- A warranty deed is the gold standard of property transfers, safeguarding buyers against past and future title issues through robust legal guarantees.

- There are two main types: the general warranty deed (full coverage) and the special warranty deed (covering only certain periods). Key protection comes from clauses obligating sellers to defend the title and ensure the property is free of undisclosed claims.

- Drafting and filing a warranty deed require accuracy, notarization, and compliance with county formatting and submission rules.

- Filing your deed means presenting it to the local county recorder, meeting margin/format rules, and paying required fees - all built into modern templates from Ziji Legal Forms.

Introduction: Understanding Warranty Deeds

Types of Property Deeds and What Sets Warranty Deeds Apart

Quitclaim Deed

Special Warranty Deed

General Warranty Deed

Key Parties and Clauses in a Warranty Deed

The Main Parties

- Grantor: the person or entity selling and transferring the property

- Grantee: the person or entity purchasing and receiving the property

Important Clauses

- Granting clause - transfers ownership rights to the buyer

- Habendum clause - specifies the scope of the transfer

- Covenant of seisin - confirms the seller owns the property and has the right to transfer it

- Covenant against encumbrances - guarantees the property is free from liens, loans, or other hidden claims

- Covenant of quiet enjoyment - protects the buyer’s use of the property from interference

- Covenant of further assurance - obligates the seller to correct paperwork or resolve issues if a problem arises

How a Warranty Deed Works in a Real Estate Transaction: Step-by-Step Overview

1. Title Search

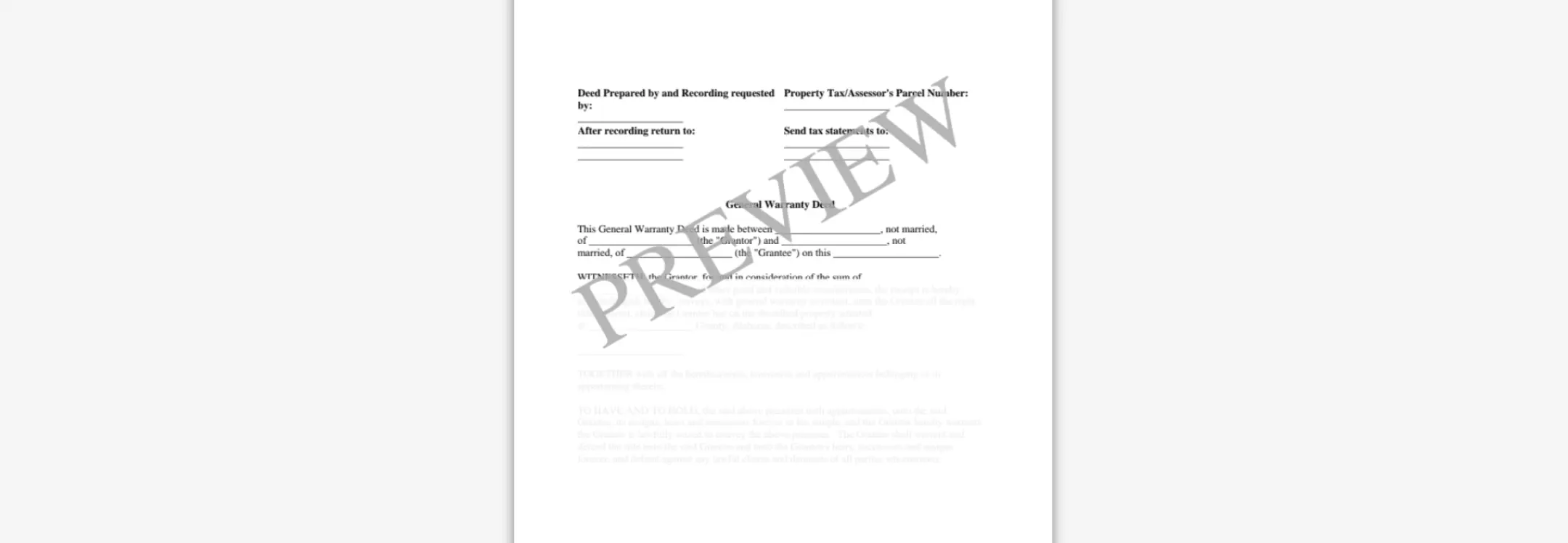

2. Drafting the Warranty Deed

3. Notarized Signing

4. Delivery and Acceptance

5. Recording with the County Office

The Filing Process for a Warranty Deed

Why Recording Matters

How to File a Warranty Deed

1. Prepare the Deed

- Use a warranty deed template that complies with county requirements, including layout, language, and margins. Most counties require:

- Standard paper size (often 8.5 x 11 inches)

- Margins of at least three inches at the top of the first page for stamps

- Margins of at least one inch around other edges

- Black or blue ink for legibility

- Printed names below all signatures

- Complete legal description, parcel number, and mailing addresses for both grantor and grantee

2. Have It Notarized

3. Submit to County Recorder

4. Review and Record

5. Notify Tax Authorities and Others

Benefits and Limitations of a Warranty Deed

Key Benefits

- Maximum legal protection for the buyer - if title issues surface, the seller is on the hook

- Creates permanent public record of ownership, which aids in resales, loans, or estate planning

- Preferred by mortgage lenders, making financing easier

Main Limitations

- Seller may be exposed to liability for defects that occurred before they even owned the property

- Drafting errors or missing clauses can weaken protection or void the deed

- More complex and costly to prepare than other deed types

Common Mistakes to Avoid

- Using inaccurate legal descriptions or failing to match county records. This can void the transfer or create disputes.

- Forgetting required covenants or omitting signature lines.

- Failing to notarize or record promptly. Unrecorded deeds are not legally effective and the buyer may lose priority in court.

- Ignoring margin or formatting rules, resulting in rejection or delays.

- Typing party names incorrectly. These must match property records and identification exactly.

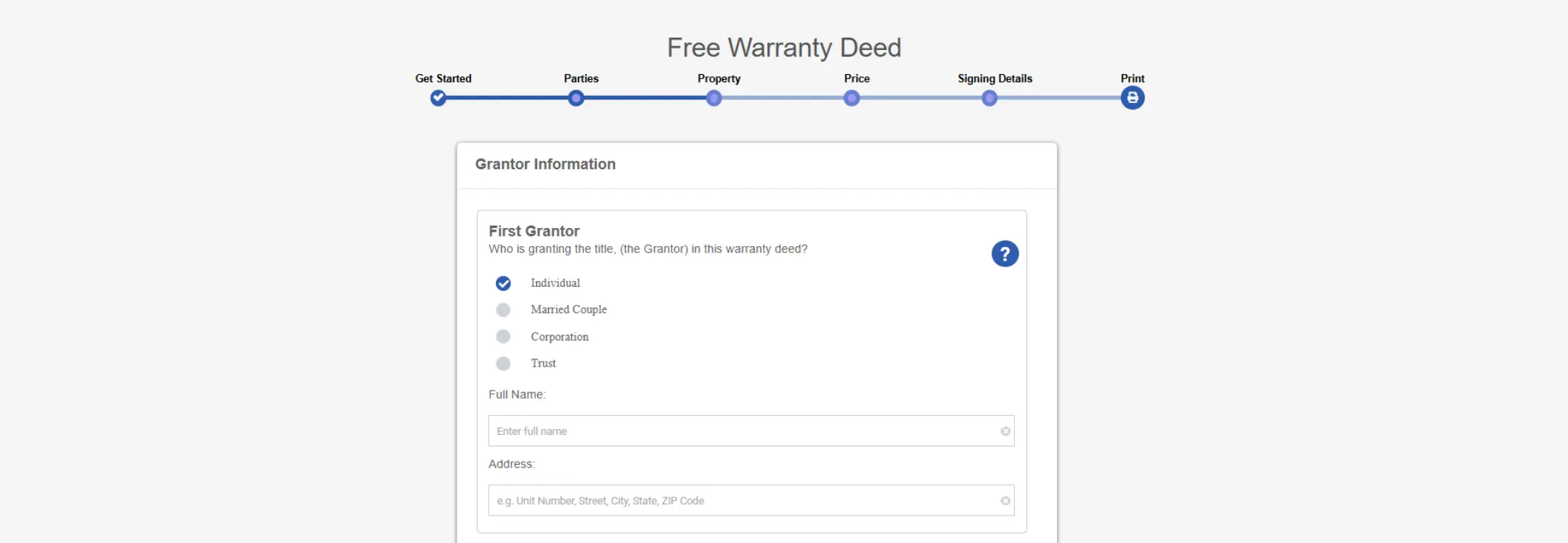

How to Create a Warranty Deed Using Ziji Legal Forms: Step-by-Step Guide

1. Select the warranty deed template from Ziji Legal Forms, choosing general or special warranty as needed

2. Enter the names, addresses, and legal description of both parties and the property

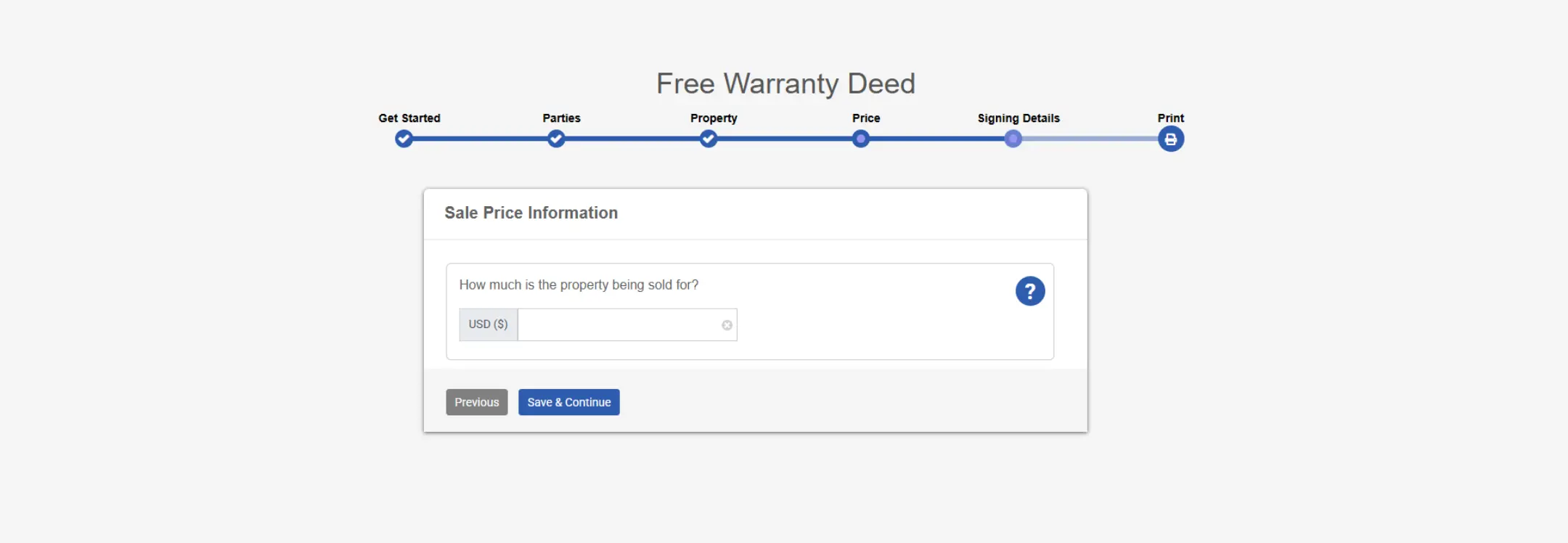

3. Answer easy prompts about the transaction type, price, and covenants to include

4. Download, review, and print the document. Check margin compliance, spelling, and all required fields

5. Sign the deed before a notary public, then submit for recording at the local county office

6. Confirm recording, store your certified copy, and notify any relevant parties (tax, lenders, etc.)

General vs. Special Warranty Deed

| Feature | General Warranty Deed | Special Warranty Deed |

| Protection Scope | Covers all ownership history | Covers only seller’s ownership |

| Seller's Obligation | Must address defects from any time | Only obligated for their period |

| Buter's Security | Highest Protection Available | Only obligated for their period |

| Typical Use | Conventional home sales, mortgages | Commercial or special transactions |

Why Warranty Deeds Build Trust

Conclusion

Warranty Deed FAQs

What is a warranty deed?

A warranty deed is a document used to transfer ownership of real estate from the grantor to the grantee. It is where the grantor warrants, or promises, that the grantor owns the property free and clear and has the authority to transfer the title to the grantee. In essence, the grantor is guaranteeing that there aren’t any encumbrances like mortgages, liens or judgement against the title and the grantee will receive the ownership of the property.

Warranty deeds are typically used in most real estate transaction where the grantee is paying full market value for the property and the grantor is transferring the property to the grantee in the sale. There are two different types of warranty deeds: general warranty deed, and special warranty deed.

What is a general warranty deed?

A general warranty deed offers the highest level of protection for the grantee. The grantor guarantees that the grantor owns the property and can legally transfer it to the grantee. Secondly, the grantor represents that there are no outstanding encumbrances like mortgages, lies, judgements, or other claims against the property by creditors. Under a general warranty deed, the grantor will also compensate the grantee if there’s a defect or breach in the warranty. In essence, the general warranty deed covers the title during any time period and guarantees that there are no defects in the title.

What is a special warranty deed?

A special warranty deed offers less protection than the general warranty deed because it only guarantees that there are no defects in the title during the grantor’s ownership period. The time period before the grantor owned the property is not guaranteed in a special warranty deed.

Who is the grantor in a warranty deed?

The grantor is the person whose name is currently on title and is transferring the interest of the property to the grantee. Generally in a real estate transaction, the grantor is the seller.

Who is the grantee in a warranty deed?

The grantee is the person who is receiving the interest of the property from the grantor. Generally in a real estate transaction, the grantee is the buyer.

Please note in some cases a person can be both the grantor and the grantee in a real estate transaction. For example if you are the sole owner of the property and want to add your spouse to the title, you would list yourself as the grantor and list yourself and your spouse as the grantee. Essentially, you are transferring your interest of the property to yourself and your spouse in this way with the quitclaim deed. A warranty deed is generally not used for adding a spouse’s name to the property; it is more often done via a quitclaim deed.

What is the legal description of the property and how do I find it?

The legal description specifies the boundaries of a track of land that is generated by licensed land surveyors. The legal description is not the physical street address of the property.

The easiest way to find the legal description of the property is to look at the deed of the property, or the mortgage documents of the property. You can also consult the county register or the county recorder where the property is located and search through the county land records. The legal description will typically be listed in the document or be attached as an exhibit on the back of the document.

What is the property tax/assessor’s parcel number?

The property tax number is a number assigned to the property for the purpose of property taxes. Depending on the jurisdiction, the property tax number can also be referred to as follows:

- Assessor’s Identification Number, or AIN

- Property Identification, or PID

- Property Identification Number, or PIN

- Property Account Number

- Sidwell Number

- Tax Account Number

What is the consideration on a warranty deed?

The consideration is the money or anything of value the grantee gives to the grantor in exchange for the property. List the actual sale price paid to the grantor to create a valid agreement.

Do I have to notarize the warranty deed?

The transfer of property is an important act even when it’s done between family members via a warranty deed. Yes, the grantor must sign the warranty deed in the presence of a notary in the jurisdiction to make it a valid document.

What are the blank spaces on top margins of the warranty deed?

Once the warranty deed has been signed and notarized, it must be taken to the county register or county recorder to be registered in land records. Most county recorders need a space on the top page of the document to stamp and record the warranty deed. The blank spaces are left there intentionally for recording purposes and they are normal.

What needs to be done after getting the warranty deed notarized?

Once the warranty deed is signed by the grantors and notarized in front of a notary, the deed must be submitted to the county register or county recorder to be recorded into land/property records.

Can a warranty deed be used to add a new owner to the property?

Typically, warranty deeds are not used to add owners to a property. Instead, adding a co-owner is usually done via a quitclaim deed. Warranty deeds are primarily used in sale transactions where ownership is being transferred from seller to buyer with guarantees about the title.

What protections does a grantee have under a warranty deed?

A grantee under a warranty deed is protected by the grantor’s promise that the title is free of defects and claims. If a title issue arises, the grantor may be legally responsible to compensate the grantee for any losses resulting from defects or claims on the property.

How does title insurance relate to a warranty deed?

Title insurance often accompanies a warranty deed transaction to protect the buyer against any title defects that were not discovered during the title search. While the warranty deed provides certain guarantees from the grantor, title insurance offers an added layer of protection against unknown issues.

Can a warranty deed be used for properties with liens or mortgages?

A warranty deed can be used, but the grantor must disclose any existing liens or mortgages on the property. Typically, these encumbrances must be cleared or addressed during the closing process so the grantee receives the property free and clear as guaranteed by the warranty deed.

What should I do if I discover a title defect after receiving a warranty deed?

If a title defect is discovered, the grantee should notify the grantor immediately as the warranty deed guarantees clear title. Depending on the issue, the grantor may be required to resolve the defect or compensate the grantee for any losses caused by the defect.

What jurisdictions can use our warranty deed?

You can use our template to create a legal and valid warranty deed for the following jurisdictions:

|

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

District of Columbia

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming |

AL

AK

AZ

AR

CA

CO

CT

DE

DC

FL

GA

HI

ID

IL

IN

IA

KS

KY

LA

ME

MD

MA

MI

MN

MS

MO

MT

NE

NV

NH

NJ

NM

NY

NC

ND

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VT

VA

WA

WV

WI

WY |