Last Updated: February 20, 2026

TL;DR

- Quitclaim deeds provide a simple, cost-effective method for transferring property ownership within families without warranty guarantees

- Ideal for adding spouses to titles, removing ex-spouses after divorce, gifting property to children, or transferring property to family trusts

- Benefits include quick execution and lower costs, but risks include no title guarantees and potential hidden liens or ownership issues

- Free quitclaim deed forms and quitclaim deed online platforms streamline the process with state-compliant templates and guided completion

- Best suited for trusted family relationships where parties understand the property's ownership history and accept inherent risks

- You can easily created a legally valid Quitclaim Deed with Ziji Legal Forms' Quitclaim Deed Template

Introduction: Family Property Transfers and Legal Simplicity

Family property transfers occur frequently for various practical reasons, from adding a spouse to a home title after marriage to simplifying inheritance arrangements or removing an ex-spouse following divorce proceedings. These transfers often involve trusted parties who understand the property's history and ownership status, making them ideal candidates for streamlined legal processes.

The appeal of using a quitclaim deed for family transfers centers on three key advantages: speed, simplicity, and cost effectiveness. Unlike traditional real estate sales that require extensive title searches, inspections, and warranty guarantees, quitclaim deeds allow families to transfer ownership quickly without the complex legal protections typically required for transactions between strangers.This approach makes particular sense in family contexts where trust exists between parties and the property's ownership history is well understood. Parents transferring property to adult children, spouses adding each other to titles, or families consolidating assets into trusts can accomplish these goals efficiently through quitclaim deed forms designed specifically for such purposes.

What Is a Quitclaim Deed and How Does It Work in Families?

A quitclaim deed represents a legal document that transfers whatever ownership interest the grantor possesses in a property to the grantee, but provides no warranties or guarantees about the validity or extent of that ownership. This "as-is" approach distinguishes quitclaim deeds from warranty deeds, which promise clear title and protection against ownership disputes.

The Limited Warranty Concept

What is a quitclaim deed in practical terms means understanding its fundamental limitation: it only transfers the interest the grantor actually holds, if any. If the grantor has full ownership, the grantee receives full ownership. However, if the grantor has no legal ownership or only partial ownership, that's exactly what the grantee receives, with no legal recourse against the grantor for misrepresentation.

This limitation explains why quitclaim deeds work well for family transfers where relationships are trusted and property ownership is clearly understood. Family members typically know whether parents actually own the family home outright or if there are existing mortgages, liens, or other complications that might affect the transfer.

Common Family Transfer Scenarios

Quitclaim deed forms frequently facilitate several specific family situations. Adding a spouse to a property title after marriage allows both partners to hold ownership rights, simplifying future decision-making about the property and providing inheritance protection. Conversely, removing an ex-spouse from a title after divorce ensures clean property division as outlined in divorce settlements.

Parents often use free quitclaim deed options to gift property to adult children for estate planning purposes, potentially avoiding probate proceedings while maintaining family control over valuable assets. Similarly, transferring property into family trusts using quitclaim deeds can provide tax advantages and inheritance planning benefits while keeping ownership within the family structure.

Benefits and Risks in Family Property Transfers

Understanding both advantages and potential complications helps families make informed decisions about whether quitclaim deeds suit their specific property transfer needs.

Key Benefits for Families

Quick execution represents the most significant advantage for busy families coordinating property transfers. Quitclaim deed online platforms enable document preparation and execution within days rather than the weeks or months required for traditional real estate transactions with full title searches and warranty protections.

Cost effectiveness appeals to families managing multiple financial priorities. Free quitclaim deed forms available through various sources eliminate attorney fees for routine transfers, while the simplified process avoids title insurance costs, extensive property inspections, and other expenses associated with traditional real estate transactions.

The trust factor among family members reduces many risks associated with quitclaim transfers between strangers. When children receive property from parents who purchased and maintained it for decades, the likelihood of unknown liens or ownership disputes is minimal compared to transactions involving unfamiliar parties.

Understanding the Risks

No guarantee of clear title means families accept responsibility for any existing problems with property ownership. Hidden liens from previous owners, boundary disputes, or other title defects become the grantee's responsibility to resolve, potentially creating unexpected expenses or legal complications.

Potential for family disputes can arise if relationships deteriorate after the transfer. Unlike warranty deeds that provide legal protections, quitclaim transfers offer limited recourse if family members disagree about the terms or implications of the ownership change.

Hidden liens and encumbrances represent perhaps the most serious financial risk. Previous owners may have taken loans secured by the property, or contractors might have filed construction liens for unpaid work. These obligations typically remain attached to the property regardless of ownership changes, making them the new owner's responsibility.

Creating a Quitclaim Deed with Ziji Legal Forms

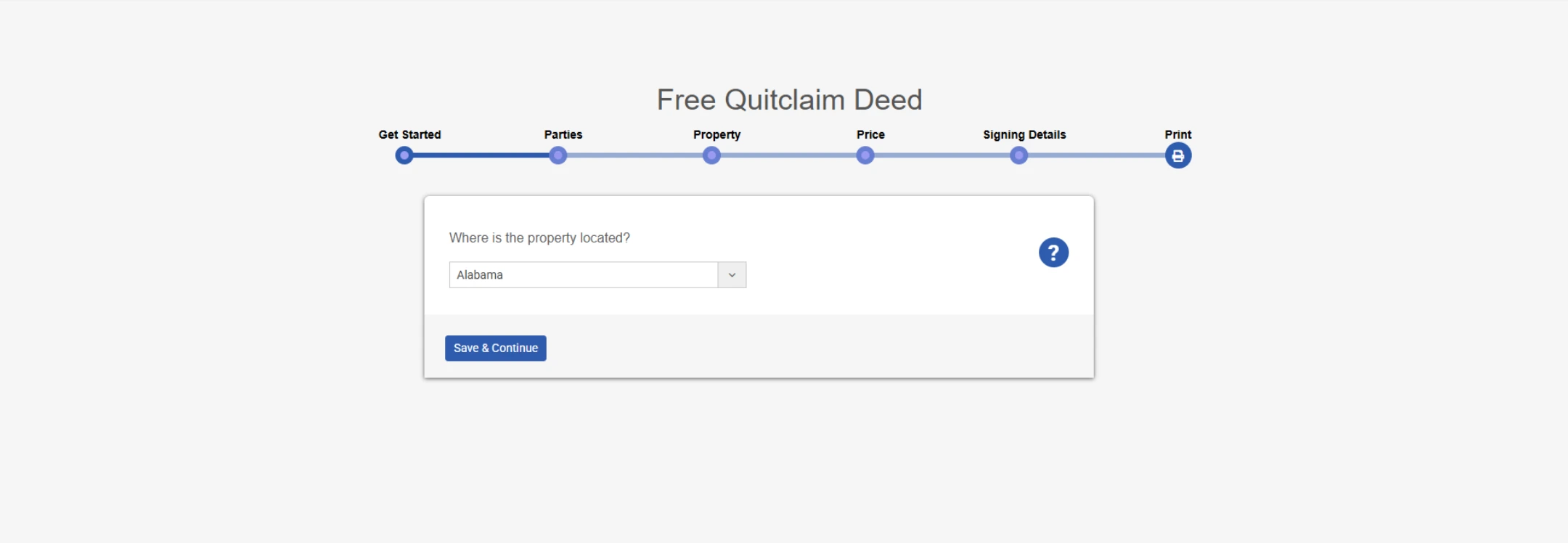

Let’s go through how you can create a proper quitclaim deed using Ziji Legal Forms; an online platform that helps you generate legal documents by guiding you through a series of questions. By using such a guided service, you ensure that all the necessary information is included and correctly formatted. Here’s an overview of the process:

1. Start and Select the Quitclaim Deed Template

Log in to Ziji Legal Forms and navigate to the real estate or property forms section. From the dashboard, select the Quitclaim Deed form.

2. Enter the Grantor and Grantee Details

The system will prompt you to fill in the information for all parties involved. You’ll enter the grantor’s name and address and the grantee’s name and address in the appropriate fields. Our interface will ensure you don’t forget details like middle initials or suffixes if they’re part of the legal name.

3. Provide the Property Information

Next, you’ll add the property details. This includes the legal description of the property. Ziji provides guidance on where to find the legal description (for example, from your previous deed or tax statement). You’ll type in or paste the full legal description.

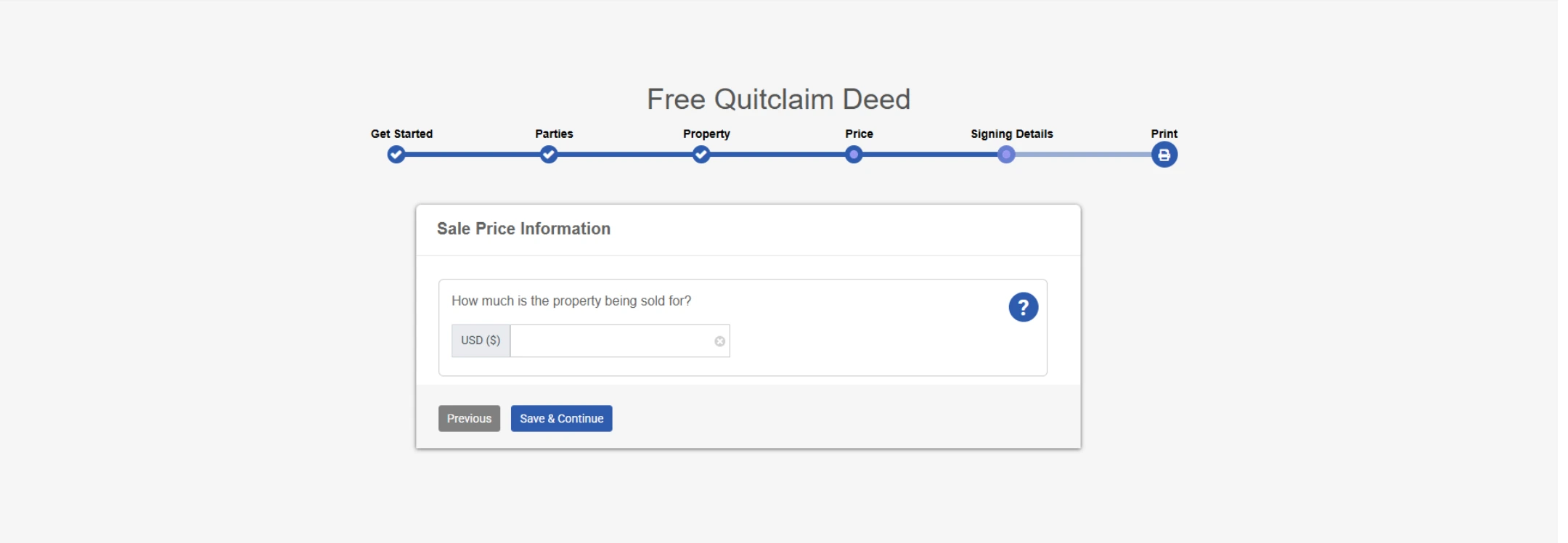

4. Specify Consideration and Other Clauses

Our platform will ask you if any payment (consideration) is given for the transfer. For family gifts, you might enter a nominal amount like $10. If your state requires a specific phrasing (e.g., “Ten dollars and other good and valuable consideration”), the platform will auto-fill that once you indicate it’s a gift transfer. Also, if your state has any unique requirements like a preparer’s name, or a return address after filing, our platform will include those in the workflow.

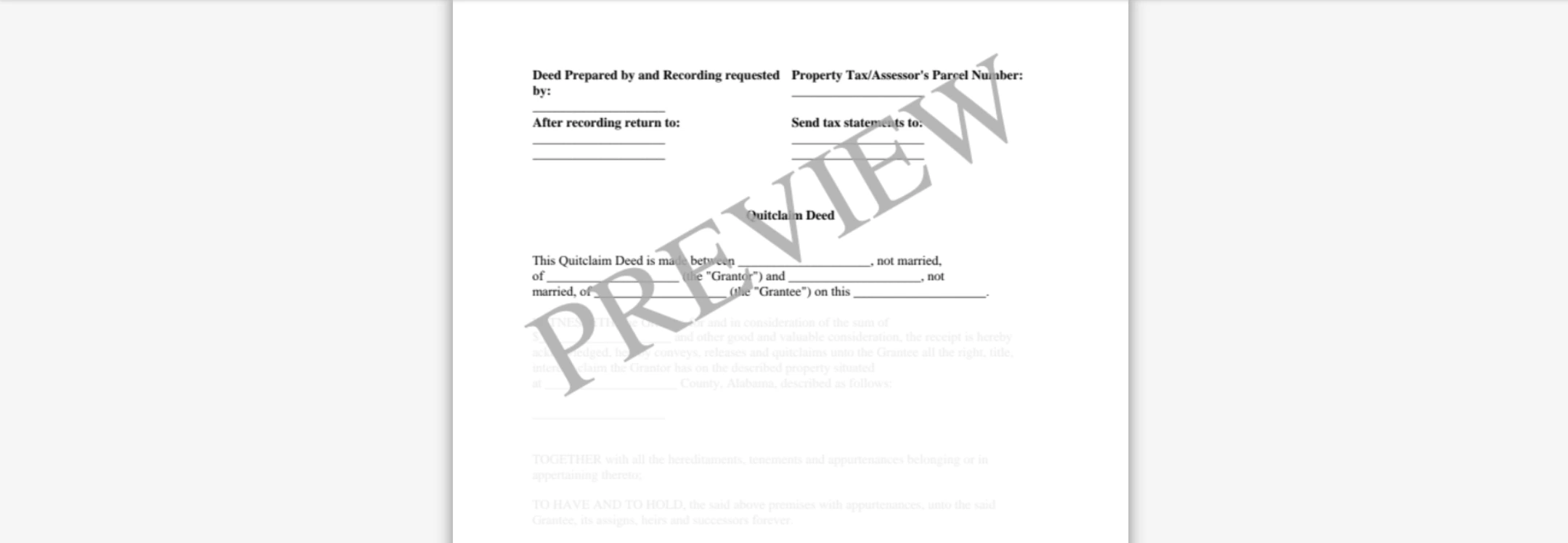

5. Review Auto-Generated Deed Preview

After filling in the questionnaire, the platform will generate a preview of your quitclaim deed with all the information plugged into the correct legal format. You can review the document on screen to double-check whether all details are correct. If you see anything off, you can go back a step and edit the input.

6. Finalize and Download the Quitclaim Deed

Once everything looks good, you’ll finalize the document. Our platform will then allow you to download the quitclaim deed as a PDF or Word document. The downloaded deed will be professionally formatted, including lines for the grantor’s signature, notary acknowledgment, and any witness lines if needed for your state. All the required elements like the venue, preparer info, and mailing address for recording, will be present, as per the info you provided.

After downloading, you’ll print the deed. Then you follow the standard procedure of signing it in front of a notary, and witnesses if required.

Why this helps

The guided experience means you don’t have to be a legal expert to get it right. It’s like having a virtual checklist built into the process. This reduces the risk of mistakes such as missing a name, messing up the legal description, or using wrong wording. In short, Ziji Legal Forms make the process of creating a quitclaim deed simple, fast, and legally sound, even for first-time users.

Is a Quitclaim Deed Right for Your Family Transfer?

Determining whether quitclaim deeds suit specific family situations requires evaluating the relationship between parties, property characteristics, and transfer objectives. Several factors help guide this decision-making process. If you are unsure whether a quitclaim deed is the best option for your situation, read our guide on choosing the right deed type to compare quitclaim deeds with warranty deeds and other transfer options.

Trust and relationship stability between family members represents the most critical consideration. Quitclaim transfers work best when parties maintain strong, stable relationships and understand each other's intentions and expectations about the property transfer and future ownership responsibilities.

Property ownership clarity affects transfer appropriateness. Families with clear understanding of property ownership history, existing mortgages, and potential complications can more safely use quitclaim transfers than those with complex or uncertain ownership situations requiring professional investigation.

Financial implications including tax consequences, gift tax requirements, and potential capital gains issues should be understood before proceeding. While quitclaim deed online platforms simplify document creation, they don't provide tax or estate planning advice that might affect the wisdom of particular transfer timing or structures.

Consider consulting legal or tax professionals for complex situations, high-value properties, or transfers involving significant estate planning implications. While routine family transfers often work well with free quitclaim deed forms, complicated situations benefit from professional guidance to avoid unintended consequences.

Conclusion

Quitclaim deeds offer families an efficient, cost-effective method for transferring property ownership when trust exists between parties and property ownership is clearly understood. The combination of speed, simplicity, and affordability makes these transfers attractive for routine family situations like adding spouses to titles, implementing divorce settlements, or facilitating estate planning transfers.

However, the lack of warranty protections means families must carefully evaluate their specific circumstances before proceeding. Understanding the property's ownership history, existing liens or encumbrances, and potential complications helps families make informed decisions about whether quitclaim transfers meet their needs or if alternative approaches provide better protection.

Quitclaim Deed FAQs

Can a quitclaim deed be reversed or canceled?

A quitclaim deed can only be reversed if agreed by both parties, usually by executing a new deed transferring the property back.

Does a quitclaim deed affect the mortgage on the property?

No, a quitclaim deed only transfers ownership, not financial responsibility. The original owner will still be liable for the mortgage.

Is a quitclaim deed valid without recording it?

It may be legally valid once signed and notarized. However not recording it can lead to future disputes or issues with title clarity.

Can I use a quitclaim deed to disinherit someone?

Not directly. A quitclaim deed is used to transfer property, not to remove future inheritance rights. Estate planning tools are better suited for that.

What are the risks of accepting a quitclaim deed as a buyer?

The grantee receives neither title protection nor guarantees. There could be unknown liens, claims, or title defects.

What jurisdictions can use our quitclaim deed?

You can use our template to create a legal and valid quitclaim deed for the following jurisdictions:

| Alabama (AL) | Alaska (AK) | Arizona (AZ) | Arkansas (AR) | California (CA) |

| Colorado (CO) | Connecticut (CT) | Delaware (DE) | District of Columbia (DC) | Florida (FL) |

| Georgia (GA) | Hawaii (HI) | Idaho (ID) | Illinois (IL) | Indiana (IN) |

| Iowa (IA) | Kansas (KS) | Kentucky (KY) | Louisiana (LA) | Maine (ME) |

| Maryland (MD) | Massachusetts (MA) | Michigan (MI) | Minnesota (MN) | Mississippi (MS) |

| Missouri (MO) | Montana (MT) | Nebraska (NE) | Nevada (NV) | New Hampshire (NH) |

| New Jersey (NJ) | New Mexico (NM) | New York (NY) | North Carolina (NC) | North Dakota (ND) |

| Ohio (OH) | Oklahoma (OK) | Oregon (OR) | Pennsylvania (PA) | Rhode Island (RI) |

| South Carolina (SC) | South Dakota (SD) | Tennessee (TN) | Texas (TX) | Utah (UT) |

| Vermont (VT) | Virginia (VA) | Washington (WA) | West Virginia (WV) | Wisconsin (WI) |

| Wyoming (WY) |

GET STARTED FOR FREE

Create your

Get Started For Free