TL;DR- Incorrect legal descriptions create title defects and cloud ownership because property boundaries must be precisely defined in formal legal language rather than street addresses alone

- Misspelled names or incorrect grantor/grantee information invalidates deeds or creates ownership disputes when names do not match government identification documents

- Missing title guarantees exposes grantors to liability for defending title against future claims and leaves buyers vulnerable to undisclosed ownership problems

- Forgetting proper notarization prevents deeds from being recorded and creates legal invalidity because notary authentication is mandatory for property transfers

- Using outdated or generic templates leaves critical clauses missing and fails to comply with current legal requirements or property-specific recording standards

- Not recording the deed with county recorders leaves your property transfer incomplete and creates ambiguity about who legally owns the property in public records

- Ziji Legal Forms provides comprehensive warranty deed templates that prevent these critical mistakes while ensuring all legal requirements and recording compliance

Introduction: Why Warranty Deed Accuracy Matters

A warranty deed represents one of the most important legal documents in real estate transactions. This document transfers property ownership while guaranteeing that the seller holds clear title free from hidden claims or encumbrances. Any errors in this critical document threaten the validity of the entire property transfer and create legal problems that persist for years after the transaction closes.

Warranty deed mistakes cause title defects, prevent property sales or refinancing, trigger disputes between parties, delay transactions, and sometimes require expensive court intervention to resolve. Understanding common errors and how to avoid them protects all parties in property transactions while ensuring smooth transfers and clear ownership.

Mistake 1: Incorrect or Insufficient Legal Description

Why Legal Descriptions Matter More Than Addresses

A property's legal description is its unique identifier in official records, fundamentally different from a street address which can change. Legal descriptions define exact boundaries using precise measurements, lot numbers, or metes and bounds calculations that distinguish one property from all others.

Street addresses alone cannot convey property identity because addresses change, multiple properties can share similar addresses, or buildings can have multiple units. Courts and recording officials require legal descriptions extracted from surveys, recorded plat maps, or subdivision documents that create permanent, unchangeable property identification.

Consequences of Wrong Legal Descriptions

Incorrect legal descriptions create title clouds that prevent future sales or refinancing because title companies and lenders will not proceed without clear descriptions matching official records. Courts may determine that deeds with wrong legal descriptions fail to convey any property or convey the wrong property entirely, leaving ownership unclear.

Neighbors can dispute boundary claims, and future buyers might discover that the property they believed they owned actually refers to different land entirely. Correcting legal descriptions requires expensive judicial reformation or filing corrective deeds that complicate ownership history.

Verifying Legal Descriptions

Always copy legal descriptions directly from prior deeds or current property surveys rather than creating new descriptions from memory. Compare descriptions against county assessor records and plat maps to confirm accuracy. Use precise measurements and reference exact lot numbers, block numbers, and subdivision names rather than approximations.

Mistake 2: Misspelling Names or Using Incorrect Party Information

Identity Verification Requirements

Names in warranty deeds must match exactly with government-issued identification documents and prior deeds. Misspellings, nicknames, married name variations, or incomplete legal names create confusion about who the actual parties are and whether the deed transfers property from the correct owner.

Using "Bob" instead of "Robert," "Marie" instead of "Mary," or omitting middle initials creates ambiguity about party identity. Recording officials may reject deeds or mark them as questionable when names do not match identification documents or prior ownership records.

Legal and Financial Impact

Title companies refuse to insure properties when grantor names do not match prior deeds because they cannot confirm that the seller actually owns the property. Buyers may later discover that they cannot refinance or sell properties because title insurance refuses coverage due to name discrepancies.

Lenders withhold loan approvals or demand expensive title corrections before funding. If disputes later arise about whether the correct person actually transferred the property, name errors undermine arguments about who intended to transfer the property.

Correct Procedures for Names

Use full legal names exactly as they appear on driver's licenses, passports, or prior deeds. Spell out complete names rather than nicknames, include middle initials where used in prior documents, and use consistent name formats throughout the deed. Verify names match identification documents before signing or notarizing deeds.

Mistake 3: Leaving Out the Title Guarantee or Warranty Language

What the Warranty Actually Means

The warranty provision is the core that distinguishes warranty deeds from other deed types. This language guarantees that the grantor owns the property free and clear, that no other person has superior ownership claims, and that the grantor will defend title against future challenges.

Warranty language establishes grantor liability for any title defects that emerge later, whether caused by previous owners, creditors, judgment lienholders, or other claimants. Omitting this language converts the deed into a quitclaim deed that provides no guarantees, leaving grantees vulnerable to undisclosed claims.

Grantor Liability Exposure

Grantors who omit warranty language expose themselves to potential legal disputes if title defects emerge. However, property owners who fail to include warranty language in received deeds lose the ability to recover damages from the grantor if later discovery reveals title problems.

The warranty provision creates enforceable obligations protecting property owners' investments. Without clear warranty language, grantees bear all risk of future title defects regardless of circumstances or the grantor's knowledge of problems.

Essential Warranty Language

Proper warranty deeds include language like "grantor warrants that the property is free from encumbrances except as follows" or "grantor guarantees clear title and agrees to defend against all claims." This explicit language creates legally binding obligations that courts enforce.

Mistake 4: Forgetting Proper Notarization and Witness Requirements

Why Notarization Is Mandatory

Notarization authenticates deed signatures by confirming the identity of signers and verifying that signatures were made willingly without coercion. Recording officials will not accept deeds without proper notary seals and signatures because unnotarized documents cannot be verified as authentic.

Notaries provide legal proof that the person claiming to transfer the property actually exists, personally signed the document, and intended to create binding obligations. Without this verification, anyone could create deeds in another person's name, creating opportunities for fraud.

Missing Notary Seals Create Rejection Problems

Deeds rejected for missing or improper notarization must be re-executed and re-notarized before recording, delaying property transfers and creating complications. If the grantor becomes unavailable or unwilling to sign again, the entire transaction may fail.

Electronic notarization now provides valid alternatives to in-person notarization in many jurisdictions, enabling remote signing while maintaining proper authentication through video verification and digital notary seals.

Witness and Acknowledgment Requirements

Some jurisdictions require witness signatures in addition to notary acknowledgments. Witnesses must sign the deed in front of the notary, attesting that they observed the grantor sign voluntarily. Proper witness procedures include providing printed names, addresses, and phone numbers as required by current recording standards.

Mistake 5: Using Outdated or Generic Templates

Problems with One-Size-Fits-All Approaches

Generic deed templates designed for general situations miss state-specific requirements, property-specific considerations, or updated legal standards that current transactions require. Templates created years ago may not reflect legal changes affecting deed validity or recording requirements.

One-size-fits-all templates often omit mandatory clauses required by specific jurisdictions or fail to address variations needed for different property types like commercial properties, multi-unit buildings, or properties with easements or other encumbrances.

Missing Mandatory Clauses and Requirements

Outdated templates may lack affidavits of consideration, homestead exemption language, or other provisions required by current law. Missing required clauses can result in deeds being rejected or recorded with defects that create future problems.

Recording standards evolve as technology and legal requirements change. Templates from older sources may not comply with current recording format requirements, leading to rejection or digital recording complications.

Selecting Appropriate Current Templates

Use deed templates specifically created for current year legal requirements that reflect your jurisdiction's recording standards. Verify that templates include all mandatory clauses and verify they comply with your property type and transaction structure. Professional legal form services regularly update templates to reflect legal changes and recording requirement updates.

Mistake 6: Not Recording the Deed with County Recorders

Why Recording Is Essential

Recording transforms warranty deeds from private agreements into official public documents establishing legal ownership. Without recording, your deed remains a private contract between parties, leaving you vulnerable to competing claims or fraudulent transfers by others claiming authority to convey the property.

Public recording provides notice to the entire world that you legally own the property. Recording establishes priority in cases where multiple people claim ownership rights to the same property based on recording date and time stamps.

Recording Timeline Requirements

Most jurisdictions require deeds to be recorded within specified timeframes after closing, typically 30 to 90 days. Failure to record within required periods can trigger penalties, title complications, or lender contract violations if financing is involved.

Late recording may also result in priority problems if other parties record conflicting claims to the property. Recording delays create gaps during which ownership remains ambiguous in official records.

Recording Process and Costs

Submit completed, notarized deeds to the county recorder's office in the county where the property is located. Include required cover sheets or recording request forms with the deed and applicable recording fees. Recording fees vary by county but typically range from fifteen to fifty dollars depending on deed length and county fee structures.

Expect recording turnaround times of several days to a few weeks depending on county workload. Electronic filing where available typically processes more quickly than mailed documents. Retain recorded copies as proof that your deed is officially on file in public records.

How to Create a Warranty Deed Using Ziji Legal Forms

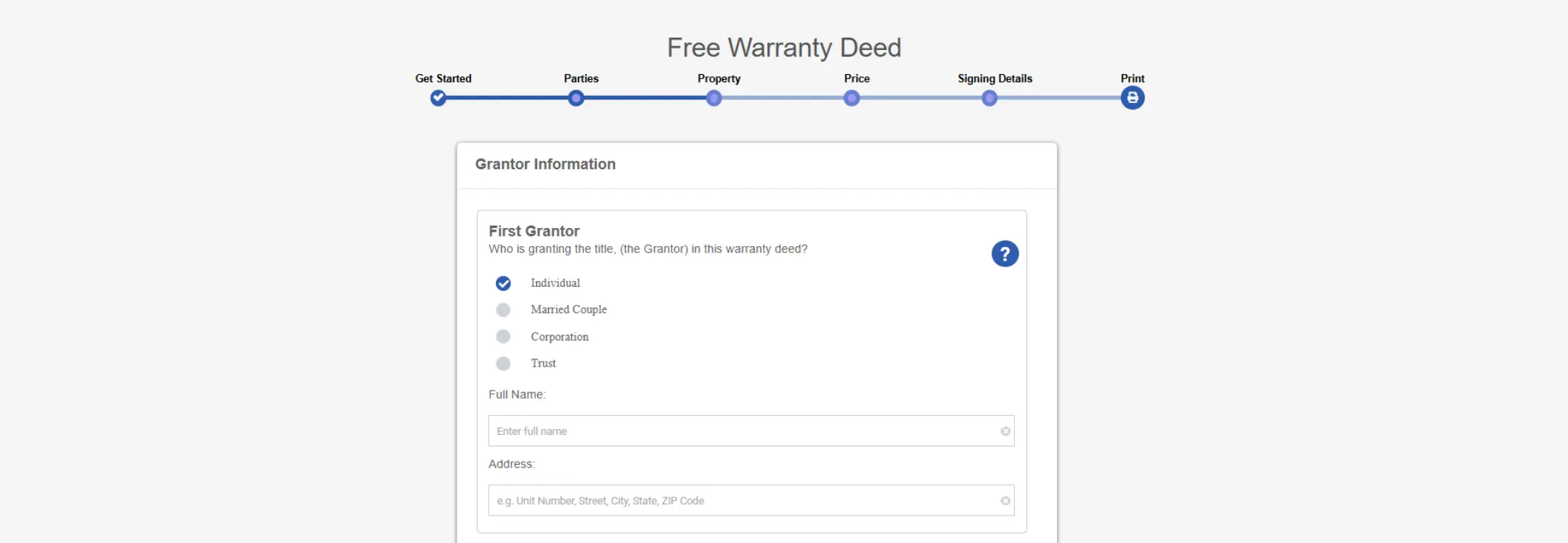

1. Choose template

Access Ziji Legal Forms' Real Estate section and select the Warranty Deed Template designed to include all essential legal elements and current recording requirements.

2. Add Parties' Details.

Enter complete legal names exactly as they appear in government identification, addresses, and relationship information for both grantor and grantee to establish clear contractual parties.

3. Add Property Details.

Include the complete legal property description extracted directly from prior deeds or surveys, not street addresses, ensuring precise boundary definition and property identification.

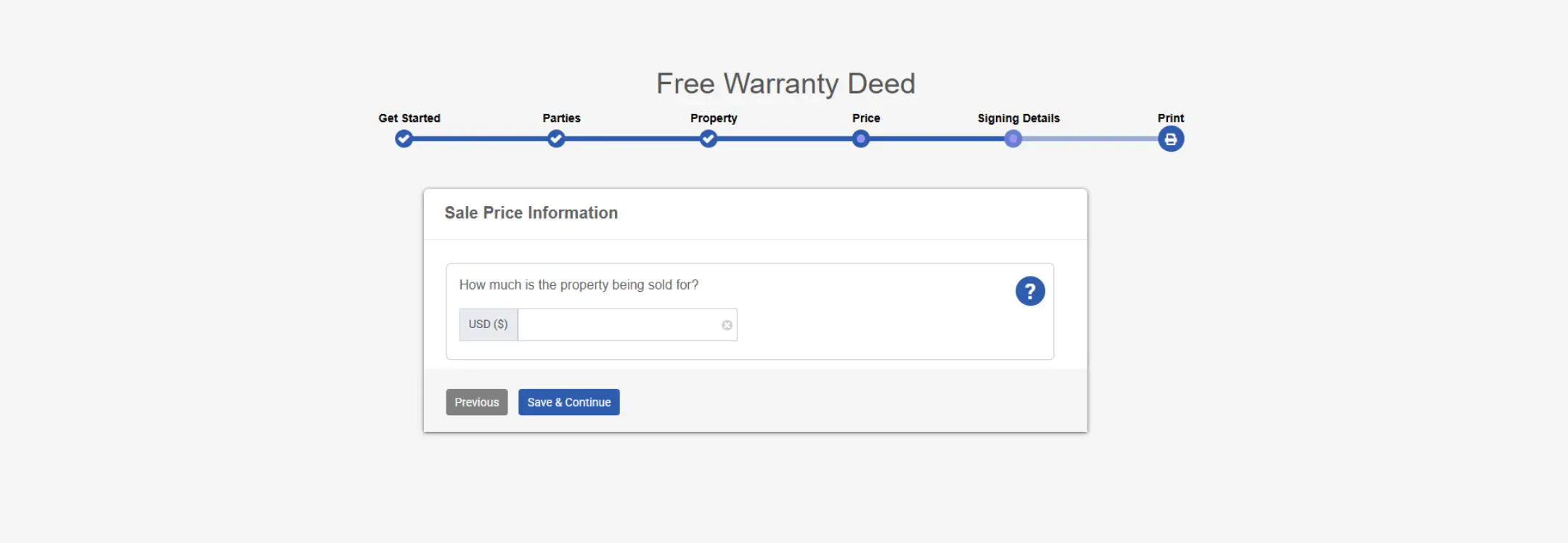

4. Add Price Details.

Specify the consideration amount representing fair value for the property transfer and any special terms or conditions that affect the property conveyance.

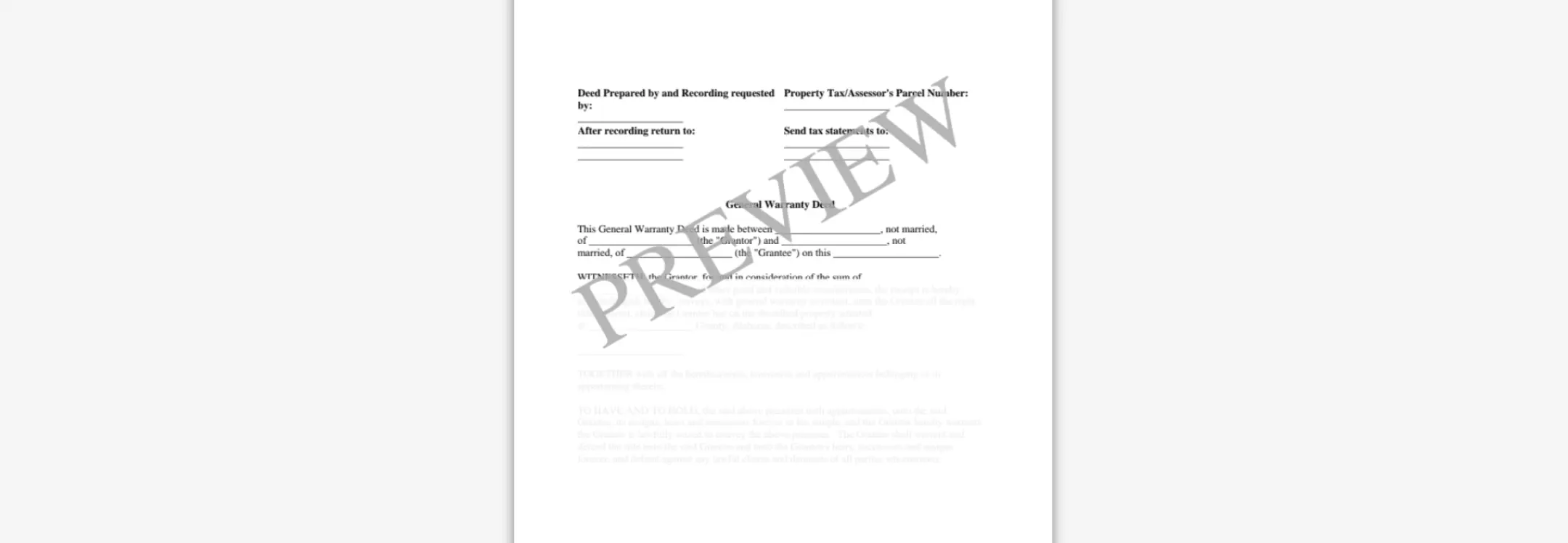

5. Preview and print.

Review the completed deed carefully for accuracy and completeness, then download in PDF or Word format for notarization and county recorder submission with all required fees and documentation.

Using Ziji Templates Reduces Common Mistakes

Ziji Legal Forms ensures accurate legal descriptions by requiring specific extracted information rather than general approximations. The platform includes mandatory warranty language guaranteeing title, preventing omissions that would create ambiguity. Current templates incorporate all state-required clauses and formatting standards for proper recording. Built-in formatting compliance prevents rejection due to margin, font, or layout problems. Guided completion helps users provide complete grantor and grantee information matching identification requirements.

Conclusion: Protect Your Property Transfer with Accurate Warranty Deeds

Warranty deed accuracy is essential for valid property transfers that protect all parties' interests while establishing clear legal ownership in official records. Using Ziji Legal Forms' professionally designed templates eliminates the most common drafting errors while ensuring all legal requirements and recording compliance are maintained.

Warranty Deed FAQs

What is a warranty deed?

A warranty deed is a document used to transfer ownership of real estate from the grantor to the grantee. It is where the grantor warrants, or promises, that the grantor owns the property free and clear and has the authority to transfer the title to the grantee. In essence, the grantor is guaranteeing that there aren’t any encumbrances like mortgages, liens or judgement against the title and the grantee will receive the ownership of the property.

Warranty deeds are typically used in most real estate transaction where the grantee is paying full market value for the property and the grantor is transferring the property to the grantee in the sale. There are two different types of warranty deeds: general warranty deed, and special warranty deed.

What is a general warranty deed?

A general warranty deed offers the highest level of protection for the grantee. The grantor guarantees that the grantor owns the property and can legally transfer it to the grantee. Secondly, the grantor represents that there are no outstanding encumbrances like mortgages, lies, judgements, or other claims against the property by creditors. Under a general warranty deed, the grantor will also compensate the grantee if there’s a defect or breach in the warranty. In essence, the general warranty deed covers the title during any time period and guarantees that there are no defects in the title.

What is a special warranty deed?

A special warranty deed offers less protection than the general warranty deed because it only guarantees that there are no defects in the title during the grantor’s ownership period. The time period before the grantor owned the property is not guaranteed in a special warranty deed.

Who is the grantor in a warranty deed?

The grantor is the person whose name is currently on title and is transferring the interest of the property to the grantee. Generally in a real estate transaction, the grantor is the seller.

Who is the grantee in a warranty deed?

The grantee is the person who is receiving the interest of the property from the grantor. Generally in a real estate transaction, the grantee is the buyer.

Please note in some cases a person can be both the grantor and the grantee in a real estate transaction. For example if you are the sole owner of the property and want to add your spouse to the title, you would list yourself as the grantor and list yourself and your spouse as the grantee. Essentially, you are transferring your interest of the property to yourself and your spouse in this way with the quitclaim deed. A warranty deed is generally not used for adding a spouse’s name to the property; it is more often done via a quitclaim deed.

What is the legal description of the property and how do I find it?

The legal description specifies the boundaries of a track of land that is generated by licensed land surveyors. The legal description is not the physical street address of the property.

The easiest way to find the legal description of the property is to look at the deed of the property, or the mortgage documents of the property. You can also consult the county register or the county recorder where the property is located and search through the county land records. The legal description will typically be listed in the document or be attached as an exhibit on the back of the document.

What is the property tax/assessor’s parcel number?

The property tax number is a number assigned to the property for the purpose of property taxes. Depending on the jurisdiction, the property tax number can also be referred to as follows:

- Assessor’s Identification Number, or AIN

- Property Identification, or PID

- Property Identification Number, or PIN

- Property Account Number

- Sidwell Number

- Tax Account Number

What is the consideration on a warranty deed?

The consideration is the money or anything of value the grantee gives to the grantor in exchange for the property. List the actual sale price paid to the grantor to create a valid agreement.

Do I have to notarize the warranty deed?

The transfer of property is an important act even when it’s done between family members via a warranty deed. Yes, the grantor must sign the warranty deed in the presence of a notary in the jurisdiction to make it a valid document.

What are the blank spaces on top margins of the warranty deed?

Once the warranty deed has been signed and notarized, it must be taken to the county register or county recorder to be registered in land records. Most county recorders need a space on the top page of the document to stamp and record the warranty deed. The blank spaces are left there intentionally for recording purposes and they are normal.

What needs to be done after getting the warranty deed notarized?

Once the warranty deed is signed by the grantors and notarized in front of a notary, the deed must be submitted to the county register or county recorder to be recorded into land/property records.

Can a warranty deed be used to add a new owner to the property?

Typically, warranty deeds are not used to add owners to a property. Instead, adding a co-owner is usually done via a quitclaim deed. Warranty deeds are primarily used in sale transactions where ownership is being transferred from seller to buyer with guarantees about the title.

What protections does a grantee have under a warranty deed?

A grantee under a warranty deed is protected by the grantor’s promise that the title is free of defects and claims. If a title issue arises, the grantor may be legally responsible to compensate the grantee for any losses resulting from defects or claims on the property.

How does title insurance relate to a warranty deed?

Title insurance often accompanies a warranty deed transaction to protect the buyer against any title defects that were not discovered during the title search. While the warranty deed provides certain guarantees from the grantor, title insurance offers an added layer of protection against unknown issues.

Can a warranty deed be used for properties with liens or mortgages?

A warranty deed can be used, but the grantor must disclose any existing liens or mortgages on the property. Typically, these encumbrances must be cleared or addressed during the closing process so the grantee receives the property free and clear as guaranteed by the warranty deed.

What should I do if I discover a title defect after receiving a warranty deed?

If a title defect is discovered, the grantee should notify the grantor immediately as the warranty deed guarantees clear title. Depending on the issue, the grantor may be required to resolve the defect or compensate the grantee for any losses caused by the defect.

What jurisdictions can use our warranty deed?

You can use our template to create a legal and valid warranty deed for the following jurisdictions:

|

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

District of Columbia

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming |

AL

AK

AZ

AR

CA

CO

CT

DE

DC

FL

GA

HI

ID

IL

IN

IA

KS

KY

LA

ME

MD

MA

MI

MN

MS

MO

MT

NE

NV

NH

NJ

NM

NY

NC

ND

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VT

VA

WA

WV

WI

WY |