is “as is” or if any guarantees are given by the seller. By default, most private sales are understood to be as-is, meaning the buyer accepts the item in its current condition without any promise of repair or refund. However, if you don’t explicitly state this, you leave room for the buyer to allege that some warranty was implied or that the seller misrepresented the item’s condition. Conversely, if you are offering a specific guarantee (perhaps a short-term guarantee that an appliance works, for example), failing to put it in writing is also a mistake. In short, omitting any language about warranties or “as-is” conditions is risky.

Why it’s a problem

A bill of sale generally should list any warranties made by the seller or any conditions of the sale. If it doesn’t, there can be uncertainty. The buyer might later claim that the seller verbally assured something about the item like “the car engine was recently rebuilt and will last a long time” and that this was effectively a warranty. Without a written “as-is” clause or warranty disclaimer, a court might have to interpret what the buyer and seller intended. This becomes a classic he-said/she-said scenario. In some cases, consumer protection laws or default rules (like the implied warranty of merchantability) could apply if not disclaimed – though often those don’t bind private sellers the way they do dealers, it can vary. The bottom line is, not clarifying the warranty status can lead to disputes over who is responsible if something goes wrong after the sale.

On the other hand, if you do promise something (say the item is under warranty, or you guarantee it’s free of defects for a certain period), leaving that out of the written bill of sale means the buyer has no proof of your promise. Likewise, if the sale has conditions (like “sale is void if payment is not completed by X date” or “seller will deliver the item to buyer by X date”), not including those terms in the document is a mistake because they won’t be enforceable.

How to avoid it

Include a clear statement regarding the sale condition and any warranties. The most common scenario is a simple as-is sale: in that case, write a clause such as: “This item is sold as is, with no warranty expressed or implied. The buyer acknowledges they have inspected the item or had the opportunity to do so, and accepts it in its present condition.” This language, or something similar, makes it explicit that the buyer is taking the item with no future recourse to the seller for issues that arise. By adding an as-is clause, you effectively prevent the buyer from later claiming the seller must fix a problem; it “prevents the buyer from demanding repairs after the sale”

If you, as the seller, are offering a warranty or guarantee, then specify it in detail. For example: “Seller guarantees that the car’s engine and transmission are in working condition for 30 days from date of sale. If a failure occurs within that period not due to buyer’s misuse, seller will cover 50% of repair cost.” Be very clear on the scope and duration of any warranty. If the item is still covered by a manufacturer’s warranty or service contract that will transfer to the buyer, mention that too, and provide the documentation to the buyer.

In either case, make sure both parties understand what, if any, promises are made about the item’s condition. It’s often wise for the bill of sale to also state, “Except as noted in writing in this bill of sale, no other warranties or guarantees are given.” This kind of merger clause helps ensure that any side conversations or assumptions don’t carry weight – only what’s written counts.

In summary, don’t leave the warranty question blank. Either indicate the sale is without warranty (as-is) or spell out the exact terms of any warranty. This protects the seller from unwarranted claims and makes the buyer fully aware of what they are, or are not, getting in terms of quality assurance.

Using a Bad Template or Not Customizing the Form

Mistake

With the abundance of sample bill of sale forms and templates online, a frequent mistake is using a poor-quality template or failing to customize it properly. People might download a generic bill of sale template and assume it’s fine as-is, without checking if it fits their situation or covers all necessary points. Some templates floating around may be outdated, too simplistic, or geared toward a different type of sale. Another error is not removing instructions or placeholders from the form – for example, leaving “[Seller Name]” or blank lines unfilled. In some cases, individuals try to piece together a bill of sale by copying text from multiple sources, which can lead to inconsistent or contradictory terms.

Why it’s a problem

A bad template can give a false sense of security. It might omit critical sections (like those we’ve discussed above) or include clauses that don’t apply to your sale. For instance, a generic template might not include a spot for an odometer reading, which is vital for a car bill of sale. Or it might not have the “free from all claims or liens” statement that protects the buyer (more on that in Mistake #9). If you rely on such a form blindly, you could end up with an incomplete document. Leaving placeholder text or blanks unfilled is equally dangerous – a blank could theoretically be filled in later by someone else, or it simply renders that part of the contract undefined. An inconsistent patchwork form might have conflicting language (say, one part implies the sale is as-is, while another part includes a warranty clause that you forgot to delete), which could cause confusion or legal issues if ever examined.

How to avoid it

Choose your bill of sale form carefully and tailor it to your transaction. If possible, use a reputable source or service, such as Ziji Legal Forms, that provides professionally drafted bill of sale forms by lawyers. Trusted templates are more likely to contain all the essential elements and be up-to-date with general legal standards. Avoid very bare-bones templates that you might find on random websites, as these could be missing key language. It’s often worth using a specific template for the type of asset. For example, a vehicle bill of sale template for vehicle sales, which will prompt you for details like VIN and mileage, or a separate template for selling a boat or animal if those have unique considerations.

Once you have a suitable template, fill out every applicable field completely. Do not leave blanks. If something doesn’t apply, either write “N/A” or draw a line through it, so no one can add information later. For example, if there’s a line for a vehicle’s loan/lien information and there is no lien, write “No liens” or “N/A”. This ensures clarity.

Also, remove any instructional text. Many templates have italicized guidance or placeholders in brackets – delete those after you replace them with actual information. The final document should read like a coherent contract, not like a form letter.

If you find a section in the form that seems irrelevant or confusing, don’t just leave it or ignore it. Either clarify it or remove it before signing. For instance, if a template includes a section about a “witness signature” but you’re not using a witness, you might remove that section to avoid questions later. (Or better yet, consider using a witness if appropriate; see Mistake #6.)

In summary, the quality of your bill of sale form matters. A well-prepared template can help you avoid many of the other mistakes on this list by prompting you to include the right information. But it’s up to you to use the template correctly. Always review the entire document before signing. Ensure it is clear, consistent, and fully filled in. If you’re not confident in a template you found, invest a bit of time in finding a better one or use an online service that guides you through it – it will pay off by giving you a stronger legal document.

Not Including All Necessary Signatures

Mistake

One of the most crucial steps in executing a bill of sale is obtaining the proper signatures, yet people sometimes get this wrong. Failing to include all necessary signatures (or forgetting signatures entirely) is a major mistake that can invalidate the bill of sale. This might happen if someone thinks only the seller needs to sign and doesn’t bother having the buyer sign, or if there are co-owners/sellers and only one signs. In some cases, people sign but forget to initial or sign any attached pages or amendments, leading to questions about completeness. Also, using electronic signatures without mutual agreement or where not permitted could be problematic.

Why it’s a problem

The signature is what indicates that the parties agree to the terms of the bill of sale. Without the seller’s signature, the document is essentially just a draft. Many states explicitly require the seller’s signature on a bill of sale for it to be accepted in vehicle transactions. If the buyer doesn’t sign, in some jurisdictions the bill of sale might still be considered valid (since the buyer’s acceptance is usually by taking the item and paying), but it’s far better to have both signatures. A missing buyer signature could be an issue if, for example, the buyer later claims they never consented or that the document isn’t accurate. Additionally, if there are two sellers (say a car owned by a married couple or business partners), typically both should sign to release their interest. Missing one owner’s signature could render the bill of sale incomplete – a DMV or buyer’s bank may reject it because it wasn’t signed by the person whose name was on the title. If any terms were added or changed on the bill of sale (perhaps hand-written in), those changes should be initialed by both parties. Failure to do so could invite allegations that the change was made after the fact and not agreed upon.

How to avoid it

Always have the seller sign and date the bill of sale, and preferably have the buyer sign and date it as well. It’s a good practice for both parties to sign, even in states where only one signature is legally required. The presence of both signatures makes the document a mutual agreement and provides stronger evidence that both sides acknowledged the terms. If the item has multiple owners/sellers, ensure all of them sign (example: if a car title is in two names with an “and” between them, both individuals must sign the bill of sale to fully transfer it). Likewise, if there are co-buyers, having all buyers sign is wise to acknowledge their joint ownership.

Be mindful of the format of signatures: sign in ink, if on paper, and print names beneath the signatures' space. Include the date of signing next to each signature. If you’re using a digital template and signing electronically, use a reputable e-signature method and ensure both parties consent to e-sign. Some jurisdictions might not accept electronic signatures for vehicle sales, so when in doubt, a handwritten signature on a printed form is safest for official purposes.

Remember to also have any witnesses or notary sign/stamp at the time of execution if you are using one (we’ll talk more about notarization in the next section). Don’t sign until all blanks are filled and you’re in the presence of any required witness/notary. Finally, once signed, make copies (we’ll cover providing copies as Mistake #10). The original signed document should ideally go with the buyer, and the seller should keep a copy. If multiple originals can be signed, that’s even better.

In short, never skip the signatures. A bill of sale without the proper signatures is just a piece of paper with typing – it has no legal weight. Protect yourself by signing and by having the other party sign, thereby confirming that everyone agrees on the sale details.

Skipping Witnesses or Notarization When Appropriate

Mistake

Not considering the use of a witness or notary public for the signing of the bill of sale can be a mistake, especially for significant transactions. While it’s true that most bills of sale for private sales do not strictly require a notary or witness (except in certain states or special cases), skipping notarization or witnesses outright without thought can be an oversight. This mistake can manifest as: failing to notarize a bill of sale that does require it by law (some states mandate notarization for vehicle sales or other types of sales), or not using a notary/witness in a high-value transaction where it would add extra protection. Some people don’t even realize notarization is an option or mistakenly assume it’s too much hassle, thus they ignore it entirely.

Why it’s a problem

If your state or the nature of the transaction does require a notarized bill of sale and you don’t do it, the document may be rejected by authorities (for example, the DMV could refuse to register a vehicle without a notarized bill of sale in certain states). That would force you to track down the other party again to redo the paperwork properly. Even if not required, having a notary or at least a third-party witness sign can provide powerful evidence that the signatures are legitimate and the transaction occurred as described. Without that, if either party later claims “I never signed that” or alleges fraud, it becomes harder to prove them wrong.

A notary’s seal, in particular, carries legal weight – the notary has verified the identities and willingness of the signers. Consider also that in some out-of-state or long-distance sales, notarization can reassure the parties of each other’s identity. And from a buyer’s perspective, a notarized bill of sale might make it easier to clear any questions when they go to register the item. In short, while not always necessary, failing to use a notary or witness when circumstances suggest you should could leave you more vulnerable to disputes.

How to avoid it

First, know the requirements for your type of sale. Double-check if your state requires a notarized bill of sale for certain items such as vehicles or boats. If it’s required, simply do it – schedule a notary at the time of signing. Many banks, postal stores, or online notary services can handle this quickly for a small fee. Our platform automatically takes care of these state-wise intricacies during the Bill of sale creation process itself.

Even if not required, consider the benefits of notarization for valuable sales. For instance, if you’re selling a car for a large sum of money or selling any item worth many thousands of dollars, having the bill of sale notarized might be a good idea to add formality and security. It’s an extra step, but it can deter the other party from later claiming the deal was invalid.

In other words, if there’s any doubt or any possibility of challenge, a notary’s involvement preemptively solves it. If a notary is not accessible, at least use a neutral witness if you can. This could be a friend or neighbor who watches both parties sign and then signs as a witness. Some bill of sale forms have a line for a witness signature. A witness is not as legally robust as a notary, but it’s still better than nothing in terms of evidence.

One caution

If you choose to get the document notarized, do not sign it in advance. You and the other party must sign in front of the notary. The notary will check your IDs and then witness the signing, then apply their notary seal. In summary, don’t be afraid to get your bill of sale notarized or witnessed. It adds credibility to the transaction. If you’re using Ziji Legal Forms, note that their platform might prompt you about notarization if applicable, or you can choose to print the completed form and bring it to a notary. Taking this step can save you from headaches and is a relatively simple way to bolster the legal enforceability of your bill of sale.

Omitting Statutory Disclosures (Odometer, etc.) for Certain Sales

Mistake

Omitting legally required disclosures is another mistake that can occur, particularly in specialized sales like vehicles. The prime example is not including an odometer disclosure for a car bill of sale. As mentioned earlier, federal law in the U.S. mandates that the seller provide a statement of a vehicle’s mileage at the time of sale for vehicles not exempt from odometer reporting. Many people don’t realize this if they are conducting a private car sale for the first time – they might simply exchange money and keys and sign a basic bill of sale that says “2009 Honda Civic sold for $X,” without any mention of the odometer reading. Another example: if selling a boat, there may be a requirement to list the HIN (Hull Identification Number) or engine hours; failing to include those could be an omission. In some transactions, there might be other disclosures. For instance, if the item is subject to any recall or if it’s a fire-sale of a branded title vehicle, etc., though those are more specialized scenarios.

Why it’s a problem

If you leave out an odometer statement when it’s required, you’re technically violating federal regulations. The buyer might need that information to register the vehicle – for example, some state DMV forms have a section for confirming the mileage. If your bill of sale doesn’t match or you didn’t do the separate odometer statement, it could delay the title transfer. Moreover, odometer fraud is a serious issue; by providing a truthful odometer reading in writing, you protect yourself as the seller from later accusations that you misrepresented the mileage. If a buyer later discovers the mileage was higher than stated verbally, a written odometer disclosure is key evidence. Not having it could expose you to legal claims. In fact, effective January 2021, federal rules extended odometer reporting requirements. Now vehicles from model year 2011 onward need mileage disclosures for 20 years. So more car sales than before will require this info.

For other disclosures: imagine selling a car that had a salvage title or a major defect. While a bill of sale might not legally require you to disclose those in all cases, not doing so could be construed as fraud if you actively hide it. It’s better to disclose known material information in writing. If the law specifically requires a form or statement.

How to avoid it

Research if your transaction needs any specific disclosures or statements. For vehicle sales, always include the odometer reading on the bill of sale. A simple line like: “Odometer reading: 124,500 miles .” Then both buyer and seller can initial or sign near that. This covers your bases. Also include any other identifying numbers: VIN for vehicles, HIN for boats, serial numbers for large equipment. Many bill of sale templates for vehicles prompt for these details, as we saw. Follow that prompt. If there are any mandatory forms for your item in your jurisdiction be sure to use them in conjunction with your bill of sale. This blog focuses on the bill of sale document itself, but remember that a bill of sale doesn’t replace official title transfer forms, it complements them.

A mistake some make is thinking a generic bill of sale is all that’s needed and ignoring the official paperwork. Don’t fall into that; use the bill of sale to reinforce and document the deal, and still file any required notices. For example, notice of sale or release of liability to the state. In private sales of cars, the seller often should also notify the state DMV of the sale promptly to avoid liability for the buyer’s driving. While that’s slightly outside the creation of the bill of sale, it’s related, failing to do so is a common mistake that can cause you to receive parking tickets or tax bills intended for the new owner. So as a tip, after you’ve completed a vehicle bill of sale, send in the seller’s report of sale to the state so that you aren’t held responsible for the vehicle after the sale.

In summary, don’t omit required or vital disclosures. Including the odometer reading for vehicles is one of the most important. It keeps you compliant with the law and provides clarity. If you’re unsure about what needs to be disclosed for your particular sale, a bit of research or using a guided form (again, Ziji Legal Forms or similar services often build these prompts in) will help ensure you don’t miss anything.

Leaving Blanks or Making Errors on the Document

Mistake

This mistake is more about execution: leaving blank spaces or making mistakes on the bill of sale and not correcting them properly. We touched on this in earlier points, but it’s worth emphasizing on its own. Sometimes people fill in most of a bill of sale but inadvertently leave a field blank such as forgetting to write the date, or not filling in the buyer’s address. Or they might write something incorrectly like reversing digits in the price or date and either not catch it or attempt to correct it in a messy way. Another scenario is using white-out or crossing things out sloppily, which can raise suspicion of tampering. Essentially, any unfilled section or obvious error on the face of the document is a problem.

Why it’s a problem

Blank spaces on a signed document can be exploited. In a worst-case scenario, a blank line for something like price or date could be filled in later by someone with ill intentions, altering the deal. Even if that doesn’t happen, an incomplete form may be questioned by officials or third parties: “Was this field intentionally left blank, or was it an oversight?” It introduces doubt about whether the document is finalized. Typos or mistakes can also cause practical issues. For example, if the bill of sale says the sale date is March 32, 2025, is it valid? Or if the price is written as $5,500 but in words says “five hundred dollars” due to an error, which is it? These ambiguities can lead to conflicts or delays. A DMV clerk might reject a form that looks altered or has conflicting information. And if you ever needed to use the bill of sale in court, any irregularities on it could be used by the opposing side to cast doubt on its reliability.

How to avoid it

Fill out the document completely and review it for accuracy before signing. Use dark ink (if paper) and legible handwriting for any filled portions. If you spot a mistake before signing, it’s best to start a fresh form if possible. This keeps things neat. If a small correction is needed and both parties agree, you can line through the error, write the correct information nearby, and have both parties initial the change. That way it’s clear the alteration was mutual and legitimate. Do not leave any key field blank.

As noted earlier, put “N/A” or a line through fields that don’t apply. Double-check all numbers: dates, prices, VINs, odometer readings, phone numbers – whatever is on there. It can be helpful for both the buyer and seller to cross-verify these. For example, read the VIN aloud together and match it to the car and the paper. Count the number of digits (VINs have 17 characters for modern cars) to ensure none are missing or transposed.

If using a computer to fill the template, proofread it on screen and again on paper after printing. Sometimes formatting issues could cut off information, leaving a “blank” that you didn’t notice. Remember that a clean and correctly completed document not only looks professional but also prevents misunderstandings. Using Ziji Legal Form's Bill of Sale template ensures you do not miss out on important information. Taking a few extra minutes to do this can save you from significant trouble later. In summary, treat the bill of sale with the same care you would any important contract: fill in everything, verify it twice, and address any errors clearly before it’s finalized. By avoiding blanks and mistakes, you’ll have a document that stands up to scrutiny.

Not Stating Ownership and Liens Status Clearly

Mistake

One often-overlooked element is failing to include a statement about ownership and liens/encumbrances. A robust bill of sale usually has language where the seller asserts that they are the legal owner of the item and that there are no liens or claims against it. Many DIY bills of sale forget this. The mistake is not clearly stating that the seller has the right to sell the item and that the title is clear. Additionally, not listing if the item is being sold subject to any conditions can be a mistake if that situation applies.

Why it’s a problem

When a buyer purchases an item, they want assurance that they won’t later face someone else claiming ownership or an unpaid loan on the item. If the bill of sale doesn’t include a clause saying, for example, “Seller affirms they are the sole owner of the property and that it is free of any liens or other claims,” the buyer has less protection. Should it turn out the item was stolen or had a lien, the buyer could argue misrepresentation. From the seller’s perspective, including that statement actually helps by making the buyer acknowledge the item is being sold legitimately. Some states’ legal templates explicitly include a guarantee that the item is free from all claims. If your form leaves that out, you are omitting a key legal protection.

For instance, imagine selling a car that was collateral for a loan. If you didn’t disclose the lien and didn’t state anything about liens on the bill of sale, the buyer might later discover the bank has an interest in the car. This becomes a messy situation. Even if there are no liens, not having it in writing could make a cautious buyer nervous, and it doesn’t clearly put the promise on record.

How to avoid it

Include a seller’s certification of ownership and lien-free status in the bill of sale. This is often a sentence or two. For example: “Seller represents and warrants that they are the lawful owner of the described property, which is free of all liens, loans, or other encumbrances. Seller has full right and authority to sell and transfer this property.” If there is a lien or loan that will be paid off as part of the sale, that should be explicitly noted. For example, “This sale is contingent on payoff of the existing lien with ABC Bank; the vehicle’s title will be transferred to buyer upon lien release.”. By making this declaration part of the contract, the seller is legally attesting to the buyer that the title is clear. This can later protect the buyer if it turns out to be false. They have it in writing that the seller said it was lien-free, which can support legal action for breach of contract if necessary.

For the seller, it’s a reminder to only sell items they truly own and to be upfront. In a typical bill of sale template, this text might already be included. If you’re handwriting a bill of sale from scratch, definitely write such a statement. Not only does it cover liens, but it also implicitly covers that the item isn’t stolen.

If the transaction is happening while a lien is still on the title, then have a plan in writing: who will send the payment to the bank, how the title will be delivered later, etc.

In summary, don’t neglect the ownership affirmation. It may seem like legal boilerplate, but it’s crucial. It assures the buyer they’re getting what they think they are – full ownership of an item that no one else can claim. And it ensures the seller commits in writing that everything is above-board with the sale. This kind of transparency is what prevents nasty surprises down the line.

Failing to Provide Copies to Both Parties

Mistake

The final mistake to avoid is not providing copies of the signed bill of sale to both the seller and the buyer. Sometimes in the rush of completing the sale, only one copy is signed and handed to the buyer and the other party doesn’t retain a copy. In other cases, the document might be created electronically and emailed, but one party may not keep a proper copy or print it. Not having your own copy of the bill of sale is a mistake whether you’re the buyer or seller.

Why it’s a problem

The bill of sale is an important record for both sides. If you don’t have a copy and a dispute or question arises later, you may have nothing to refer to. For example, if you’re the seller and months later the buyer claims you promised something or didn’t disclose something, you’ll want to pull out the bill of sale to check what was written. If you didn’t keep a copy, you’ll be going by memory or hoping the buyer still has theirs.

From the buyer’s perspective, the bill of sale may be needed to prove they own the item until the official title or registration is sorted out. If a police officer or tax authority asks for proof of purchase, that signed bill of sale is your evidence. Without it, you could face hassles or be unable to prove the transaction happened. Moreover, for things like insurance, having a copy of the bill of sale can help establish the value and date of acquisition of the item.

How to avoid it

The solution is simple: make at least two original signed copies of the bill of sale, one for each party. In practice, what many do is print two copies of the bill of sale and fill them out identically. Both buyer and seller sign both copies. That way each party walks away with a hand-signed original. This is ideal, as each has an original signature document. If only one original is made, then the other party should receive a photocopy, scan, or digital copy immediately. These days it’s easy to snap a photo or scan with a smartphone; do that if you’re the one not retaining the paper.

For electronic transactions, ensure that the final PDF or document with signatures is emailed to both parties. If the sale is happening in person, it’s worth the minor extra effort to bring two copies. Also, keep the copy in a safe place. Sellers should file it with their transaction records or keep a digital backup.

Buyers should keep it until they have formal title or registration and even then, keep it as a receipt of purchase. For certain items, you might need the bill of sale years later. For example, when selling the item again or proving the purchase price for tax purposes. So treat it as an important document.

Another tip

Some jurisdictions require the seller to submit a notice of sale to a state agency. Having your own copy makes it easy to report those details correctly. By ensuring both buyer and seller have copies, you close the loop on the transaction. It fosters transparency as each party knows exactly what terms were documented. And it safeguards both sides by preserving evidence of the deal. In the context of avoiding mistakes, this one is about not letting all your good work go to waste by misplacing it or not being able to produce it when needed. So, always provide and keep copies.

Having covered the ten key mistakes to avoid, you should now have a clear sense of what to do when creating your bill of sale: include all pertinent details, describe the item accurately, clarify the terms, use a good template, sign properly, consider notarization, fulfill any legal disclosure requirements, double-check for errors, and document everything for both parties. In the next section, we’ll explain how you can achieve all of the above smoothly by using Ziji Legal Forms to create a bill of sale step-by-step.

If you’re unsure whether you need a bill of sale or a broader contract, read our detailed comparison of Bill of Sale vs. Sales Agreement

How to Create a Bill of Sale Using Ziji Legal Forms

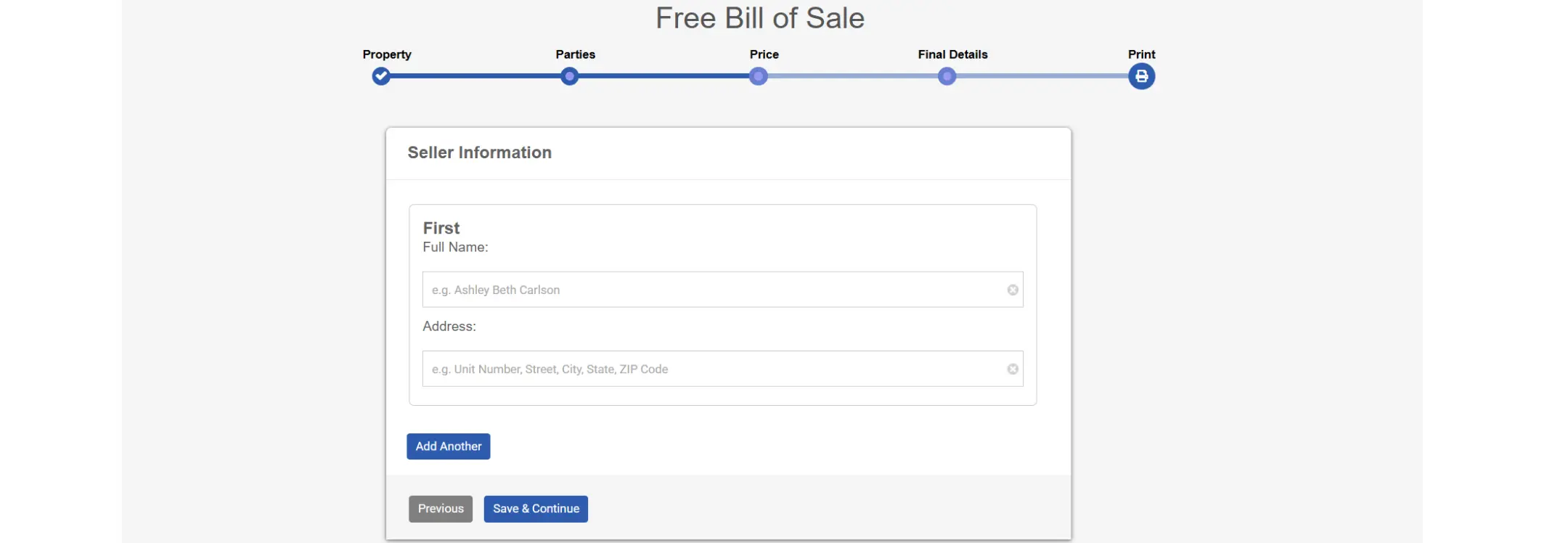

Creating a bill of sale is made easier with guided tools like Ziji Legal Forms. Ziji Legal Forms is an online service that provides professionally drafted templates by lawyers and a user-friendly questionnaire interface to generate your document. By using Ziji, you can significantly reduce the chances of making the mistakes we discussed above, because the platform will prompt you for all the necessary information and include the correct legal language automatically. Here’s how you can create a bill of sale using Ziji Legal Forms:

1. Start a Bill of Sale Form

Log in to your Ziji Legal Forms account or create an account if you’re new. Navigate to the Bill of Sale form. You may be asked to select the specific type of bill of sale you need.

2. Enter Party Details

The form wizard will ask for information about the seller and buyer. You’ll fill in each party’s full name and address. Ziji Legal Forms' interface ensures you don’t leave this blank by requiring input before proceeding. This addresses Mistake #1 (missing info) by capturing names and addresses for both sides.

3. Describe the Item

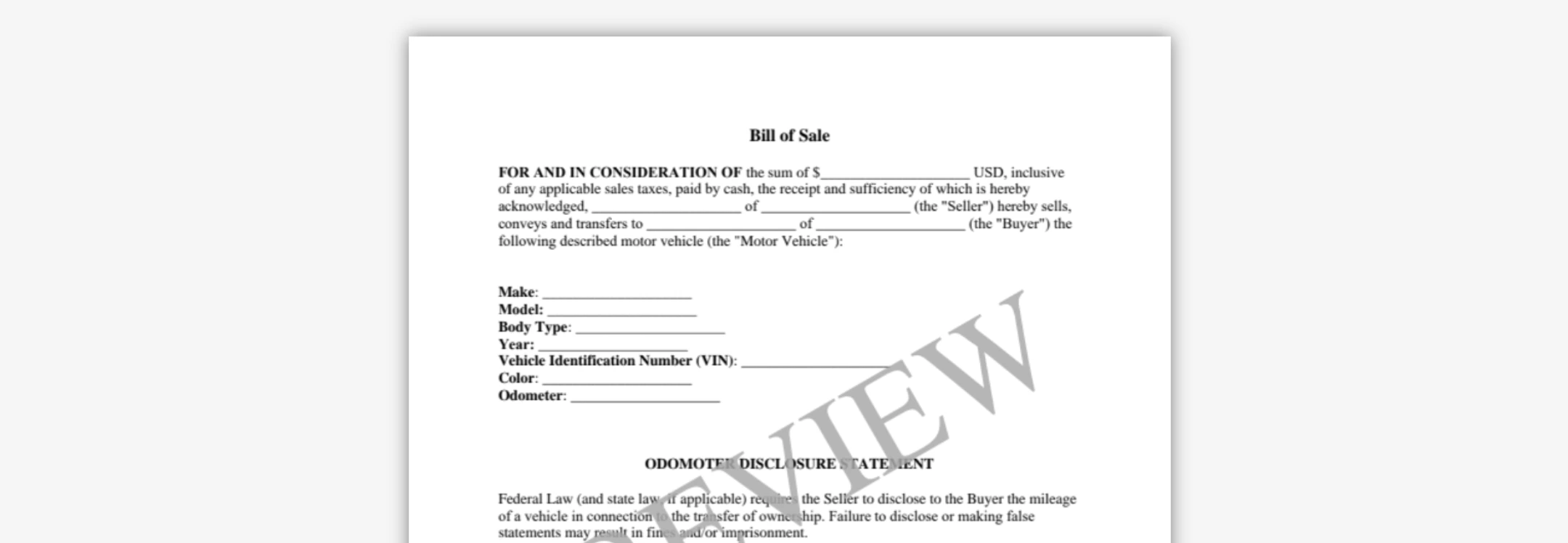

Next, you’ll input details about the item being sold. For a vehicle bill of sale, Ziji Legal Forms will prompt you for specific fields like make, model, year, VIN, color, and current mileage, covering details that prevent Mistake #2 (vague description) and Mistake #7 (omitting odometer). For other items, you’ll have fields to describe the property and include any serial numbers or identifying features. The guided format helps ensure you provide a thorough description.

4. Specify the Price and Terms

You will then enter the purchase price or the nature of the trade/consideration. You can also outline payment terms if not a one-time payment (though most private sales are paid in full on the spot). This structured input makes sure the consideration is clearly documented, and if there’s any unique payment arrangement, it gets captured preventing mistakes like leaving out payment structure.

5. Add “As-Is” and Other Clauses

Ziji Legal Forms will include standard clauses such as an “as-is” disclaimer by default if you indicate the sale is without warranty. If your sale includes a warranty from the seller, there may be a section to fill in those details. You’ll also see that the template includes the seller’s warranty of ownership and no liens. Because these clauses are built-in, you won’t forget to include them, avoiding Mistake #3 (forgetting as-is clause) and Mistake #9 (no ownership affirmation). You might see language in the preview like “Seller certifies that they are the owner and item is free of liens” already present.

6. Include Notary or Witness

If you know you need a notary or want witnesses, Ziji Legal Forms might offer an option to add a notary acknowledgment block or witness signature lines to the document. You can choose to include those so that the final printout has space for the notary or witness to sign. This is helpful to address Mistake #6 (skipping notarization) by preparing for it in the document.

7. Review the Completed Form

Once you’ve entered all the information, Ziji Legal Forms will generate a preview of your bill of sale template with all the details filled in. Review this carefully on screen. This is your chance to proofread and catch any typos (preventing Mistake #8). The platform’s Q&A format minimizes blanks, but if you see any empty fields or incorrect entries, you can go back and fix them in the form inputs.

8. Download and Print

After reviewing, you can download the finalized bill of sale as a PDF or Word document. Choose the format you prefer. At this point, Ziji Legal Forms will prompt you to select a plan to access the document. Once downloaded, print two copies so that both buyer and seller can have originals addressing Mistake #10 (failing to provide copies).

9. Sign and Complete the Transaction

With the printed forms, have all parties sign as discussed earlier. If using a notary, do the signing in front of the notary who will then notarize each copy. Each party should walk away with their signed copy of the bill of sale. Ziji Legal Forms' will have clear signature lines for everyone, which helps you not overlook obtaining all signatures (avoiding Mistake #5).

Once your bill of sale is ready to download, Ziji Legal Forms offers multiple access options to suit different needs. You can choose a one-time download, a subscription plan for ongoing access to all legal documents, or start with a free trial. Each option allows unlimited revisions and access from anywhere.

By using Ziji Legal Forms’ guided process, you essentially have a checklist built into the creation of the document. The platform won’t let you finish if required fields are empty, thereby ensuring completeness. It also uses legally vetted language for the jurisdiction you specify, so the final product is legally accurate and comprehensive. This can save you from worrying about whether you phrased the “as-is” clause correctly or if you remembered to include the right details – the heavy lifting has been done by legal experts in preparing the template.

Furthermore, Ziji Legal Forms is branded to emphasize ease of use and reliability. In a competitive market of legal document services, Ziji positions itself to help avoid “common errors with outdated or vague forms”, exactly the kind of mistakes we’ve outlined. So if you want to create a bill of sale with confidence, it’s worth considering this tool for a smooth, guided experience.

Conclusion

A well-drafted bill of sale is more than a formality – it is your written safeguard in a sales transaction. By avoiding the common mistakes discussed in this article, you ensure that your bill of sale form truly serves its purpose as a legally binding record of the deal.

In professional terms, taking the time to “get it in writing” correctly is always worth it. This is a principle that extends beyond bills of sale to any contract. But given how often individuals engage in casual sales (cars, electronics, equipment, etc.), it’s important for the general public to realize that a bill of sale is not just a throwaway piece of paper, it’s a key legal document. Treat it seriously, and you’ll avoid a host of potential problems.

We hope this comprehensive guide has armed you with the knowledge to create a solid bill of sale and avoid the pitfalls that many fall into. Whenever you’re in doubt, refer back to these ten points, or leverage tools like Ziji Legal Forms which embody these best practices in their process. With the right approach, you can confidently document your sale and move forward knowing both you and the other party are protected by a clear, correct, and complete bill of sale.

Bill of Sale FAQS

Is a bill of sale legally binding without a witness?

While not required, having a witness (especially for high-value items) can strengthen the legal validity of the transaction.

Can a bill of sale be used for gifted items (with $0 value)?

Yes, but it should clearly state the transfer is a gift and mention $0 or nominal value (e.g., $1) for record purposes.

Can I create a digital or electronic bill of sale?

Electronic bills of sale are valid in most states as long as they meet e-signature laws (like ESIGN or UETA compliance).

Do I need a separate bill of sale for each item sold?

Not necessarily. Multiple items can be listed in a single bill of sale if properly described and valued individually.

Can I cancel or amend a bill of sale after signing?

A signed bill of sale can only be canceled or amended if both parties agree, ideally with a written amendment or cancellation notice.

What jurisdictions can use our bill of sale?

You can use our template to create a legal and valid bill of sale for the following jurisdictions.

| Alabama (AL) | Alaska (AK) | Arizona (AZ) | Arkansas (AR) | California (CA) |

| Colorado (CO) | Connecticut (CT) | Delaware (DE) | District of Columbia (DC) | Florida (FL) |

| Georgia (GA) | Hawaii (HI) | Idaho (ID) | Illinois (IL) | Indiana (IN) |

| Iowa (IA) | Kansas (KS) | Kentucky (KY) | Louisiana (LA) | Maine (ME) |

| Maryland (MD) | Massachusetts (MA) | Michigan (MI) | Minnesota (MN) | Mississippi (MS) |

| Missouri (MO) | Montana (MT) | Nebraska (NE) | Nevada (NV) | New Hampshire (NH) |

| New Jersey (NJ) | New Mexico (NM) | New York (NY) | North Carolina (NC) | North Dakota (ND) |

| Ohio (OH) | Oklahoma (OK) | Oregon (OR) | Pennsylvania (PA) | Rhode Island (RI) |

| South Carolina (SC) | South Dakota (SD) | Tennessee (TN) | Texas (TX) | Utah (UT) |

| Vermont (VT) | Virginia (VA) | Washington (WA) | West Virginia (WV) | Wisconsin (WI) |

| Wyoming (WY) |

GET STARTED FOR FREE

Create your

Get Started For Free