- A warranty deed is a legal document that transfers property ownership while guaranteeing the seller holds clear title free from hidden claims or liens

- Recording your deed at the county recorder's office converts it from a private agreement into a public record that protects your ownership rights legally

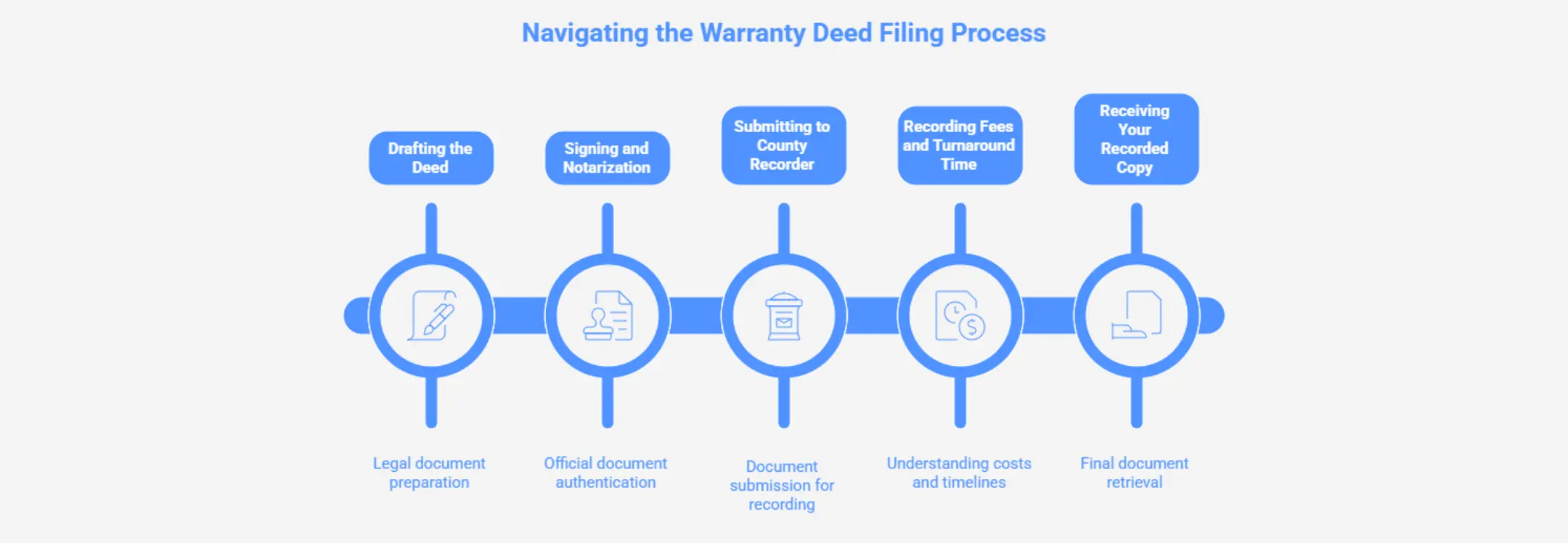

- The filing process includes drafting with accurate party information, obtaining notarization, submitting to the county recorder, paying fees, and receiving the recorded copy

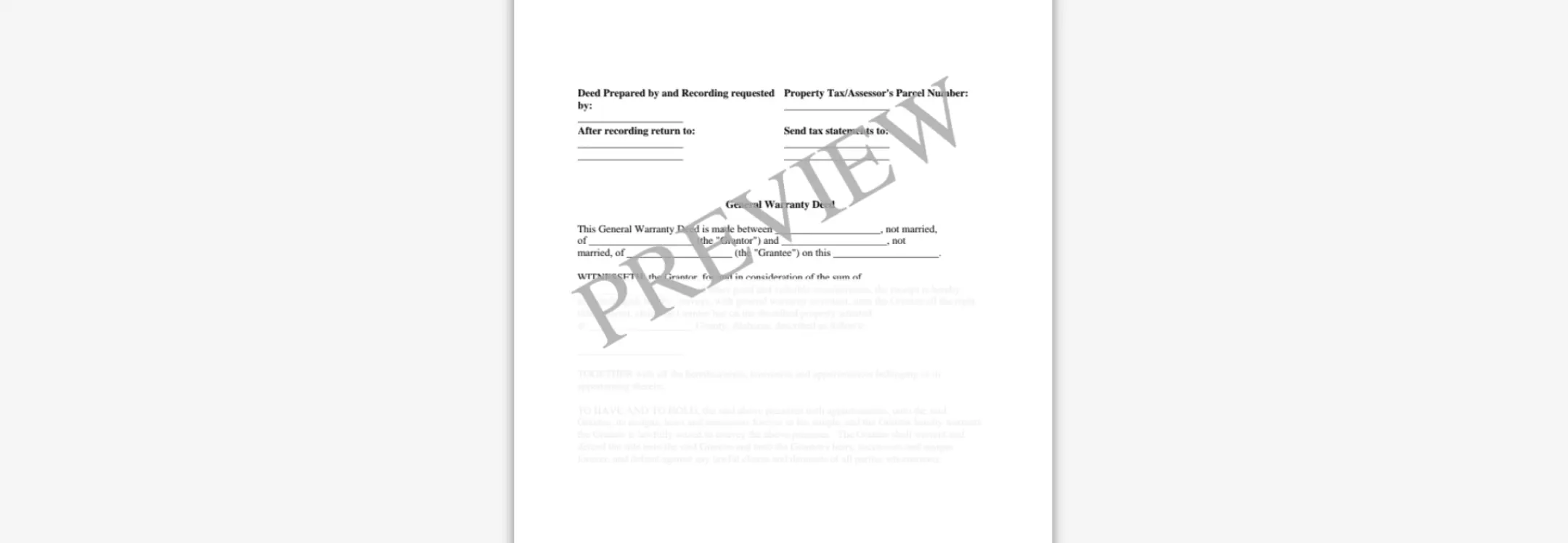

- Proper formatting with required margins, fonts, and notary acknowledgments ensures county recorders accept your deed without rejection or delays

- Ziji Legal Forms provides pre-formatted warranty deed templates that meet all county recording requirements, eliminating formatting errors and ensuring smooth filing

Introduction: Why Filing a Warranty Deed Matters

The Role of a Warranty Deed in Real Estate Transactions

How It Differs from Other Deeds

Understanding Full Ownership Guarantees

Why Recording Is Essential

Step-by-Step Warranty Deed Filing Process

Drafting the Deed

Signing and Notarization

Submitting to County Recorder

Recording Fees and Turnaround Time

Receiving Your Recorded Copy

Understanding Warranty Deed Structure and Formatting

Structure for Legal Clarity

Language Precision and Legal Meaning

County Recording Requirements

Margins, Fonts, and Formatting Rules

Notary Acknowledgment Block

Common Filing Errors to Avoid

- Missing or incorrect legal descriptions represent the most common filing error. Copy legal descriptions directly from prior deeds or tax documents without modification or interpretation. County recorders will reject deeds with vague or incomplete property descriptions.

- Incomplete notary sections cause automatic rejection. Verify that your notary included all required information including seal, signature, printed name, and commission dates before submitting your deed.

- Spelling inconsistencies in grantor or grantee names between the deed and prior documents create title defects and complicate future transactions. Verify that names appear identically to how they appear in previous official documents.

- Missing recording fees delay or prevent recording. Calculate fees based on your county's current schedule and include exact payment with your submission.

- Inadequate margins result in rejection by county recorders scanning systems. Always maintain full required blank space at top and sides for official county processing and identification.

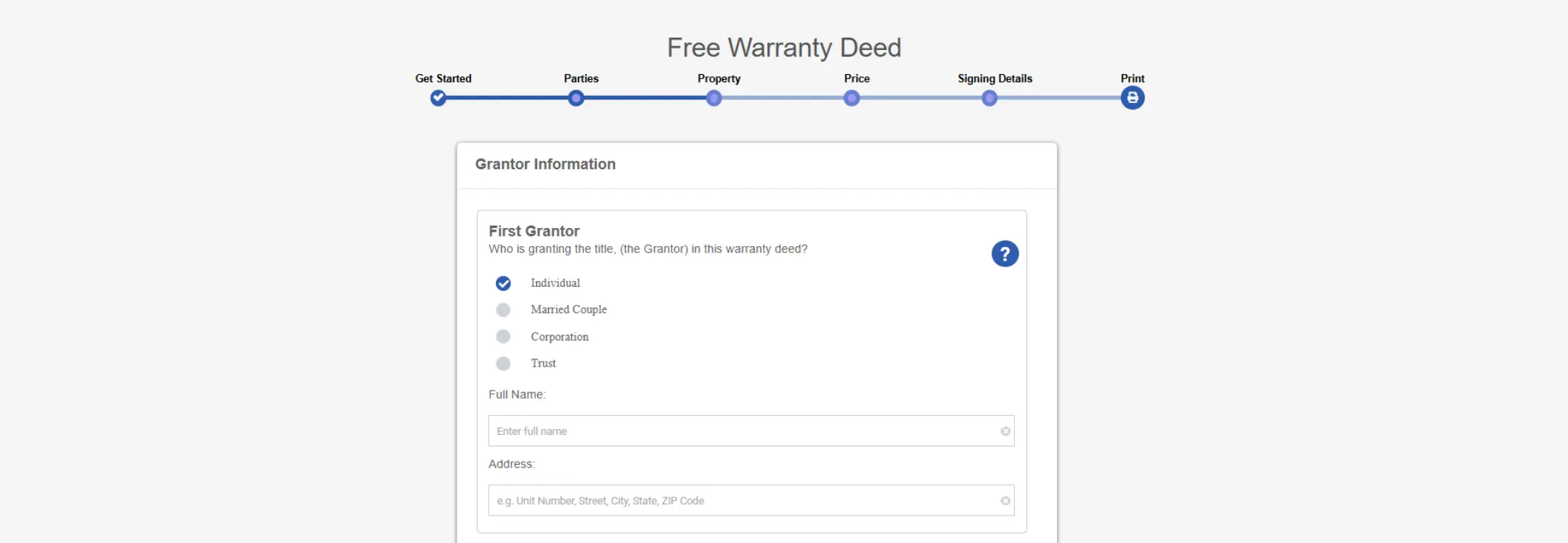

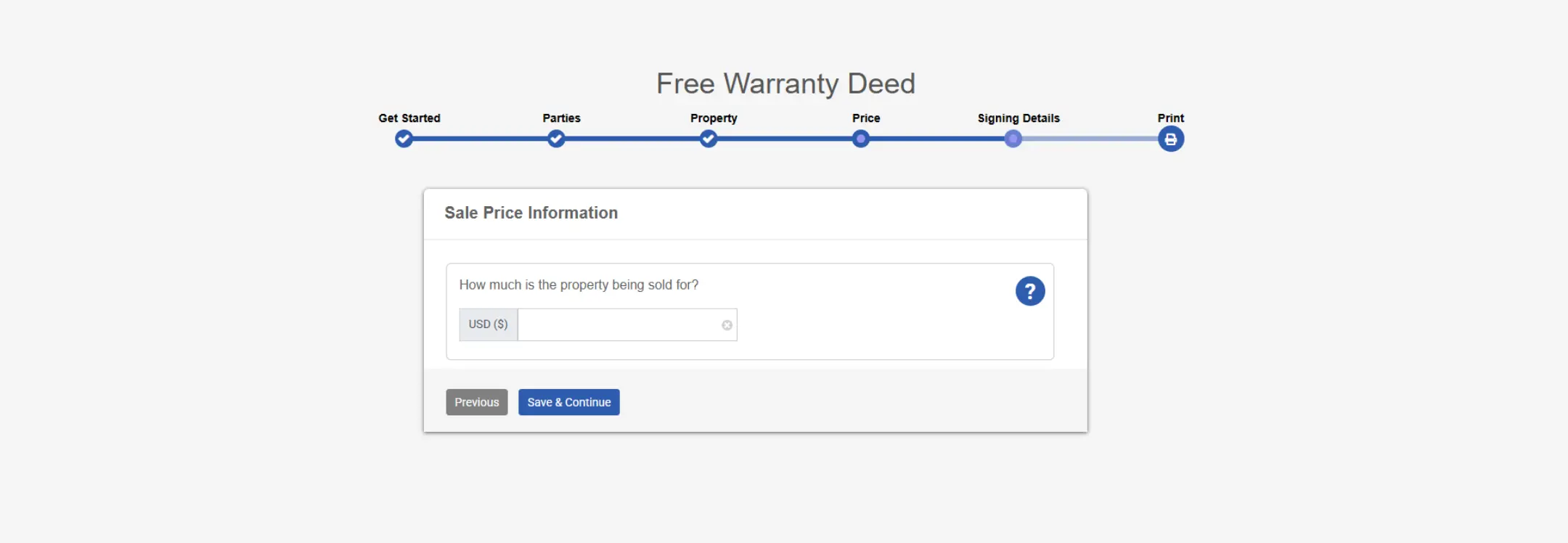

Simplifying the Process with Ziji Legal Forms

1. Choose template

2. Add Party Details

3. Add Property Details

4. Add Price Details

5. Preview and print

Conclusion: Proper Filing Ensures Legal Ownership Recognition

Warranty Deed FAQs

What is a warranty deed?

A warranty deed is a document used to transfer ownership of real estate from the grantor to the grantee. It is where the grantor warrants, or promises, that the grantor owns the property free and clear and has the authority to transfer the title to the grantee. In essence, the grantor is guaranteeing that there aren’t any encumbrances like mortgages, liens or judgement against the title and the grantee will receive the ownership of the property.

Warranty deeds are typically used in most real estate transaction where the grantee is paying full market value for the property and the grantor is transferring the property to the grantee in the sale. There are two different types of warranty deeds: general warranty deed, and special warranty deed.

What is a general warranty deed?

A general warranty deed offers the highest level of protection for the grantee. The grantor guarantees that the grantor owns the property and can legally transfer it to the grantee. Secondly, the grantor represents that there are no outstanding encumbrances like mortgages, lies, judgements, or other claims against the property by creditors. Under a general warranty deed, the grantor will also compensate the grantee if there’s a defect or breach in the warranty. In essence, the general warranty deed covers the title during any time period and guarantees that there are no defects in the title.

What is a special warranty deed?

A special warranty deed offers less protection than the general warranty deed because it only guarantees that there are no defects in the title during the grantor’s ownership period. The time period before the grantor owned the property is not guaranteed in a special warranty deed.

Who is the grantor in a warranty deed?

The grantor is the person whose name is currently on title and is transferring the interest of the property to the grantee. Generally in a real estate transaction, the grantor is the seller.

Who is the grantee in a warranty deed?

The grantee is the person who is receiving the interest of the property from the grantor. Generally in a real estate transaction, the grantee is the buyer.

Please note in some cases a person can be both the grantor and the grantee in a real estate transaction. For example if you are the sole owner of the property and want to add your spouse to the title, you would list yourself as the grantor and list yourself and your spouse as the grantee. Essentially, you are transferring your interest of the property to yourself and your spouse in this way with the quitclaim deed. A warranty deed is generally not used for adding a spouse’s name to the property; it is more often done via a quitclaim deed.

What is the legal description of the property and how do I find it?

The legal description specifies the boundaries of a track of land that is generated by licensed land surveyors. The legal description is not the physical street address of the property.

The easiest way to find the legal description of the property is to look at the deed of the property, or the mortgage documents of the property. You can also consult the county register or the county recorder where the property is located and search through the county land records. The legal description will typically be listed in the document or be attached as an exhibit on the back of the document.

What is the property tax/assessor’s parcel number?

The property tax number is a number assigned to the property for the purpose of property taxes. Depending on the jurisdiction, the property tax number can also be referred to as follows:

- Assessor’s Identification Number, or AIN

- Property Identification, or PID

- Property Identification Number, or PIN

- Property Account Number

- Sidwell Number

- Tax Account Number

What is the consideration on a warranty deed?

The consideration is the money or anything of value the grantee gives to the grantor in exchange for the property. List the actual sale price paid to the grantor to create a valid agreement.

Do I have to notarize the warranty deed?

The transfer of property is an important act even when it’s done between family members via a warranty deed. Yes, the grantor must sign the warranty deed in the presence of a notary in the jurisdiction to make it a valid document.

What are the blank spaces on top margins of the warranty deed?

Once the warranty deed has been signed and notarized, it must be taken to the county register or county recorder to be registered in land records. Most county recorders need a space on the top page of the document to stamp and record the warranty deed. The blank spaces are left there intentionally for recording purposes and they are normal.

What needs to be done after getting the warranty deed notarized?

Once the warranty deed is signed by the grantors and notarized in front of a notary, the deed must be submitted to the county register or county recorder to be recorded into land/property records.

Can a warranty deed be used to add a new owner to the property?

Typically, warranty deeds are not used to add owners to a property. Instead, adding a co-owner is usually done via a quitclaim deed. Warranty deeds are primarily used in sale transactions where ownership is being transferred from seller to buyer with guarantees about the title.

What protections does a grantee have under a warranty deed?

A grantee under a warranty deed is protected by the grantor’s promise that the title is free of defects and claims. If a title issue arises, the grantor may be legally responsible to compensate the grantee for any losses resulting from defects or claims on the property.

How does title insurance relate to a warranty deed?

Title insurance often accompanies a warranty deed transaction to protect the buyer against any title defects that were not discovered during the title search. While the warranty deed provides certain guarantees from the grantor, title insurance offers an added layer of protection against unknown issues.

Can a warranty deed be used for properties with liens or mortgages?

A warranty deed can be used, but the grantor must disclose any existing liens or mortgages on the property. Typically, these encumbrances must be cleared or addressed during the closing process so the grantee receives the property free and clear as guaranteed by the warranty deed.

What should I do if I discover a title defect after receiving a warranty deed?

If a title defect is discovered, the grantee should notify the grantor immediately as the warranty deed guarantees clear title. Depending on the issue, the grantor may be required to resolve the defect or compensate the grantee for any losses caused by the defect.

What jurisdictions can use our warranty deed?

You can use our template to create a legal and valid warranty deed for the following jurisdictions:

|

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

District of Columbia

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming |

AL

AK

AZ

AR

CA

CO

CT

DE

DC

FL

GA

HI

ID

IL

IN

IA

KS

KY

LA

ME

MD

MA

MI

MN

MS

MO

MT

NE

NV

NH

NJ

NM

NY

NC

ND

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VT

VA

WA

WV

WI

WY |