- A promissory note is a legally binding document where one party promises to pay another a specific amount, serving as written proof of debt in personal loans, business financing, and private lending arrangements

- Key types include secured notes (backed by collateral), unsecured notes (based on creditworthiness), demand notes (payable on request), and installment notes (scheduled payments)

- Essential elements include principal amount, interest rate (complying with usury laws), repayment schedule, maturity date, default provisions, and proper signatures

- Written promissory notes protect both lenders and borrowers by establishing clear expectations, providing legal proof of debt, and preventing disputes over terms

- Using professional templates like those from Ziji Legal Forms ensures compliance with federal lending laws while providing customizable options for various loan situations

Introduction: The Simplicity and Power of a Promissory Note

Money lending has existed for thousands of years, but the need for clear documentation remains as important today as ever. Whether you're lending money to a family member, financing a business venture, or structuring a private investment deal, a promissory note serves as the backbone of responsible lending practices.

A promissory note is fundamentally a written promise where one party agrees to pay another party a specific sum of money under agreed-upon terms. This seemingly simple document carries significant legal weight and transforms informal lending arrangements into enforceable contracts that protect both parties involved.

The document finds widespread use in personal loans between friends and family members, small business financing where traditional bank loans may not be suitable, private lending arrangements for real estate investments, and bridge financing for time-sensitive opportunities. Its versatility makes it an essential tool for anyone involved in money lending or borrowing activities.

Unlike complex loan agreements that may require extensive legal review, promissory notes can be straightforward while still providing robust legal protection. However, their simplicity should not be mistaken for lack of importance. A well-crafted promissory note serves as enforceable written evidence that can prevent disputes and provide clear recourse if repayment issues arise.

How a Promissory Note Works

The functionality of a promissory note centers on creating a clear, documented obligation between a lender (payee) and borrower (maker or payor). This written agreement establishes the legal foundation for money lending relationships while providing both parties with defined expectations and protections.

The Basic Process

The typical flow begins with drafting the document to include all necessary terms and conditions, followed by signing by both parties to create the binding agreement, and concluding with execution of the repayment terms as specified. Each step requires attention to detail to ensure enforceability.

The document can exist as a standalone agreement for simple personal loans, or it can complement other legal documents in more complex arrangements such as mortgages, business acquisitions, or investment deals. When used alongside other agreements, the promissory note typically focuses specifically on the payment obligation while other documents address additional terms.

Legal Standing and Enforcement

Promissory notes carry the full weight of contract law, making them legally enforceable in court proceedings. If a borrower fails to meet the repayment obligations, the lender can pursue collection through various legal remedies including demand letters, civil lawsuits, and depending on the note type, collateral recovery procedures.

The enforceability depends heavily on proper document preparation, clear terms, and compliance with applicable federal and state lending laws. Courts generally favor clear, unambiguous language and well-documented lending relationships when disputes arise.

Types of Promissory Notes

Understanding the different types of promissory notes helps lenders and borrowers select the most appropriate structure for their specific situation while ensuring adequate protection and clarity for all parties involved.

Simple or Personal Promissory Note

Simple promissory notes represent the most basic form, commonly used for informal lending between family members, friends, or acquaintances. These documents typically involve smaller amounts and straightforward repayment terms without complex collateral arrangements.

The appeal of simple notes lies in their accessibility and ease of creation, making them suitable for situations where formal bank lending is unnecessary or unavailable. However, their informal nature requires extra attention to ensure all essential elements are included for legal enforceability.

Secured Promissory Note

Secured promissory notes include specific collateral that backs the loan, providing lenders with additional protection through the right to claim designated assets if the borrower defaults. Common collateral includes real estate, vehicles, business equipment, or other valuable property.

The collateral requirement typically allows for lower interest rates due to reduced lender risk, while providing borrowers access to larger loan amounts than might be available through unsecured arrangements. However, borrowers face the risk of losing pledged assets if they cannot meet repayment obligations.

Proper secured notes include detailed descriptions of the collateral, procedures for default handling, and clear rights for both asset protection and recovery. The complexity of secured arrangements often benefits from legal review to ensure all parties understand their rights and obligations.

Unsecured Promissory Note

Unsecured promissory notes rely solely on the borrower's promise and creditworthiness without requiring specific collateral backing. These arrangements depend heavily on trust, personal relationships, or strong credit history to provide lender confidence.

The absence of collateral typically results in higher interest rates to compensate lenders for increased risk, while limiting loan amounts to levels commensurate with the borrower's demonstrated ability to repay. Unsecured notes often work best for borrowers with strong credit histories or established relationships with lenders.

Collection on defaulted unsecured notes requires legal action rather than asset recovery, making thorough documentation and clear terms especially important for enforceability and successful debt recovery.

Demand Note

Demand notes allow lenders to request full repayment at any time, providing maximum flexibility for changing financial circumstances or lending needs. These arrangements work well when lenders want to maintain control over the timing of repayment while providing borrowers with access to needed funds.

The unpredictable repayment timing requires borrowers to maintain sufficient liquidity or asset access to meet potential demand requirements. Clear notice procedures and reasonable grace periods help balance lender rights with borrower practicality.

Installment Note

Installment notes structure repayment through scheduled periodic payments, providing predictability for both parties while spreading the repayment burden over time. This arrangement works particularly well for larger loan amounts or borrowers who prefer consistent payment obligations.

Regular payment schedules help borrowers budget effectively while providing lenders with steady income streams and regular communication touchpoints. Proper installment notes include clear payment amounts, due dates, late payment procedures, and consequences for missed payments.

Key Elements Every Promissory Note Should Include

Comprehensive promissory notes require specific elements to ensure legal enforceability while providing clear guidance for both parties throughout the lending relationship. Missing or inadequate provisions can undermine the document's effectiveness and create disputes.

Principal Amount

The principal amount represents the total sum being borrowed and must be stated clearly in both numerical figures and written words to prevent disputes or misunderstandings. This dual notation helps eliminate ambiguity while providing verification of the intended loan amount.

Accurate principal amount documentation forms the foundation for calculating interest, determining payment schedules, and establishing the total obligation. Any errors in this fundamental element can compromise the entire agreement and create unnecessary complications.

Interest Rate and Usury Compliance

The interest rate requires careful attention to both documentation and legal compliance with federal and state usury laws that limit maximum allowable interest rates. These laws vary by jurisdiction and loan type, making compliance verification essential for enforceability.

Even loans between family members or friends should include interest rates to avoid potential tax implications from the IRS, which may impute interest income based on Applicable Federal Rates if no interest is charged. Current AFR information is available on the IRS website and changes monthly.

Usury violations can result in serious penalties including forfeiture of all interest, return of excess payments, and potential criminal charges in extreme cases. Professional guidance helps ensure interest rates remain within legal limits while achieving fair compensation for lenders.

Repayment Schedule and Terms

Clear repayment schedules eliminate confusion about when and how payments should be made, whether through lump sum payments at maturity, regular installment payments, or on-demand arrangements. Specific due dates, payment amounts, and acceptable payment methods provide necessary guidance.

The schedule should address payment allocation between principal and interest, procedures for early repayment including any prepayment penalties, and handling of partial payments to prevent disputes about payment application and remaining balances.

Maturity Date

The maturity date establishes when the entire obligation becomes due and payable, providing a clear endpoint for the lending relationship. This date becomes particularly important for triggering default provisions, calculating final interest amounts, and determining legal collection rights.

Fixed maturity dates work well for most arrangements, while demand notes may specify alternative triggering events or notice requirements. Clear maturity provisions help both parties plan appropriately while establishing definitive timelines for obligation fulfillment.

Default and Late Payment Provisions

Default provisions define what constitutes a breach of the agreement and specify the consequences of non-payment, including late fees, acceleration of the entire balance, and available collection remedies. Clear default language helps prevent disputes while providing lenders with defined recourse options.

Late payment fees must comply with state laws and should be reasonable in relation to the loan amount and administrative burden. Excessive fees may be deemed unenforceable or could violate usury restrictions depending on local regulations.

Grace periods and notice requirements provide borrowers with reasonable opportunities to cure defaults while protecting lender rights. Well-drafted default provisions balance firmness with fairness to maintain enforceability while encouraging voluntary compliance.

Security and Collateral Descriptions

When applicable, collateral descriptions must be specific and complete to ensure enforceability of security interests. Real estate should include legal descriptions and property addresses, while personal property requires detailed identification including serial numbers, model information, and current locations.

Proper collateral documentation often requires additional legal filings such as UCC financing statements for personal property or mortgage recordings for real estate. These requirements vary by jurisdiction and property type, making professional guidance valuable for complex secured arrangements.

Signature Requirements

Proper signatures are essential for creating binding obligations, typically requiring the borrower's signature at minimum while lender signatures may also be advisable for complete documentation. All signatures should be dated and may benefit from notarization or witness signatures depending on state requirements and loan complexity.

Signature requirements may vary based on the parties involved, with additional formalities potentially required for business entities, multiple borrowers, or guarantor arrangements. Electronic signatures may be acceptable in many jurisdictions but should comply with applicable electronic signature laws.

Governing Law Clause

Governing law provisions specify which jurisdiction's laws apply to interpretation and enforcement of the promissory note, providing clarity for potential legal proceedings while ensuring compliance with applicable regulations. This provision becomes particularly important for parties in different states or for notes involving interstate commerce.

Clear governing law designation helps prevent forum shopping while ensuring all parties understand which legal standards will apply to their agreement. Professional guidance helps select appropriate jurisdictions while considering factors such as usury laws, collection procedures, and court accessibility.

Why You Need a Written Promissory Note

Written documentation provides essential protection and clarity that verbal agreements simply cannot match, transforming informal lending arrangements into legally enforceable contracts while establishing clear expectations for all parties involved.

Benefits for Lenders

Legal proof of debt represents the primary advantage of written promissory notes, providing documented evidence of the lending arrangement, repayment terms, and borrower obligations that courts can easily understand and enforce. This documentation proves invaluable if collection action becomes necessary.

Simplified debt recovery through clear contract terms streamlines legal proceedings and collection efforts by eliminating disputes about original agreements, payment schedules, and default consequences. Well-documented loans significantly improve collection success rates while reducing legal costs.

Dispute prevention occurs naturally when terms are clearly written and agreed upon in advance, reducing misunderstandings about payment amounts, due dates, interest calculations, and default procedures. Clear documentation eliminates most common sources of lending relationship conflicts.

Professional promissory notes also provide tax documentation for lenders who must report interest income while helping establish legitimate business purposes for lending activities. Proper documentation supports tax compliance while providing records for business or investment purposes.

Benefits for Borrowers

Clear expectations help borrowers understand exactly what they owe, when payments are due, and what consequences arise from late or missed payments. This clarity eliminates uncertainty while providing a roadmap for successful debt repayment.

Protection against changing terms ensures lenders cannot unilaterally modify interest rates, payment schedules, or other agreement terms without borrower consent. Written contracts provide legal protection against unfair treatment or arbitrary changes in lending terms.

Evidence of agreement protects borrowers against inflated claims about amounts owed, interest rates charged, or payment history disputes. Proper documentation provides borrowers with legal standing to challenge incorrect or excessive collection efforts. Well-drafted promissory notes also establish credit history documentation that may support future borrowing needs while providing evidence of successful debt management when loans are repaid as agreed.

Mutual Benefits

Relationship preservation often results from clear documentation that eliminates misunderstandings and provides frameworks for addressing problems before they become serious disputes. Written agreements help maintain personal and business relationships by preventing money-related conflicts.

Legal compliance with applicable lending laws protects both parties from regulatory violations while ensuring agreements remain enforceable under current legal standards. Professional documentation helps avoid common legal pitfalls that could compromise the entire arrangement.

Professional credibility enhances both parties' reputations by demonstrating serious, business-like approaches to financial obligations. Proper documentation indicates trustworthiness and attention to detail that benefits future financial relationships.

Common Mistakes to Avoid

Understanding frequent errors in promissory note creation helps prevent problems that could undermine legal enforceability, create disputes, or result in collection difficulties when repayment issues arise.

Incomplete Payment Information

Missing payment details represent one of the most common and potentially costly errors, including failure to specify exact payment amounts, unclear due dates, ambiguous payment frequencies, or inadequate interest calculation methods. These omissions create disputes and may render notes unenforceable.

Vague payment schedules that lack specific dates, amounts, or procedures leave too much room for interpretation and disagreement. Professional templates ensure comprehensive payment documentation while providing clear guidance for both parties.

Inadequate Default Provisions

Insufficient default language fails to specify what constitutes a breach, what notice requirements apply, or what remedies are available to lenders. Without clear default provisions, collection efforts become complicated and potentially unsuccessful.

Missing consequences for late payments or defaults leave lenders without clear recourse options while failing to provide borrowers with adequate warning about potential problems. Well-drafted default provisions balance protection with fairness.

Signature and Documentation Problems

Incomplete signatures can void promissory notes entirely, particularly when required parties fail to sign, signatures are not dated, or proper witnessing or notarization requirements are not met. These technical problems can eliminate legal enforceability despite otherwise proper documentation.

Lost or altered documents create enforceability problems and may prevent successful collection efforts. Proper storage, distribution of copies, and protection against unauthorized changes help maintain document integrity throughout the lending relationship.

Interest Rate and Legal Compliance Errors

Usury violations occur when interest rates exceed legal limits, potentially resulting in forfeiture of all interest, return of excess payments, or criminal penalties depending on jurisdiction and violation severity. Professional guidance helps ensure compliance with applicable interest rate limitations.

Missing disclosures required by federal or state lending laws can create compliance problems and may provide borrowers with grounds to challenge collection efforts. Understanding applicable disclosure requirements helps avoid regulatory violations.

Unclear Terms and Conditions

Ambiguous language throughout promissory notes creates interpretation problems and potential disputes about meanings, obligations, and procedures. Clear, specific language eliminates most sources of confusion while improving enforceability.

Inconsistent terms between different sections of notes or between related documents can create contradictions that undermine the entire agreement. Careful review and professional preparation help ensure internal consistency and clarity.

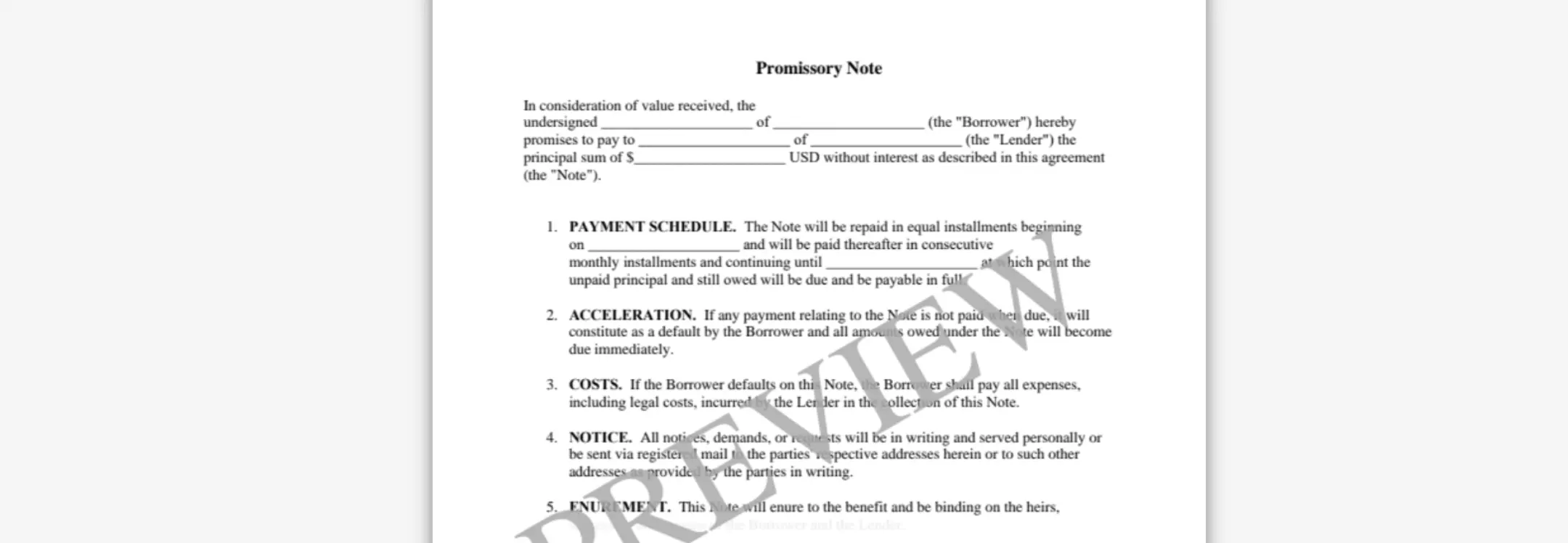

How to Create a Legally Binding Promissory Note Using Ziji Legal Forms

Professional legal form platforms provide essential tools for creating comprehensive promissory notes that meet current legal requirements while addressing specific lending needs and circumstances. Here is how you an create one using Ziji Legal Forms in 5 simple steps:

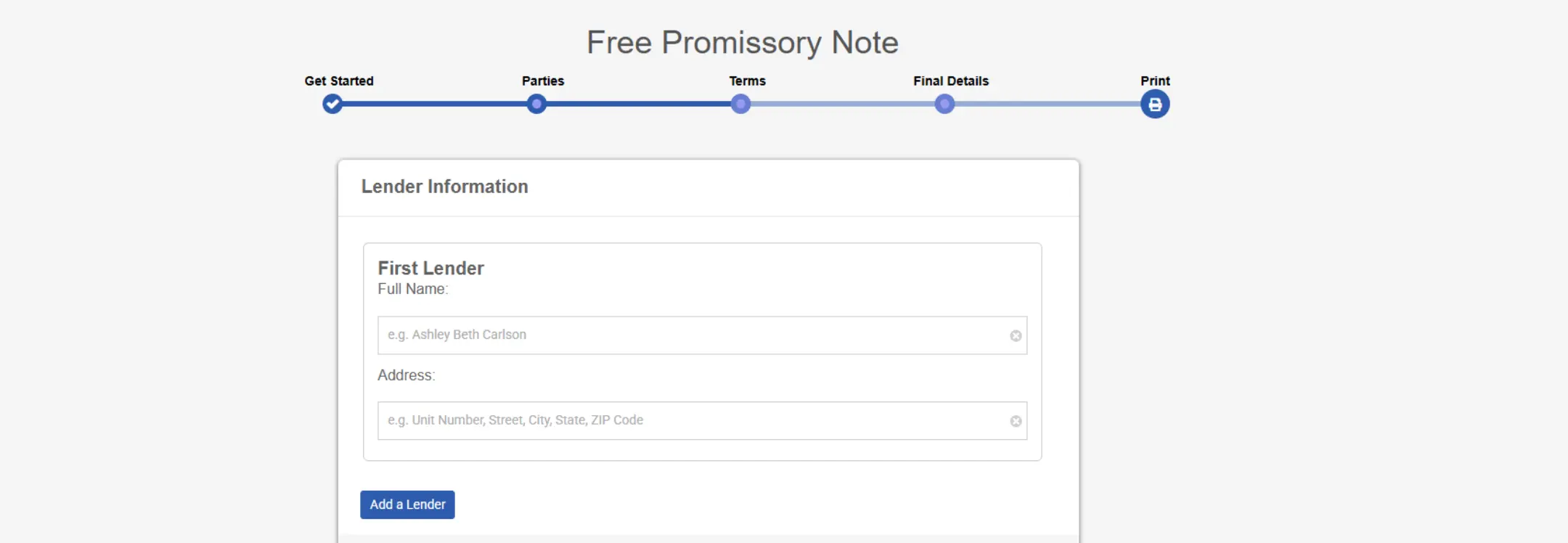

1. Choose template: Log in to Ziji Legal Forms and select the Promissory Note Template suited to your loan type.

2. Fill in details about the parties: Enter the full legal names, addresses, and roles of the lender and borrower.

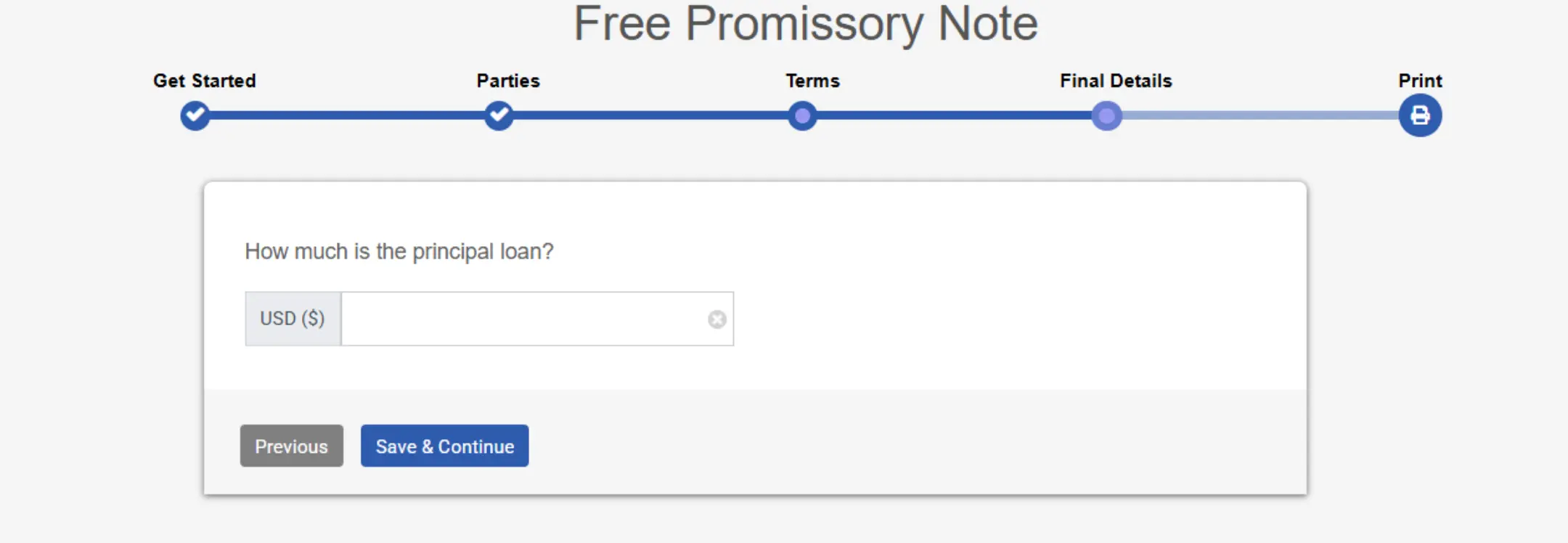

3. Fill in terms and conditions: Specify loan amount, interest rate, repayment schedule, and default provisions.

4. Add final details: Include collateral information, governing law, and any prepayment or late fee terms.

5. Preview and Print: Review the completed note for accuracy, then download, print, and sign it for legal validity.

Best Practices for Promissory Note Management

Effective ongoing management of promissory note relationships helps ensure successful repayment while maintaining positive relationships and legal protection for all parties involved throughout the lending term.

Documentation and Record Keeping

Comprehensive file maintenance should include original signed notes, payment records, correspondence history, and any modifications or amendments that affect the lending relationship. Organized documentation supports collection efforts while providing evidence of compliance and good faith dealing.

Payment tracking systems help monitor compliance with repayment schedules, calculate interest and fees accurately, and identify potential problems before they become serious defaults. Regular monitoring enables proactive communication and problem resolution.

Communication documentation provides evidence of notification efforts, borrower responses, and problem resolution attempts that may prove valuable if legal collection action becomes necessary.

Relationship Management

Regular communication helps maintain positive relationships while enabling early identification of potential repayment problems that can often be resolved through modification or restructuring rather than collection action.

Flexibility and problem-solving approaches often prove more effective than rigid enforcement, particularly in personal lending situations where relationship preservation may be as important as debt recovery.

Professional boundaries should be maintained even in personal lending situations to ensure business decisions are made objectively while preserving the legal enforceability of agreements.

Collection and Enforcement Preparation

Early warning systems help identify payment problems before they become serious defaults, enabling intervention strategies that may prevent the need for formal collection action while protecting lender interests.

Legal resource preparation includes identifying qualified collection attorneys, understanding available collection procedures, and maintaining proper documentation that supports successful legal action if needed.

Alternative resolution consideration may include debt restructuring, partial settlement, or other arrangements that achieve reasonable recovery while avoiding expensive and time-consuming litigation procedures.

Conclusion

A well-drafted promissory note ensures clarity, fairness, and legal protection for both borrower and lender. Using Ziji Legal Forms streamlines the process, helping you quickly create a professional, compliant document that safeguards your financial arrangement.

Promissory Note FAQs

What is a promissory note also known as?

A promissory note is also known as the following: demand note, IOU “I owe you”, loan agreement, or promise to pay agreement.

What is a promissory note?

A promissory note is a legal instrument where the borrower promises to repay the loan owed to the lender under the terms of the note. It’s essentially a promise to repay the lender.

Who is a co-signer for the promissory note?

The co-signer, also called a guarantor, is someone who is guaranteeing the loan and will be responsible for paying for the full amount of the loan if the borrower cannot repay the loan to the lender.

What should the promissory note cover?

The promissory note typically contains the following terms:

- the original loan amount

- interest payment, if any

- repayment schedule

- late fees, if any

- collateral for the loan, if any

You can use our template and create a promissory note with the following steps:

- Select the loan’s location

This is the state where the lender lives and the promissory note will be customized to that jurisdiction.

- List the parties to the loan

Provide the names and addresses of the lender and the borrower. You may also include a co-signer or guarantor if there is one.

- List the terms of the loan

Describe how much is the loan amount. Secondly, is interest being charged? If so, what percentage will the interest be and how will the interest be calculated and accrued. Thirdly, list the repayment schedule. Typically, loans are repaid in instalments and payments can be made weekly, monthly, quarterly, semi-annually or yearly. However, the loan can also be repaid in one lump sum, or at a later date based on the lender’s demand. You will also need to list the first and final payment date to the loan repayment schedule.

- List the prepayment teams

Loans can have prepayment penalty if the borrower repays it early because most lenders are interested in earning the most interest with the loan. You can decide whether to have a prepayment penalty in customizing this promissory note.

- Collateral

A collateral is an asset the lender accepts as security for a loan in case the borrower fails to repay the loan. This is typically reserved for risky borrowers that may not be as credit worthy and who tries to borrow a substantial amount of money. For example, the borrower can use a car, or jewellery as collateral and upon default of the loan, the lender can go to small claims court to seize the collateral or other assets from the borrower in order to satisfy the failure of repayment.

If there is collateral to the loan, describe the collateral in detail to ensure there is no ambiguity what property is being used as collateral. For example, listing the year, make and model of the car, along with the VIN number. If it’s a piece of electronics, list the serial number etc.

Do I need to notarize my promissory note?

You only need the signature of the lender and borrower to have an enforceable promissory note. However having a notary to witness the document adds another layer of authenticity and protection in case the loan gets disputed in court in the future. For loans involving substantial amount of money, it may be prudent to have it notarized.

Can a promissory note be modified after it is signed?

Yes, a promissory note can be changed or amended if both the lender and borrower agree to the new terms. Any modifications should be documented in writing and signed by both parties to avoid confusion or disputes later on.

What happens if the borrower misses a payment?

If the borrower fails to make a scheduled payment, the lender may charge late fees if specified in the note. Repeated missed payments could lead to default, giving the lender the right to demand the full remaining balance immediately or take legal action to recover the debt.

Is interest always required on a promissory note?

No, interest is not mandatory on a promissory note. Some loans may be interest-free, especially between family or friends. However, if interest is charged, the note should clearly state the interest rate and how it will be calculated.

What is the difference between a secured and unsecured promissory note?

A secured promissory note is backed by collateral, meaning the lender can seize specific assets if the borrower defaults. An unsecured promissory note has no collateral backing, so the lender’s remedy is limited to suing the borrower for repayment.

Can a promissory note be transferred to someone else?

Yes, promissory notes can sometimes be assigned or sold to a third party. This means the new holder of the note can collect payments instead of the original lender. The transfer should be documented properly to ensure the borrower knows who to pay.

What jurisdictions can use our promissory note?

You can use our template to create a legal and valid promissory note for the following jurisdictions:

|

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

District of Columbia

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming |

AL

AK

AZ

AR

CA

CO

CT

DE

DC

FL

GA

HI

ID

IL

IN

IA

KS

KY

LA

ME

MD

MA

MI

MN

MS

MO

MT

NE

NV

NH

NJ

NM

NY

NC

ND

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VT

VA

WA

WV

WI

WY |